Betting big on yogurt and supply chains...

+ we launched a podcast (!!!!)

Hello hello!

Today's issue of Express Checkout is brought to you by our friends at minisocial. If you've been struggling to get quality UGC for your brand, you need to hear about this.

minisocial connects you with micro-influencers who create authentic content for your brand (that you own the rights to). Creators share it with their audiences first, so you get that organic reach, and then you can repurpose the content literally everywhere—your ads, emails, social channels, you name it.

Brands like Bero, Copper Cow Coffee, immi ramen, and Ceremonia are already using it, and it's surprisingly affordable—starting at just $2.2k with no long-term contracts locking you in.

Mention “Express Checkout” when you book a demo, and you'll get 15% OFF🙌

Now, let’s get into the news of the week →

Last week, we did the unthinkable….and launched a podcast.

We know what you’re thinking: “Oh great. Another podcast.” As if the world needs another two 20-somethings lecturing about the goings-on in their industry, let alone recording and—heaven forbid—posting it.

And guess what? You’re right! This doesn’t need to exist! But technically, neither does another protein bar, or greens powder, or better-for-you candy, and yet… 🙃

We’ve both been in and around the consumer packaged goods (CPG) world for a minute now, and have had a lot of conversations with a lot of people both in and out of the industry. It’s an industry that loves insider jargon, but at its core, should be accessible.

After all, we all interact with dozens of brands every single day. They're in your medicine cabinet, your gym bag, your pantry. But have you ever stopped to think about why you bought them? Why that specific oat milk? Why you'll pay $60 for vitamins that might just end up being expensive pee?

We want to unpack all of that—with the critical + informed lens of insiders, but the realistic, unpretentious takes of two people trying their best to be thoughtful consumers in a world that would rather us “add to cart” than ask questions.

We'll explore a range of topics for the curious consumer—everything from why we suddenly all need the same water bottle and how brands are selling “longevity,” to why your mom is now (earnestly) asking about adaptogens.

Yes, we’ll yap ourselves (can’t help it), but we’ll also bring on some of the most interesting folks in consumer goods and learn alongside you—not just asking them to regurgitate the “About Us” on their site, but digging deep into the psychology of brands and the people behind them.

Welcome to The Curious Consumer. We're here to feed your curiosity about the stuff that's already feeding you.

P.S. If you have any feedback, ideas, or guest ideas for future episodes, feel free to email us!

CPG & Consumer Goods

Liquid I.V. shakes up the energy drink scene. The brand just launched its new Sugar-Free Energy Multiplier—a hydrating, no-sugar alternative (sweetened with allulose and stevia) with 100 mg of caffeine.

I personally thought they should’ve launched a canned beverage. I understand the positioning against another beverage, but a Liquid I.V. bevvie would have crushed it! - N

The other week, my friend gave me a Liquid I.V. that looked just like its OG hydration product (Hydration Multiplier), but had a sneaky “+ Energy” on the label. Only upon further snooping (as I do), did I discover that this electrolyte powder had 100mg of caffeine—thank goodness I checked before opting for another coffee. Clearly, the brand decided to prioritize the caffeine callout with a rename (and a new sugar-free formulation). - J

At 100mg caffeine, this also fits with our prediction that brands are starting to prioritize lower caffeine content! The typical ready-to-drink (RTD) energy drink (think: Celsius) is around 200-250mg, while this is closer to a coffee.

Rudi’s brings gluten-free nostalgia. Rudi’s Rocky Mountain Bakery teamed up with Hormel to launch gluten-free PB&J sandwiches (read: another Uncrustables competitor). We tried these at Newtopia and loved them!

The peanut butter will be supplied by none other than Justin’s. For those who don’t know, Justin Gold himself (yes, of Justin’s) started Rudi’s as well! It’s about damn time for a collab :)

Celsius and PepsiCo are getting serious... Celsius Holdings just further ✨defined the relationship✨ with PepsiCo by integrating its Alani Nu brand into PepsiCo’s distribution system while acquiring Rockstar Energy for $585 million. This union expands their energy drink portfolio and boosts retail availability, while giving PepsiCo a major energy drink leader in the U.S.

