Hormone health gets its moment

+ Plant-based protein, the future of non-alc, and more consumer news

Hello hello!

Authentic influencers drive sales, but messy workflows waste time and inflate CAC. Endlss gives lean CPG and DTC teams the Ambassador OS that scales revenue without adding headcount

Save hours of manual work, activate creators instantly, and get CAC and ROI you can trust.

Recruit accurately using AI search across 250M creator profiles and instant lookalikes for a perfect fit.

Automate activation end to end, including AI outreach, invites, gifting, SmartLinks, and tier assignment.

Migrate your existing codes and commissions with zero disruption to the field.

Run smarter programs with tiered rosters, targeted broadcasts, and auto restocks that keep UGC flowing.

See performance clearly with real time CAC, revenue, commissions, and gifting ROI in one dashboard.

Keep creators motivated with automated weekly payouts and full earnings visibility.

Brands like Del Campo scaled from zero to hundreds of ambassadors in weeks, and PepsiCo’s Nature’s Twist saw an 80% revenue spike in the first month.

If your team is small and growth matters, Endlss makes ambassador programs effortless.

Start free with up to 50 Ambassadors and turn authenticity into ROI.

Now, let’s get into the news of the week →

News from the week

It’s gift guide season! And we are dropping a few (very specific) gift guides this week 🎁

Check out the 3 we’ve already dropped!

CPG & Consumer Goods

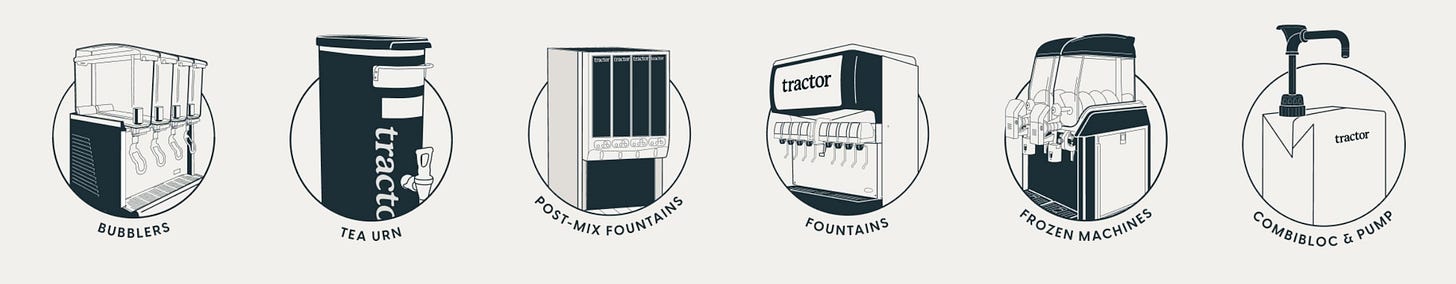

Meet the brand you never knew you knew. Tractor Beverage Company, which is best known for its foodservice offering (fountain drinks) in spots like Chipotle, university cafeterias, and hospitals, is launching its first retail product, Haymaker, a certified organic, canned apple cider vinegar-based sparkling tonic, exclusively at Sprouts Farmers Market starting January 2026.

It’s rare to see a brand move in this direction—from foodservice to retail—but Tractor, a profitable company, is proving that this could be a brilliant way to run a bev biz. This farmer-founded and employee-owned brand was able to scale by competing against the limited existing fountain soda options with a clearly better-for-you, mission-oriented offering.

Screenshot from Tractor’s B2B portal I’m excited to see a sparkling tonic that isn’t just marketed as a non-alc, but also isn’t marketed as a new-age “gut health” drink just because it has apple cider vinegar in it. Instead, the brand leaned into old-timey, homestyle aesthetics and messaging around upholding farmer tradition. - J

NA beverage co’s join forces. Proxies, a maker of non-alcoholic wine alternatives, acquired the mocktail maker Avec to launch their own line of canned NA drinks early 2026. Avec was started by Alex Doman and Denetrias Charlemagne back in 2020, Alex is now the co-founder of Stiller’s soda which launched this year.

Plant-based interest dwindles. TiNDLE, a plant-based meat company, is exiting its US operations to focus on private-label products in Europe amidst a 7% sales slump in the US market and dwindling consumer interest.

They’re not alone in struggling in the US market. Beyond Meat’s stock has plummeted from its 2019 peak of $230+ to around $1 today. Meati Foods, which raised $365M total including a $100M Series C1 round in 2024, sold for just $4M after losing most of its cash reserves—they are apparently poised for a comeback but we will see….

Meanwhile, Danone is trying to reinvigorate plant-based interest. The dairy giant is launching a high-protein (13g) version of its Silk brand of plant-based milks.

Of all the plant-based alts for animal-based products, alt-milks have the best bet of sticking around, despite a 5% dip in the overall market. They are the most ubiquitous, normalized purchase in the plant-based segment.

