Magnesium is the new “it girl”

+ Naked Doritos and other CPG and retail news from last week

Hello hello!

We’ve been talking about AI search. A lot of people have. If you feel like there’s just so much noise and you don’t want to spend any money yet, you’re not alone. We partnered back up with Petra Labs to share how to start experimenting with GEO / AEO yourself, for free.

Figure out what your customers are searching for. A good start is your google search console and SEO tools like Semrush, but try to also look at the places online where your customers are having conversations about their problems (reddit, LinkedIn, tik tok). Oftentimes you’ll find real problem-based conversations that don’t show up in traditional search data.

Create high-quality, human-written, consistent content that answers those questions. Each post should be short (<600 words), answer one question only, link back to other relevant pages, and be super clearly written.

Pro tip: use a really descriptive URL slug. Just match it to the title of the article itself if you’re unsure.

Write about unique content that only your brand can. That could be a customer case study, internal data, a market report you made, a playbook, etc.

Measure success (or lack thereof) by the only metric that matters: AI-referred site-traffic. You should see results within 7-14 days of your first new content posting.

If you want to talk to some experts who do all of this for you, tell Petra Labs Nate & Jenna sent you :)

Now, let’s get into the news of the week →

News from the week

There’s a hot new mineral in town, and—like most things in wellness—it’s capitalizing on everyone being stressed, sad, and sleepy.

A few years ago, it felt like nobody was talking about magnesium. Now, magnesium products are launching or raising funds nearly every week. In the last two weeks alone:

