All roads lead to Target.

+ MORE protein bevs, innovation that (actually) excites, and THC wins.

Coming at you live on a post-federal holiday Tuesday! Hope you all enjoyed a lovely—and hopefully, meaningful/service-oriented—long weekend.

This week, we’re talking all about how DTC brands are entering retail. And while you’re getting some of the story of a successful retail launch, there’s a whole slew of strategies happening on the backend of any launch that play a huge role in its success.

One of the most critical pieces? Creator content.

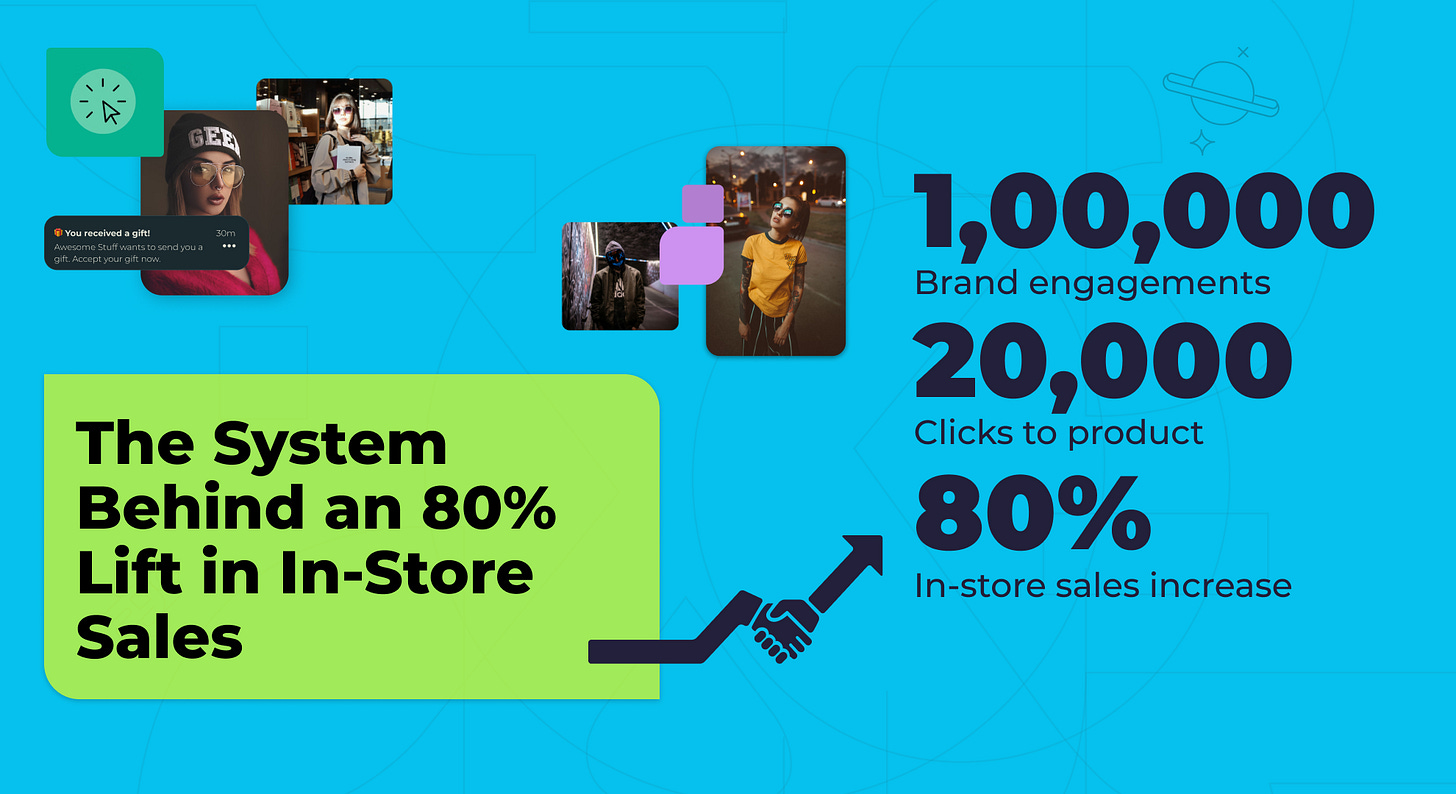

To support brand awareness and retail momentum, a fast-growing beverage brand needed authentic creator content, delivered efficiently and without heavy internal lift. They needed to 1) identify creators already aligned with their brand and audience, and 2) activate them quickly, without manual work or scattered tools.

