Beauty just got dystopian

+ how modern soda wins and other CPG and retail news from the week of 11/3/25

Hello hello!

Hate to break it to you, but Black Friday is only 18 days away. 🙃

As you focus your energy on nailing this season, it’s easy to forget that Q1 is already just around the corner—and with it, the year’s biggest opportunity for wellness and better-for-you brands: New Year, New Me season.

January is when your target customer is most receptive to trying something new. But they’re also being bombarded by every brand with the same pitch. To break through, you need content that feels less like an ad…and more like a genuine recommendation from someone who’s already seen results.

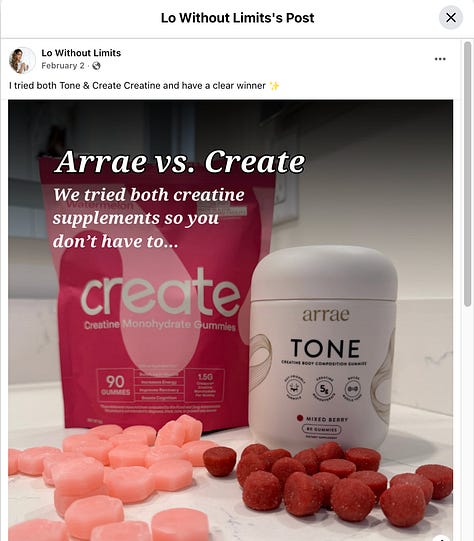

That’s where Grapevine AI comes in. They’ve helped brands like Little Spoon, Arrae, Weight Watchers, and Prose create authentic UGC that converts—delivering 20%+ lower CPAs during peak ad costs last holiday season.

Grapevine handles the full process: sourcing creators, writing briefs, negotiations, and production. You ship product and run media. They deliver scroll-stopping content to break through the noise.

Express Checkout readers:

Book by December 15th and get one additional creator FREE on your first campaign (10 additional assets and a $1,300 value).

Now, let’s get into the news of the week →

News from the week

This week, Cove Soda secured $15 million in Series A funding led by Vanterra Ventures to accelerate US expansion.

Last month, Pura Soda raised the same amount, with the same goal. Before that, Culture Pop raised $15 million (seems to be a trendy figure…), Nixie pulled in $26.9 million, OLIPOP hit a $1.85 billion valuation, and Poppi was famously acquired for $1.95 billion by beverage giant PepsiCo.

The capital is pouring in fast. And that doesn’t even cover the better-for-you soda launches in the past year, including Slice’s (formerly owned by PepsiCo) resurrection by Suja Life, Bloom Pop, Spindrift Soda, Stiller’s Soda, and so much more.

What’s wild, though, is that “Modern Soda” as a retail category didn’t really exist until Walmart created dedicated shelf space in October 2024. Three years ago, these brands fought for scraps among the sparkling waters, beloved OG diet sodas, and the infamous kombucha section.

Today, they’re rewriting the rules of a $142 billion US industry.

Soda was on the decline and Poppi and Olipop cracked the code: nostalgic flavors + beautiful branding + a functional health claim (prebiotics!) = permission to indulge. They positioned themselves as soda, but better.

(We don’t need to tell you the story of Poppi and Olipop’s insane success. Just look at PepsiCo’s acquisition of Poppi for $1.95 billion in March, or Olipop’s valuation of $1.85B this February.)

That shift is now reflected at shelf. Retailers have expanded craft soda shelf space by 25% since 2023, with major chains like Albertsons, Kroger, and Raley’s creating dedicated “Modern Beverage POGs” (AKA planograms, which map where products are placed on shelf).

And the timing is right for new entrants. Modern sodas are growing rapidly, reaching $1.8 billion in 2024—an 83% jump from 2023—but still represent less than 2% of the total carbonated soft drink (CSD) market.

Ellis Fried, Principal at Vanterra Capital who led Cove Soda’s investment, told us that he sees modern sodas reaching 5-10% of the market, creating “billions of dollars of new sales opportunities over the coming years.”

And the numbers back his confidence. Mintel projects the overall CSD category will grow nearly 30% over the next three years, while the better-for-you subset is expected to grow 75% in that same period.

“Early movers like Olipop and Poppi have done a great job educating the market on better-for-you soda, investing many millions of dollars doing so,” Fried told us. This allows other emerging modern soda brands, like Cove, to stay lean—focusing less on general market education or speaking for a category, and more on why they are a superior product.