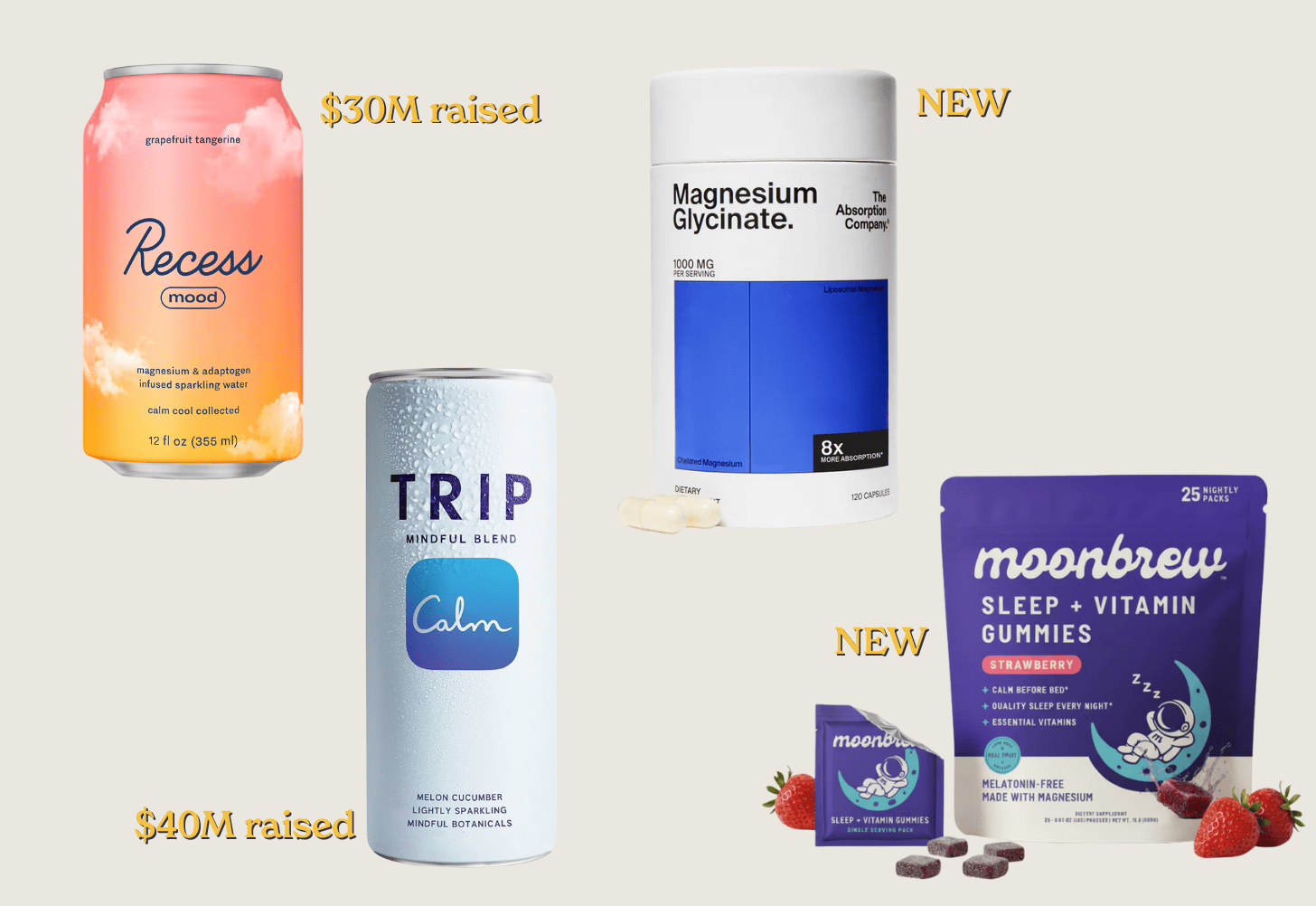

Recess, a “relaxation beverage” most known for its magnesium drink, raised $30M

The UK beverage brand TRIP secured a cool $40M to bring its magnesium “Mindful Blend” to the US

The Absorption Company launched its first-ever single-ingredient supplement, Magnesium Glycinate

Sleep supplement brand, MoonBrew launched its Sleep + Vitamin supplement in the increasingly popular gummy format

So where did all of this magnesium hype come from, and why now?

The basics: Magnesium is an essential mineral (and #12 on the periodic table, for our chem nerds) that’s vital for the body’s functioning. Magnesium deficiency is a problem—similar to how sodium deficiency is a problem—but pre-2020s, the average person didn’t seem to know much about this mineral. That is, until it was dust-ified.

Enter: The Dust Era* (not to be confused with the Dust Bowl).* Any Millennial wellness girlie can tell you: Moon Juice set the stage for supplements in the 2010s. The brand, founded by Amanda Chantal Bacon, built its rep on powdered supplement “Dusts” like Sex Dust, Beauty Dust, and Brain Dust.

When Bacon learned about magnesium deficiencies (and tied them to her own autoimmune condition + resulting imbalances), she decided to launch her own dust-y version—marketed specifically to women who experienced symptoms like anxiety, depression, PMS, and sleep troubles.

In August 2023, Moon Juice Founder Amanda Chantal Bacon launched Magnesi-Om—a casual $44 formula that combines three magnesiums plus L-theanine, turning pink when mixed with water—an Instagram-worthy visual that made supplementation feel like self-care ritual rather than medical intervention.

The genius was positioning magnesium as a lifestyle product. Sold at Erewhon and Sephora alongside beauty products, Magnesi-Om signaled: magnesium is a sexy supplement.

By early 2024, magnesium made its way to TikTok’s FYP. The “sleepy girl mocktail“—tart cherry juice, magnesium powder, and sparkling water—exploded during Dry January with 58.7 million TikTok views. Moon Juice’s pink powder became the star ingredient, and magnesium marketing took off.

**Now it’s 2025… and everyone seems to think they’re magnesium deficient. The symptoms magnesium supposedly treats read like a checklist of modern malaise: Brain fog and poor focus, difficulty sleeping, chronic stress, muscle tension, and digestive issues… just to name a few.

When you’re feeling any of the above (who isn’t?!), and TikTok doctors and wellness influencers suggest “you’re probably deficient,” it confirms what burned-out consumers already suspect: something is wrong, and it must be fixable with the right supplement.

Zeke Bronfman, Co-Founder of The Absorption Company, explained this perfectly:

“TikTok and social media have created a new kind of health education loop—people are discovering ingredients like magnesium through creators, functional medicine doctors, and long-form wellness content. This confluence has created a wave of growth for magnesium: the very ‘TikTokification’ of our lives that’s driving people toward stress, stimulation, and burnout is also the mechanism through which they’re discovering magnesium as a solution.” 😮💨

As a result, VC money is pouring in. Recess, which launched in 2018 as a CBD beverage, announced that 95%+ of its sales now come from its magnesium-based Recess Mood line. The brand’s $30M raise brought in CAVU’s Jared Jacobs, who explained the thesis: “There’s a $25 billion-plus energy drink market in the U.S. built on stimulation, and we believe there needs to be a counterweight built on relaxation.