Using Endlss, alongside The Artists Agency, the brand launched a creator program built for precision and scale. The result was a repeatable system:

High-fit creators discovered and activated fast

AI Copilot–personalized outreach that increased response rates

Seamless gifting that removed friction from activation

Authentic UGC flowing consistently

Content reused across social, paid, and retail

The impact?

20,000 product page clicks in one month

6.7% creator response rate

Over 1 million brand engagements

An 80% increase in in-store sales!!!

News From the Week

Over the past ~decade, digitally native, direct-to-consumer (DTC) brands have rewritten the rules of product discovery and brand loyalty. Many have managed to build cult-like followings and incredibly strong businesses simply by displaying their product on a screen—no brick-and-mortar discovery or tangibility required.

But over the past few years, the competitive noise of social media—and thus, cost-of-acquisition pressure—has only continued to escalate, leaving many DTC founders with a pivotal question: when, and where, should growth move into the physical world?

Over the past few years, Target has increasingly answered that question as the preferred first major retail entrance for DTC brands. DTC darlings like Native, Quip, Bloom, Daily Harvest, Grüns, and more have claimed Target shelf space—wholly redefining their channel strategy, how consumers interact with their brands, and, ultimately, the course of their business.

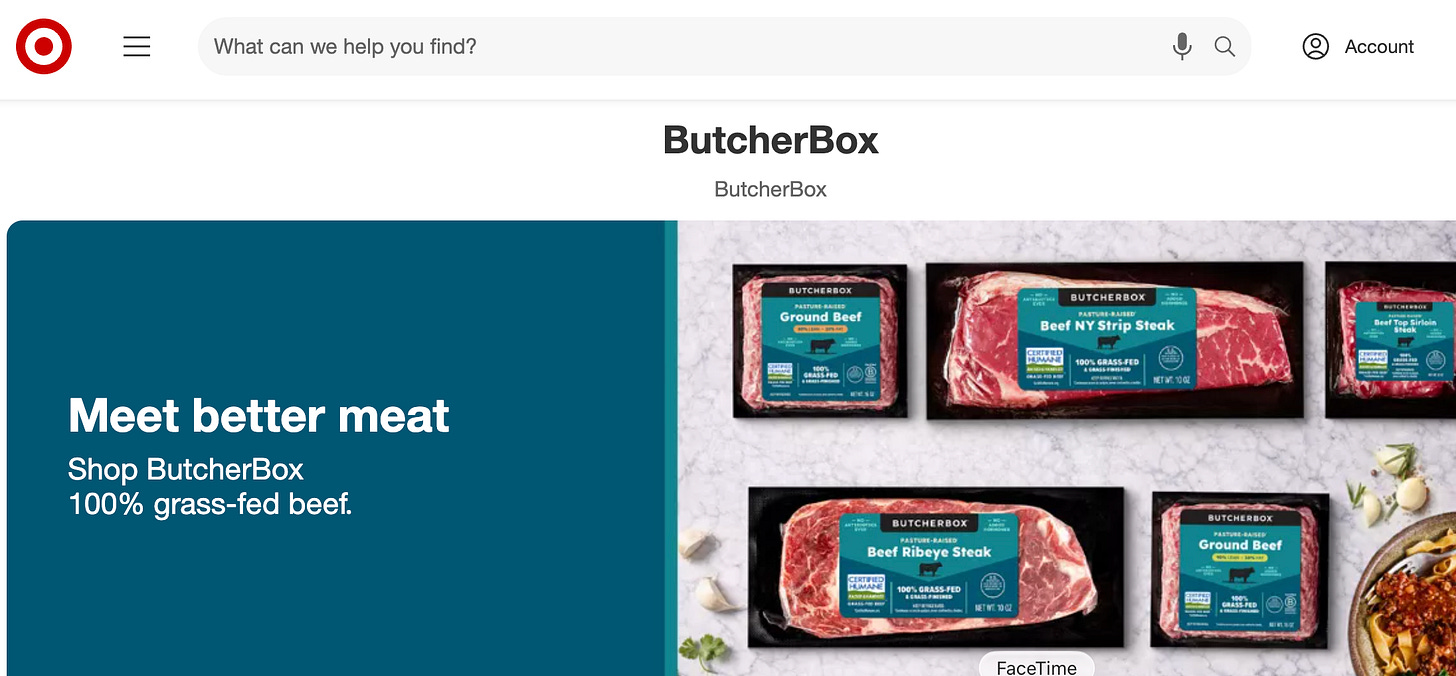

More recently, brands like Little Spoon, Nara Organics, and Bonafide Health have made the same move. And just this week, we saw three major DTC-first Target launches from brands that had all been built on subscription: Ryze Coffee (mushroom coffee) ButcherBox (high-quality meats), Factor Meals (ready-to-heat meals, available at 70 Target stores in the Midwest).

Clearly, DTC-first Target launches are now the norm. This trend left us wondering: why is Target the go-to retailer for DTC brands? We asked the brands + their partners directly, and this is what we learned →

First: Target’s core customer is primed for discovery. They’re typically trend-curious, shopping without a list, and comfortable mixing BigCo brands with emerging, lifestyle-focused products. Unlike traditional mass retail environments where price often wins out, Target has carved a space that embraces curated, design-forward, wellness-oriented, and culturally relevant products. This unique platform attracts brands—and their audiences—who value quality and story as much as accessibility and convenience.

As Angela Vranich, co-founder and Chief Product Officer at Little Spoon, told us:

“We started by asking our customers where they already shopped, and Target was at the top of the list. Over 80% of Little Spoon customers were already shopping there. That made it a natural fit for us. We want to be accessible while still feeling aspirational, and Target allows you to do both.”

Eleanor Hayden, founder and CEO of Veriti—a shopper marketing agency for emerging brands—further emphasized this discovery mentality:

“There’s this ‘I let Target tell me what I need’ mentality of Target’s core audience of Millennial moms and Gen Z shoppers. They go to Target to discover. We helped Magic Spoon launch into Target back in 2021, and we had to teach shoppers that they now could buy individual boxes at Target instead of a 6-pack online only. Shoppers get excited when DTC brands go live at retail because they can try without a huge commit.”

Currently, Veriti is helping ButcherBox with its Target launch, which went live last week. We also talked to the team at ButcherBox, who shared another core insight: brands can launch on Target.com before launching in store, which offers a number of benefits for DTC-native brands.

Mike Salguero, ButcherBox’s CEO and founder, and Reba Hatcher, ButcherBox’s Chief Commercial Officer, told us:

“Target Plus gave us a chance to learn how to tell the ButcherBox story in a retailer’s ecosystem and gather real data on Target’s customer base before committing to brick-and-mortar. What we found was compelling was that Target shoppers who discovered us online behaved a lot like our highest-value subscription customers who care about quality and transparency. We also learned that eliminating the subscription barrier mattered for customers who just wanted great meat without a commitment. So, all of that gave us the confidence and customer insights we needed to develop fresh products for in-store launch.”

“We had, over the last few years, tested retail in pockets, but nothing that really stuck. Internally, Target Plus was about proving we could succeed in Target’s ecosystem and learning what their customers wanted from ButcherBox. We had to demonstrate performance and customer resonance before a retail conversation was even on the table. It was less ‘this is definitely leading to stores’ and more ‘let’s do this right and see where it takes us.’”

And finally, Target is the queen of merchandising. As Eleanor told us: “Target’s merchandising is key to these DTC-first launches. Target allows for really beautiful, eye-catching displays and endcaps that emphasize storytelling over SKUs.” Many DTC brands would fail in a chaotic grocery aisle—but Target gives them space to breathe.