According to Mintel data cited by Danone, fewer than 1% of protein-focused innovations are in the plant-based drinks segment—they’re seeing a white space, and while every other brand goes left (into dairy), they’re going right.

Coming for Hims. Oddity, parent company of makeup brand Il Makiage and skin/hair supplement brand Spoiled Child, launched Methodiq, a telehealth platform offering prescription and over-the-counter, medical-grade skincare products for acne, eczema, and hyperpigmentation. This new platform directly competes with Hims in the $113 billion medical skincare market.

We’re seeing a major stratification in skincare: either leaning fully into all-natural products (think: beef tallow skincare) or fully into science-based, medical-grade skincare (think: “ingredients you can’t pronounce” gasp!). I predict that brands that sit in the middle will increasingly struggle to capture consumers, especially as companies like Methodiq drive down the prices + improve accessibility of products that were historically prescription-only. - J

Fragrance meets body care. Former Ulta exec Lauren McDonald launches PurelyYou, featuring “clean” body creams in three ‘moods’ for $38 each, tapping into a growing demand for premium body care among millennials and Gen Z.

It’s so cool to see someone who came from the retailer side launch their own brand. McDonald has seen the rise of body care firsthand in her time at Ulta, and understands consumer demand for more clean ingredient, scented products in the category.

Retail

Speaking of clean beauty... Credo Beauty launched “Credo Qualified,” a certification program for contract manufacturers promoting transparency in their ingredient sourcing and sustainability. The retailer also formed a “Clean Beauty Council” of industry experts to guide standards, aiming to demystify beauty’s historically secretive supply chain and combat greenwashing.

This is a really interesting step for Credo. Credo is already known for having really strict requirements for the brands on its shelves, but this move goes beyond the brand-level: Credo is essentially creating a values-based certification that aligns with their retail standards.

Interestingly, a contract manufacturer-level cert doesn’t really exist in food/beverage yet. The closest parallel might be individual certifications like Organic, Fair Trade, or B Corp, but those are brand-level, not CM-level certifications.

The next Sephora?! Olive Young, the South Korean retailer, dominating its home market with over 1,370 stores, will open its first US location in May 2026, directly challenging Sephora and Ulta Beauty in the ever-growing K-beauty market.

According to Nielsen IQ, K-Beauty sales in the U.S. surged to $2 billion—up 37% year-over-year. But with 70% of K-Beauty sales currently happening online (primarily TikTok Shop), it’ll be interesting to see if consumers shift purchase patterns to shop for K Beauty in stores more once dedicated K Beauty stores launch.