Coefficient Capital’s Arpon Ray led TRIP’s $40M round, and shared a similar thesis:

“We’ve done proprietary consumer research and it shows that the timing is right for the calming category today—sleep, stress, and mental health are among the top health priorities for U.S. consumers. What makes TRIP special is that it takes powerhouse ingredients—magnesium, ashwagandha, lion’s mane, l-theanine—and makes them mainstream with mass-market appeal.”

TRIP’s strategy reveals the playbook: take clinically-backed ingredients from the wellness fringe and make them “delicious and approachable” for Target shoppers, not just Whole Foods devotees. The brand’s Wild Strawberry Mindful Blend became one of the UK’s biggest carbonated beverage launches this year.

As magnesium goes mainstream, brands are now competing on a new axis: bioavailability. The Absorption Company’s Bronfman argues the category is entering its second act:

“Consumers are becoming more and more aware of the importance of absorption… it is now clear that bioavailability is the next frontier in health and wellness. Google search volume is up exponentially, Supply Side West is now overflowing with absorption talk, and most of the big brands are trying to add ‘high absorption’ to their packaging or messaging in some form.”

With over $55M in recent funding across just two beverage brands—and a new battleground emerging around who can prove their magnesium actually works—the relaxation economy is just getting started. As Bronfman puts it: “We are still in the first quarter, but momentum is building every day.”

CPG & Consumer Goods

Losing your namesake brand. Miyoko Schinner’s bid to reclaim her plant-based dairy brand (Miyoko Creamery) failed, despite raising $103,000 on GoFundMe. The company entered insolvency back in October 2025. An undisclosed buyer won the auction for Miyoko’s Creamery, which Schinner founded in 2014 but was removed from as CEO in 2022 amid board disputes.

Miyoko took to LinkedIn with a very pointed message to the new buyer, questioning their vision for the brand. She emphasized that while the buyer owns the “Miyoko’s Creamery” trademark, they cannot use her name or image in marketing. The brand name could become “just an empty name, unrelated to any person, persona, or ethos.” She also challenged them on product quality (which customers say has declined due to cost-cutting reformulations) and asked if they have a visionary leader beyond “the usual suits in their data room.” 👏

It’s so cool to see a founder who cares this much about her brand!

Speaking of plant-based company fires… Meati, the mycelium-based alternative meat company, is back under a new owner and is now debt-free through a court-supervised process after the company entered bankruptcy alternative proceedings. The new owner, Yasir Abdul, invested $14.2M, resolved payroll issues, and plans a 2026 rebrand with national marketing. Mass layoffs occurred during restructuring, though some staff were rehired.

Birthday suit or bust. PepsiCo launched Simply NKD™, Doritos and Cheetos without artificial flavors or dyes—completely colorless, but apparently, same taste. Available December 1, the line includes Nacho Cheese, Cool Ranch, Puffs, and Flamin’ Hot varieties.

This comes off the heels of a handful of big CPG companies saying they’ll commit to dye free. We have a lot of thoughts on the dye-free movement, which you can read here.

But our biggest Q for PepsiCo right now is… who is this for?! The dye-free advocates are also likely anti-ultra-processed-foods more broadly, and probably aren’t going for these products—even when they’re of the NKD variety. This is probably more of a play to appease retailers than consumers.

Going granola. RIND Snacks, known for their dried fruit snacks that uniquely keep the peel (rind) on, launched Raspberry Almond Granola Squares exclusively at Sam’s Club nationwide—RIND’s first granola product since acquiring Small Batch Organics, a Vermont based granola manufacturer, in 2023.

Some high-highs and low-lows in infant formula:

ByHeart, an infant formula company, recently issued a voluntary recall of all Whole Nutrition Infant Formula products amid a botulism investigation. (More info on ByHeart’s site)

After a successful launch on Costco.com in July, Bobbie, the Certified Organic formula designed to be similar to European brands, won in-store placement at the big box retailer—projecting a retail revenue increase over 100% compared to last year.