When we asked about potential for cannibalization, the ButcherBox team shared the real win of launching in retail as a subscription-based, DTC brand:

“If anything, we see retail driving subscription growth where customers can discover us and then get access to our full selection of 120+ cuts. The question isn’t ‘which channel wins?’ It’s ‘how do we meet customers wherever they are?’ and we believe many customers will buy through both channels.”

The takeaway: Target isn’t just a place where DTC brands show up—it’s a place where they learn. With a discovery-oriented customer, brand-friendly merchandising, and the ability to test online before committing to shelves, Target gives DTC brands a rare opportunity to translate what worked online into physical retail… without losing their identity.

CPG & Consumer Goods

Every trend in one can. Koia, a beverage company known for its ready-to-drink plant-based protein shakes, is launching a prebiotic protein soda line featuring 10 grams of plant-based protein, 4 grams of prebiotic fiber, and 2 grams of sugar. The sodas will initially be sold exclusively on TikTok Shop, with retail expansion planned for later this year.

This hits nearly every major CPG food trend: We’ve got prebiotics and fiber, protein (not just any protein, but clear, plant-based protein), low sugar, and it’s sold on TikTok.

Not an April Fools joke. Beyond Meat is also jumping on the protein (+ every other trend) beverage train, launching Beyond Immerse—a plant-based, sparkling protein drink with pea protein, tapioca fiber, antioxidants, and electrolytes. The drinks are only available for a limited time, exclusively on Beyond Meat’s e-commerce platform Beyond Test Kitchen. What’s especially interesting? Each of the three flavors comes in two protein levels (10g or 20g), both with 7g fiber.

As our friend Elly Truesdell pointed out in her Substack article, this seems like a cry for help from a company that has lost its way a bit amongst the rise and boom and fall of the plant-based meat market. That doesn’t mean plant-based is dead in the water, but maybe there are better things for Beyond Meat to focus on right now.

We’ve got plentyyyy of thoughts on this launch that we’re sharing on our podcast, The Curious Consumer, tomorrow! Subscribe so ya don’t miss it :)

Two plant-based protein stories must be followed by one gut-health dairy story. We don’t make the rules 🤷. Lifeway Foods, known for its kefir products, is launching Probiotic Kefir Butter™, a European-style “cultured” butter.

The butter category is a $6 billion market, with premium and spreadable formats driving growth as consumers trade up for quality and full-fat dairy again. Lifeway’s betting on the intersection of two rising trends—cultured foods and butter’s cultural moment—to scale within refrigerated dairy.Gluten-free innovation never ceases. Cheez-It officially (finally?!) launched a gluten-free version of its beloved crackers.

It’s genuinely shocking how long it takes some BigCo food brands to launch dietary restriction-friendly versions of their products. Mars, Cheez-It’s owner, is a $65 billion business; it certainly has the cash to innovate, and the company shared that this has been “one of the most highly requested innovations in the brand’s history,”—curious why it took so long to act!

Now this is real innovation. Foodberry and Bel Group (the folks behind Babybel and GoGo squeeZ) are teaming up to launch fruit-and-protein snacks using Foodberry’s plant-based coating tech. First products drop in select U.S. markets this year.

Foodberry’s platform turns real fruit purée into no-mess coatings that can wrap around everything from nut butters to cheese to ice cream—creating bite-sized, shelf-stable snacks. Think: nature’s wrapper, but much more engineered. They have over 20+ utility patents enabling them to completely reimagine what snackable fruit can be.

I interviewed Foodberry’s founder (and fellow Johns Hopkins alum!), Marty Kolewe, last year, and he shared the behind-the-scenes of Foodberry’s tech and the company’s move into B2B—the foundation for this Bel Group partnership. Check it out here! - Jenna

More! Canned! Ultra-filtered! Protein shakes!!!! Prime is ALSO jumping into the protein ready-to-drink game, with a new lactose-free Ultra-Filtered Protein Shake featuring 32g protein, 3g sugar, and 150 calories.