Eggo gets protein-packed. Eggo introduced three new protein waffle and pancake SKUs, featuring 10-13g protein per serving.

It was only a matter of time before Big Breakfast would hop on the protein trend alongside the startup innovators…and only a decade after Kodiak Cakes dominated this space.

eCommerce

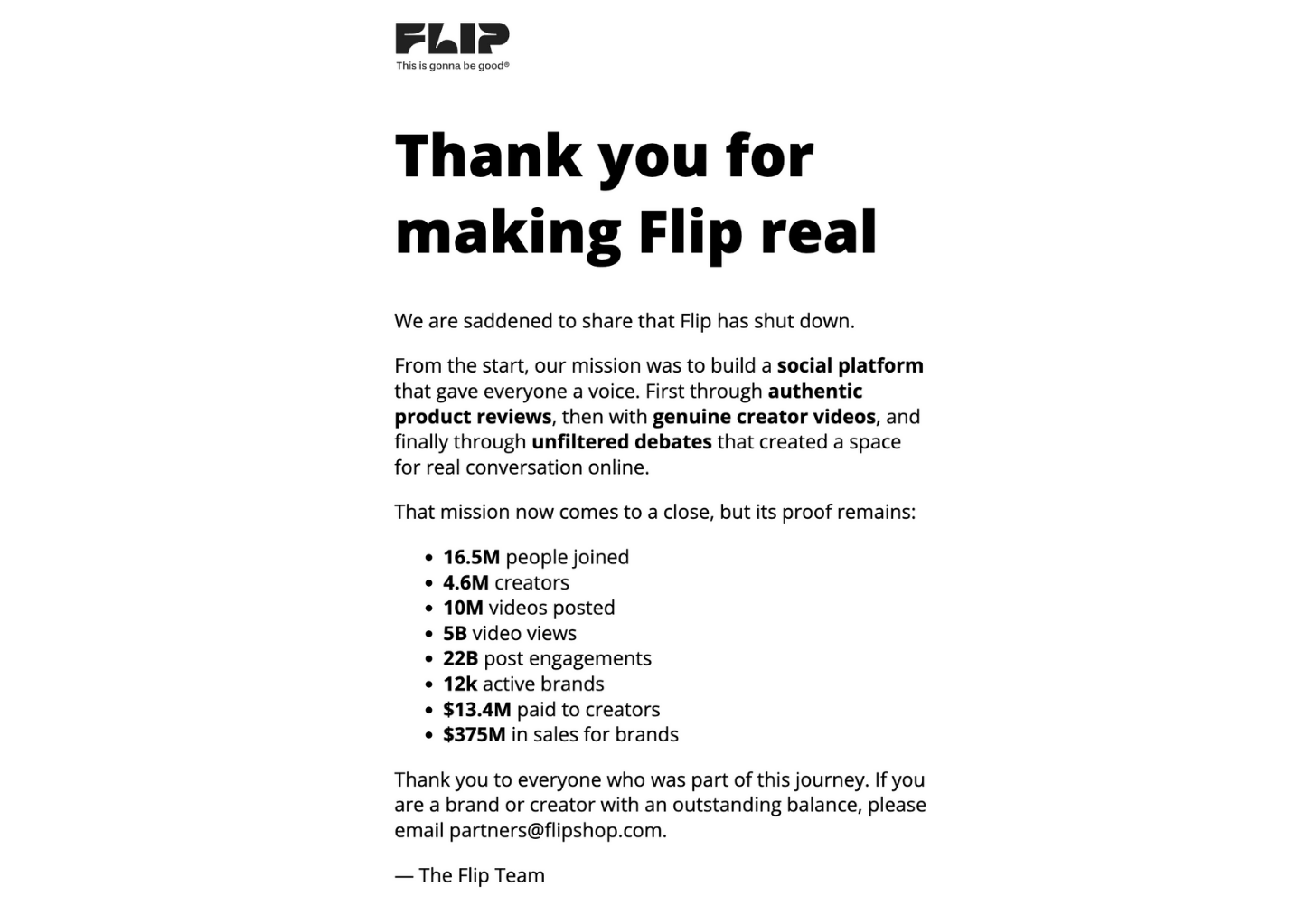

Flip… flops. The social commerce app (and purported TikTok competitor) Flip—better known to many as the app that spammed you to give free money to all of your friends—shut down after raising over $300 million and reaching a $1 billion valuation.