The infrastructure exists. A broader consumer base is starting to understand the value proposition. Now it’s a land grab.

The goal has shifted: from getting people back to soda to converting the 98% of CSD consumers who still reach for Coke and Pepsi. And because of this, new craft are learning to speak the language of Coke and Pepsi—subtly shifting away from leading with function and instead focusing on taste.

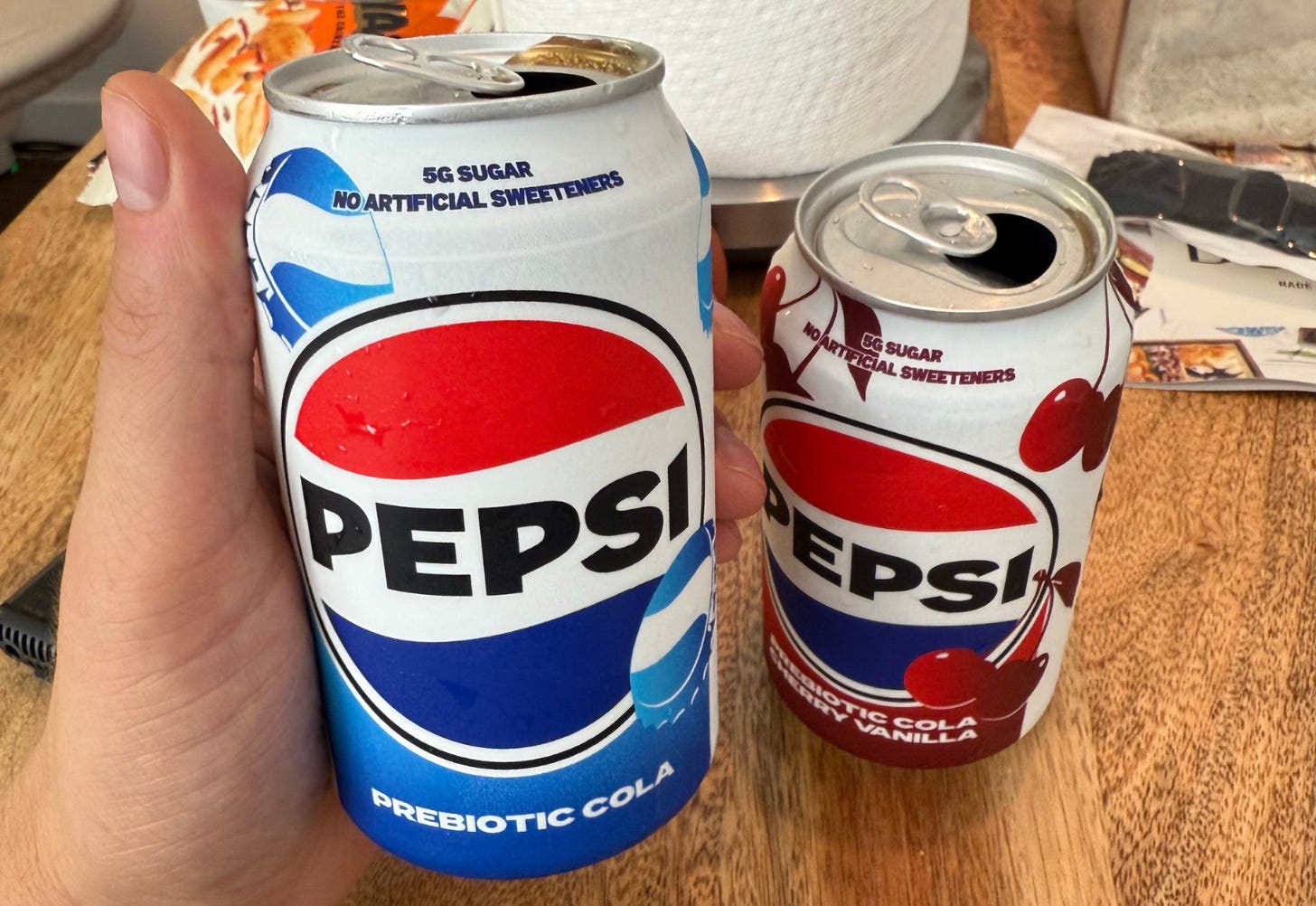

Even PepsiCo, despite buying Poppi, is trying their hand at a healthier version of Pepsi with Pepsi Prebiotic. I got to try PepsiCo’s new attempt at prebiotic soda (pre-launch), and it did taste like the real thing—I think that’s exactly what they need to do to win and convert traditional soda drinkers. - Nate

“We believe taste is a big reason that many traditional soda drinkers have not swapped for a BFY alternative yet, which is why part of our investment will go toward sampling the product in as many communities as possible,” Fried told us. “Many early adopters of Cove have converted from its competitors and have been drawn to Cove for a variety of reasons, particularly its taste profile, zero-sugar and lower calorie count, or its one-of-a-kind flavors like Ice Pop.”