Feels like a “finally” moment for a brand that’s been wrapped up in fitness and athletes since day one. The timing’s interesting considering how crowded the protein shake space already is—Fairlife, Slate, and others have been owning this category for years. It’s also worth noting that Prime has been facing declining momentum lately, making this launch feel like a last minute pivot to reignite some growth.

Light at the end of the THC regulatory tunnel… Indiana Congressman Jim Baird introduced legislation to delay a hemp THC ban that was tucked into a 2025 appropriations bill ending the government shutdown. The ban threatens the $28 billion hemp industry and puts farmers in an impossible position—they made planting decisions based on the 2018 Farm Bill’s rules, and now those rules are changing mid-game. The legislation has bipartisan support.

For context: Congress slipped the hemp THC ban into an appropriations bill that ended the November 2025 federal government shutdown. The new rules—set to go into effect this November—would change the definition of hemp under federal law and ban products containing more than 0.4 milligrams of delta-9 THC per package, replacing the 2018 Farm Bill’s 0.3% by dry weight standard.

This threatens most hemp products currently on shelves. But at the same time, major retailers like Target, Sprouts, and Circle K are now in the hemp game, and they’re not backing down quietly. These aren’t small players—they represent massive distribution channels for hemp products. When you combine their weight with all the investment flowing into hemp brands themselves, you’ve got real pressure building against these restrictions. The industry is big enough to push back.

Retail

Aldi is on an absolute tear! In its 50th year in the U.S. (wild!), the discount grocer is set to open 180+ stores in 2026 across 31 states, entering Maine and announcing plans for Colorado (50 stores), while converting 80 former Southeastern Grocers locations.

Path to #3: Aldi is racing toward 2,800 stores by end of 2026 and 3,200 by 2028—positioning it to surpass Kroger (2,700 stores) as America’s third-largest grocer behind Walmart and Costco!

Another retail win for THC in Texas. Circle K becomes the first major convenience chain in Texas to sell hemp-derived THC beverages, partnering with VARIN (full transparency: we have never heard of this brand) to offer THC drinks across dozens of Dallas-Fort Worth locations. Another retail win for the fast-growing infused category.

Last week, Sprouts Farmers Market announced they’re rolling out hemp-THC beverages in 115 Texas and Florida stores, marking another major retailer entering the $28.3 billion alternative adult beverage market.

Funding

MPearlRock snacks up a winner. MPearlRock acquired The Good Crisp Company, a clean-label snack brand known for its clean-label, gluten-free Pringle-like chips and cheese balls (certified delicious). With over 20,000 retail doors globally, this partnership positions Good Crisp for rapid growth in the health-conscious snack market.

Quick background on MPearlRock: This is Kroger’s strategic investment arm (launched in January 2024), partnering with private equity firm MidOcean Partners to back emerging CPG brands doing $50-150M in revenue. Kroger brings the muscle—2,800+ stores, 84.51°’s consumer data from 62M+ households, and retail expertise—while maintaining independent investment decisions. Brands aren’t locked into Kroger exclusivity, but they get serious distribution firepower.

Their debut acquisition was nutpods (the plant-based creamer brand) in January 2024, and now Good Crisp becomes portfolio brand #2.

The Good Crisp, founded in 2014, was part of that early-to-mid-2010s wave of better-for-you versions of beloved snack products—think: Siete, SkinnyPop, Simple Mills—that have all been acquired in the past few years. It feels like that “generation,” so to speak, is either being phased out or scooped up at the ten-year mark.

Bark goes private? The online pet retailer is considering a take-private offer at $0.90 per share from Great Dane Ventures (obsessed with the fact that this exists), amid financial struggles and NYSE compliance issues. This could reshape their path as they grapple with declining sales and mounting pressure.

Adult sports leagues are about to go wild. Spiked Ade, a bev brand that’s somehow merging functional hydration with booze in a non-carbonated ready-to-drink, raised $10M to position vodka drinks in the sports aisle.

The brand has already sold 15,000 cases sold in New Jersey alone and secured 100% reorder rates from Total Wine & More locations in the state, proving that there’s a market for sporty alcohol—in the great state of NJ, at the very least.