The writing was on the wall (feed?). By the time Flip launched in 2021 and hit its stride, TikTok Shop had already steamrolled the market, capturing 68% of social commerce GMV in just 16 months after its September 2023 US launch.

Users didn't want shopping with entertainment; they wanted entertainment with shopping. And you simply can't compete with TikTok's algorithm—it’s trained on billions of interactions and can learn user preferences in a mere 40 minutes.

Then there was the economics of it all: The app paid users up to $240 in referral credits, offered 70-80% discounts, charged just 4-6% seller commissions, and paid creators 375x more than TikTok per view... great for the consumer but not a sound business model.

At the end of the day, Flip couldn’t differentiate. Despite positioning as "the last honest place on the internet" with reviews from verified purchasers, it wasn't the cheapest (Temu), most entertaining (TikTok), or even most trustworthy (2.1 Trustpilot rating. And I mean, how honest can you really be when you’re paid that much to review?!).

Retail

Fabletics flexes its retail muscles. The activewear brand best known for swindling you into its VIP subscription is set to open 20–25 new stores annually, bolstered by a billion-dollar revenue stream—and its infamous VIP program that drives 95% of sales.

Say hello to our new overlords. Robomart announced its new autonomous delivery robot that carries 500 pounds, offers $3 flat delivery fees (70% cost reduction), and operates through an app-based marketplace (competing with the likes of UberEats and DoorDash). The company plans to launch in Austin later this year after raising $4M in funding.

Funding news

Beauty brands are buying up their supply chain:

Olaplex, the hair care brand known for its proprietary bond-building ingredient, acquired biotech firm Purvala to boost R&D capabilities.

Magic Molecule, a skincare brand best known for its hypochlorous acid spray, used funding from PE firm NexPhase Capital to acquire its hypochlorous acid manufacturer.

So, why is this happening? And why does it sound like David x Epogee all over again…

Sabrina Sadeghian, co-founder of 4AM Skin, explains: “Over-the-counter doesn't really have patents—and brands can reverse engineer—so the only way to take out the competition is drive down your price by buying the whole supply chain or controlling all the supply.”

By acquiring manufacturers, brands gain two critical advantages: They can achieve cost structures that let them compete with increasingly popular private label and dupe brands like Elf, which offer near-identical products at significantly lower prices. Or they can lock up supply chains entirely, preventing competitors from accessing the same high-quality ingredients or production capabilities.

In an industry where your "proprietary" formula can be sitting on Target shelves under a generic label within months, controlling the means of production might be the only sustainable competitive advantage left.

Betting on dairy:

Skyr’s the limit for Painterland Sisters. The cult-favorite, rural PA-based dairy brand raised a seven-figure seed round, expanding its organic skyr yogurt into Whole Foods stores nationwide, bringing it’s total door count to over 5,000.

And in other yogurt news… Danone is investing millions to expand its Ohio plant, adding 48,000 square feet and a new production line as yogurt sales soar with a 40% rise in Oikos sales last year.

Tequila gets a mini makeover. 818 Tequila is launching 818 Minis (along with Labubu-esq keychain holders) and securing an investment from Grupo Solave to further grow its market presence.

General Mills plants seeds for innovation. The food giant is investing $54M to expand its Minnesota innovation hub, boosting R&D space by over 20% to keep pace with evolving consumer tastes.

Post Holdings breaks up with pasta. Post Holdings (yes, like the Post cereal) is selling its pasta business for $375 million while holding onto its nut butters and granola segments, which are projected to contribute $45-50 million in EBITDA for fiscal 2026. It's a strategic pivot to shift focus to more profitable ventures.

Make sure you’re subscribed so you don’t miss our next edition!

congrats with launching podcast! So exciting!