As more modern soda brands launch with function, the brands that will win remember what made soda iconic in the first place: It’s not about gut health. It’s about the joy of cracking open a cold can on a hot day, it’s about flavors that activate nostalgia, it’s about—as Coca Cola has convinced us so effortlessly—sharing happiness.

Function opened the door for modern soda. But now, being “better-for-you” isn’t good enough—modern soda brands just need to be better than the OGs. 🥤

CPG & Consumer Goods

Beauty just got dystopian. Shay Mitchell, actress and founder known for her Beis Luggage brand, just launched Rini, a new “skincare and play product” brand for “growing faces” aged three and up. Yea, you read that right.

Emphasizing gentle formulas made in Korea, the brand launched with the “first ever hydrogel mask for kids.” Sometimes, things are “first ever” for good reason—because they probably don’t need to exist in the first place.

We don’t have an issue with skincare designed for teens, who have unique skin needs, and are already flocking to Sephora attempting to purchase products that don’t suit their needs. We also don’t have an issue with body care designed for babies or toddlers—like a gentle body wash or lotion for eczema, or, I don’t know, diaper cream? But we do have an issue with projecting beauty standards onto three-year-olds, as many others have mentioned (just look at these comments).

I don’t think there was blatant malintent in the creation of this product. I get the thesis: let’s create products for the kids who look at what their mom is doing, and want to do it too. But that “problem” already has a “solution”—and it’s play. It’s a kid seeing their mom in a face mask, and smearing an avocado on their doll in response. Taking a cotton pad doused in nothing but water, and pretending to swipe it on and off their faces. Using air as their greatest accessory—seeing a whole world of invisible products stretched out in front of them, and knowing everything they need is already in their minds. When play gets commoditized like this, it’s no longer about imagination and experimentation. It positions “growing faces” as the “problem” that need a “solution.” It teaches children to start worrying about beauty before they even enter kindergarten. It takes away the abundance of imagination and replaces it with the scarcity of tactile goods. - Jenna

And if you needed something else to feel angry about… Monster just launched an energy drink specifically for women, called Flrt.

Gendered branding has officially gone too far. Yes, there are more feminine-leaning energy drinks already, like Alani Nu and Gorgie. But this screams “a bunch of old men in a boardroom trying to speak ‘Young Woman.’” The tagline? “Meet your new crush in a can.” The call to action? “Let us slide into your inbox with details on our hard launch.” I’m genuinely so offended by this branding, which, at best, is WILDLY cringe, and, at worst, reduces female consumers to mere objects of romantic interest. Who approved this?! - Jenna

…and speaking of energy. Unwell, Alex Cooper’s hydration beverage brand, has expanded into energy with the launch of its special edition flavor for Christmas, frosted cranberry.

The brand now has a hydration beverage, a protein + hydration beverage, and a hydration + energy drink. Talk about checking off every trend box...

Another. Celebrity. Skincare. Brand. My god. Dua Lipa launches her skincare line ‘Dua’ in collaboration with Augustinus Bader, featuring three products powered by TFC5 technology. A cleanser, a “glow complex” (serum?), and a multitasking daily moisturizer.

I know we sound annoyed, but Dua cannot do any wrong in our hearts. She’s perfect.

All aboard the colostrum train. Kourtney Kardashian Barker’s Lemme launched Colostrum Gummies and Colostrum Liposomal Liquid, which is essentially a creamer for “enhanced absorption.” Both are made with Maolac’s colostrum isolate and are intended to support gut health, digestion, immune health, and “overall vitality.”

It was only a matter of time before Lemme would get into colostrum. The brand ARMRA Colostrum really put colostrum on the map with seemingly infinite ad budget and messaging that positioned colostrum as the solution to every health concern under the sun. In reality, colostrum is the nutrient-dense fluid released from mammals (in this case, cows) after they give birth, specifically enriched with nutrients for infants. Its benefits are clear for babies, but are still being proven out for adults. Despite Lemme citing its colostrum as “clinically backed,” most clinical studies of colostrum for adults contain a small number of participants in specific contexts—not just healthy adults.