While I can’t say I fully condone the positioning of an alcoholic sports beverage from a safety perspective, this brand does capture a big white space in alc. Since the dawn of the darty, partygoers have been mixing some sort of hydrating liquid/powder (Gatorade, Pedialyte, and most recently, Liquid IV) into their bevs to avoid hangover. This is a zero-sugar, non-carbonated beverage (AKA easy to chug…) that claims hydration—all in a ready-to-drink format. It’s definitely got legs. - Jenna

I can full support it - Nate

More money → magnesium. Taste Tomorrow Ventures invested in TRIP, a fast-growing wellness beverage brand (with a magnesium-focused core SKU) that recently raised $40M to expand in the US market and has partnered with numerous celebrities like Joe Jonas.

Taste Tomorrow Ventures is an early-stage venture capital firm launched in 2025 by veterans from LA Libations. They launched a $30M investment fund back in May 2025, starting with their first check going to Just Iced Tea.

We’ve seen growing interest in brands that merge wellness trends and incorporate them across different formats—from beverages to supplements to personal care. Retailers are clearly betting on this convergence, with stores like Target, Walmart, and Ulta onboarding countless wellness brands in the past two years across physical and online channels.

Two groups raise sizable funds to keep betting on CPG! 🤑

SEMCAP Food & Nutrition closed its inaugural fund at $125 million, targeting sustainable, better-for-you food companies with $25M+ revenue. The firm focuses on organic, natural, and non-GMO brands. Past investments include ALOHA, Fresh Prep, Good Culture, Kite Hill, and Purely Elizabeth.

Bansk Group closed its Fund II at $1.45 billion. The consumer-focused private investment firm specializes in CPG staples—consumer health, food & beverage, household products, and personal care. Fund II has invested in PetIQ, BYOMA, and Arcadia Consumer Healthcare, while Fund I backed Foundation Wellness, Red’s, and Woodstream.

Coffee consolidation, in two parts:

Chameleon changes hands. Chameleon Cold Brew was acquired by Next In Natural, signaling a strategic move in the competitive coffee market as brands consolidate to enhance growth and reach.

Explorer Cold Brew expands its caffeine-conscious empire. Explorer, one of our favorite cold brew brands, acquired Savorista to expand its portfolio in the decaf and half-caff market, paving the way for a multi-brand coffee platform that caters to diverse caffeine preferences.

Three brands, one mission. Female-led, Latinx CPG brands Nemi (cactus snacks), Tuyyo (powdered agua fresca), and Todo Verde (seasoning blends) are merging to amplify their impact in the market under the name Tuyyo Foods.

Nicotine-free innovation. Ultra, a functional nicotine-free pouch brand, just raised $11 million to expand its team and distribution after selling 1 million cans in six months, tapping into a booming market for “guilt-free” focus (AKA nicotine-free pouches).

Stoli takes a hard turn. The U.S. arm of Stoli Group shifted its bankruptcy filings to Chapter 7 liquidation, marking the end of a 25+ year saga marked by financial woes and geopolitical strife—leaving its global operations intact but the U.S. market in shambles.

Some background: Stoli initially filed for Chapter 11 in December 2024 with over $100M in assets and $50M-$100M in liabilities, hoping to restructure

In August 2025, they proposed paying their $78M debt to Fifth Third Bank with 35,000 barrels of unfinished bourbon—the bank objected, citing depressed bourbon prices

The company’s portfolio includes Stoli and Elit vodkas, Bayou rum, Kentucky Owl whiskey, Cenote Tequila, and Se Busca mezcal

Weekly Pickups

Last week, we attended FancyFaire in San Diego and tried a load of fantastic new food + bev products! We recapped our favorite bites here:

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

did u see good culture was sold to private equity? thoughts?

Super smart breakdown of Target's DTC advantage. That stat about 80% of Little Spoon customers already shopping at Target is telling,it's not just distribution but audience overlap. The MPearlRock mention is interesting too, Kroger clearly sees the same play unfolding but with their retaildata edge. I'd actually argue that Target Plus testing before in-store is underrated as ade-risking strategy. Most brands rush into brick and mortar without understanding the retail ecosystem first.