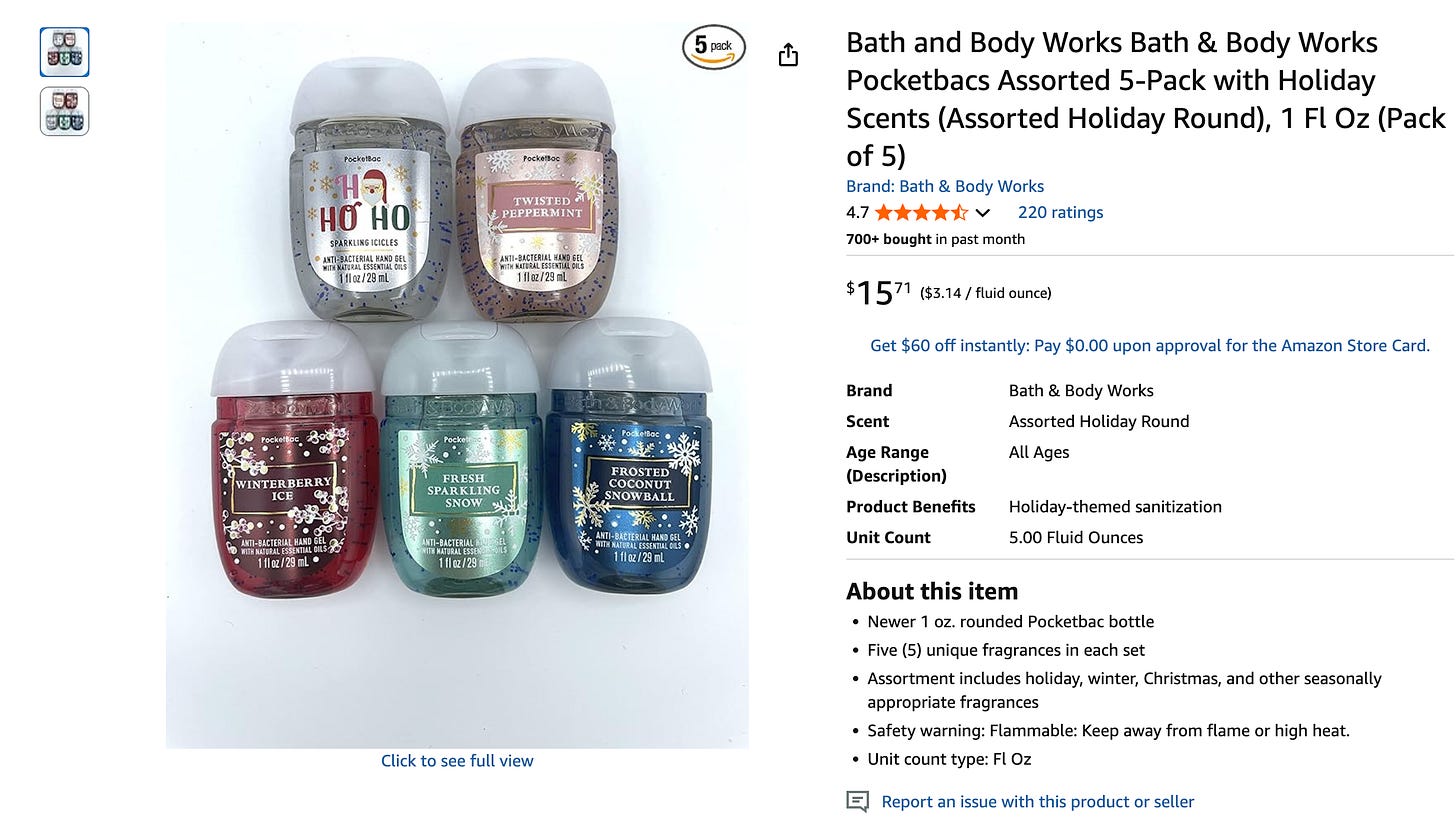

Taking back control. Bath & Body Works is launching on Amazon in early 2026. The retailer will start with a small evergreen product assortment as part of its new “consumer first formula” strategy to capture lost revenue and strengthen brand presence.

Bath & Body Works is evidently hoping to reclaim what they state is the “$60-80M in gray market sales” currently happening on the platform—AKA third-party resellers buying Bath & Body Works products and reselling them on Amazon without the company’s approval.

This may be a bit of a Hail Mary for the brand, whose net sales are down 1% year over year, with net income down over 27% to $77 million. As the body care and fragrance categories are surging, B&BW seems to be struggling to keep up with its newer competitors.

But they’re not the only beauty brand that was once anti-Amazon… and is now embracing the platform. Amazon even acknowledged the “gray market” concerns by creating the Amazon Premium Beauty store—a dedicated space for verified skincare and beauty brands that offers better brand protection, enhanced shopping experiences, and measures to combat counterfeits.

We’re seeing major beauty brands like Kiehl’s, Clinique, and brands under The Estée Lauder Companies have also launched on Amazon after years of resistance.

eCommerce

Is this the end of eCommerce as we know it? Target is launching a shopping experience within ChatGPT itself, allowing users to browse, purchase multiple items, and choose fulfillment options including Drive Up and shipping. The beta launches next week, featuring personalized recommendations across Target’s full assortment.

Earlier this year Shopify and Walmart also announced embedded integrations within ChatPGT….will we even be shopping on websites anymore in the future?! Spooky shit.

Funding news

Monogram Capital Partners acquired Luckyscent, a 23-year-old perfume eCommerce platform and specialty retailer with three Scent Bar locations. The deal will fund retail expansion to around dozen stores, brand development, and a subscription service. Luckyscent sells 450 brands and 3,000 fragrances.

The fragrance space is the fastest growing category within beauty/skincare right now, the opportunity here is clear as day. We dove into the booming fragrance space in our recent newsletter here!

Women’s health company Perelel secured a $27 million investment from Prelude Growth Partners, with participation from existing investors Unilever Ventures, Willow Growth Partners and Selva Ventures.

Perelel earned its fame for offering trimester-specific prenatal vitamins and solutions for various women’s health needs—available direct-to-consumer, on Amazon, and at Erewhon. The investment reflects growing investor interest in the women’s health market, with Perelel demonstrating strong customer retention and revenue doubling year-over-year since launch.

Another new non-alc. Aplós, the alcohol-free spirit brand, secured $5 million to scale production and expand its presence. They have seen triple-digit growth across their 2,000+ stores and 1,000+ menus in the US.

The non-alc space hasn’t picked up speed as much amongst consumers and we think that on-prem activations is probably the best route forward to build better category awareness. Victoria waters, co-founder of the The Dry Atlas, resource for non-alcoholic beverage enthusiasts, told us:

“Non-alc founders have poured their energy into retail and DTC, but most don’t have the marketing muscle to drive retail sell-through or lift DTC AOV high enough to offset shipping costs. Aplos shifting its focus to on-premise after the raise is the right move. That’s where trial is cheapest to drive, and their RTDs are built for that channel.”

Did you know we have a podcast? It’s called The Curious Consumer! Check out our recent episode, with new episodes every Wednesday.

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.