Team butter or team mayo re: grilled cheese? Now, you can be both. Tillamook and Kewpie mayo teamed up to launch Butternaise, a hybrid spread combining butter and mayonnaise, designed for the “ultimate grilled cheese.” This is an A+ collab in our books, and we can’t wait to try it for tomato soup + grilled cheese season.

Founder aims for a comeback. Miyoko Schinner, founder and former CEO of Miyoko’s, is planning a bid to reclaim her plant-based dairy brand after the company allegedly forced her out.

It’s been a crazy few years for this plant-based brand, packed with lawsuits, a court-mandated mediation, a “financial stabilization plan” after a dramatic drop in sales, and now, Schinner’s proposed bid.

With plant-based cheese sales declining by 8.5%, her revival strategy focuses on targeting early adopters and premium products. It also focuses on returning “point of view”: “People are not interested in whitewashed, middle-of-the road, me-too brands,” Schinner told AgFunder. “I believe that I have the best shot at breathing life into this brand again, not as an ambassador on the side like a dancing monkey, but somebody who is leading with principles.” Pop off, Miyoko!

Frozen fusion hits the shelves. Laoban and Bachan’s new collaboration combines Taiwanese Popcorn Chicken and Japanese Barbecue Sauce and looks ridiculously good.

Tito’s launches Turkey Rot. Tito’s is pouring one out for those who have been victimized by their fit neighbors bragging about their fit family running the Turkey Trot with the first ever “Turkey Rot,” a fake race for the couch that donates $5 per registration to Meals on Wheels.

Urban Farmer makes a cauli-power move. Urban Farmer, a fully integrated producer of specialty dough products for leading brands, acquired CAULIPOWER, the leading gluten-free frozen pizza brand, uniting their manufacturing strengths to create a dominant force in better-for-you frozen foods.

Pacha gets a youthful glow ✨. Pacha Soap Co. just launched Foxly, a clean beauty brand for Gen Z and millennials, priced between $4.99 and $12.99 and “designed with TikTok trends in mind.”

Retail

Whole Foods and Amazon get extra cozy. Whole Foods launches its first “store within a store” concept in Pennsylvania featuring a 10,000-square-foot micro-fulfillment center through Amazon, allowing shoppers to grab name-brand items, like Goldfish (that are not carried at Whole Foods) via QR codes. The idea is to have shoppers complete their entire shopping trip in place. I mean, convenience is king!

Kroger and Sprouts get smart. Kroger and Sprouts Farmers Market are rolling out Instacart’s Cart Assistant, an AI-powered tool that lets shoppers build baskets through chat.

Funding news

Cognitive boost, secured. Nootropic brand Graymatter Labs raised $1.3M in seed funding after achieving a staggering 2000% year-over-year growth, underscoring the growing demand for brain-boosting products in the wellness space.

Cymbiotika scores big. The supplement brand just raised a whopping $25M in a star-studded seed round, fueled by celebrity investors like The Weeknd, the Jonas Brothers, and Post Malone, as it ramps up its retail expansion into Target stores nationwide.

The supplement space is, dare I say, getting a tad oversaturated. But even still, funding is pouring in. Cymbiotika has stood out (and reached $150 million in annual revenue) for its “bioavailable” supplements (AKA liquid and gel supplements).

Taking on Jell-O. Oddball raised $2 million to launch a new line of fruit-based, “jiggly” snacks (AKA, a Jell-O competitor) intended to as founder founder Sophia Cheng told us “evoke the simple joy of the treats families have loved for generations—made for today’s world, with real ingredients and a modern point of view.”

Geting that dough! Doughlicious, the award-winning cookie dough brand just nabbed investment from Future Back Ventures by Bain & Company, marking a major step in its global expansion.

Eggs without chickens? The EVERY Company secured $55 million in Series D funding to scale its precision fermentation egg proteins, now rolling out at Walmart, addressing supply chain stability amid avian flu concerns.

Kimberly-Clark acquires Kenvue. The consumer goods giant is acquiring Kenvue for $32 billion, creating a powerhouse in the global health and wellness sector.

Did you know we have a podcast? It’s called The Curious Consumer! Check out our recent episode, with new episodes every Wednesday (except this week, because Nate is OOO)!

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

Thank you for the link!