Time to start caring about hand health. Paume, a luxury hand care brand founded in 2021, expanded to 700 Ulta Beauty stores and reached profitability. The brand offers elevated hand sanitizers and care products, focusing exclusively on hand care.

I have the hand sanitizer and love it! Especially as someone who is prone to destroying my cuticles, plus with the cold weather coming this brand is needed! - Nate

Retail

Amazon has been making moves with Whole Foods.

Whole Foods Market is opening two more Daily Shop locations in December: Brooklyn (Dec 11) and Hoboken (Dec 18), following the launch of its initial Daily Shop location on the Upper East Side in Sept. 2024. Data from the Lenox Hill store showed that 42% of its shoppers between September 2024 and May 2025 were new or re-engaged customers who hadn’t visited other NYC metro Whole Foods locations during the same period the previous year.

Amazon is integrating all 100,000+ Whole Foods employees (corporate and frontline) into its own systems through Project Cremini (like… the shroom?). This is Amazon’s latest move to solidify it’s grocery business including: revamping Amazon Grocery private label, expanding same-say perishable delivery, opening new Whole Foods store within a store Amazon concept stores, and making Whole Foods CEO Jason Buechel of VP of Amazon Worldwide Grocery Stores.

Funding news

Despite us entering our “relaxation era,” energy is still having a moment… and that’s on the dichotomy of man 🥳. Lucky Energy, a fast-growing energy drink brand (founded by the survivor of a plane crash—insane story), closed a $25M Series B led by Paine Schwartz Partners, with participation from North Fifth Services, Sequel, and Joyance Partners, to fuel further nationwide expansion (they’re already in 15,000 doors).

Clearly the energy drink market hasn’t been tapped out yet. Sure there are a few players that control most of the market (Red Bull, Celsius, and Monster), but many of the new brands are making quick strides. On top of Lucky Energy…

Mateína, the “clean” energy (yerba mate) brand co-owned by Andrew Huberman, just launched exclusively at Whole Foods.

Gorgie has been growing fast, raising $25M in April 2025, and has been adding doors like Target and Sprouts.

Also in April 2025, Alani Nu (now owened by Celsius) surpassed $1B in retail sales a year.

Even Monster is testing out a new energy drink line, Flrt, which we had some thoughts on in last week’s newsletter…

According to beverage industry expert Mark Gallo, “energy is entering its ‘craft beer’ moment”:

New energy brands like Lucky are quietly filling structural gaps in distributor portfolios. For years, energy has been a high-velocity but narrow category — dominated by legacy brands with little flexibility in pricing, placement, or innovation. Distributors carried volume, but not always variety.

Now, emerging brands are stepping into that white space: offering modern branding, differentiated functionality. Distributors aren’t just looking for cases that move — they’re looking for brands that evolve with the market.

A team-up that just makes sense. Chrissy Teigen joined Sanzo, the Asian flavored beverage brand, as an investor and partner. Sanzo was founded in 2019 and is currently sold nationwide at major grocery chains, including Whole Foods Market and Sprouts Farmers Market.

Kim Kardashian’s Skims raised $225M at a $5B valuation (for context, Gap’s market cap is $9B), led by Goldman Sachs. Approaching $1B in annual revenue, Skims plans to deploy the capital toward retail expansion and international markets. The brand is shifting from its direct-to-consumer origins to physical retail, currently operating 18 US locations along with a Nike collaboration

Private Label manufacturer TreeHouse Foods has been acquired by Investindustrial for $2.9 billion. TreeHouse manufactures everything from crackers, to pickles, to cookies, to coffees, to waffles for retailers like Walmart and Aldi.

Betting on chia jam. Smash Foods, a brand of superfood spreads and snacks (most known for its scrumptious, no-sugar-added chia seed jam), closed a seven-figure funding round led by Eclair Partners, with participation from Label Capital, The Family Fund, and a strategic supply chain partner.

People want their (gummy) supplements. Manna Tree, a global private equity firm, has made a strategic investment in Plant People, a fast-growing functional wellness brand known for gummy supplements. The brand achieved 95% year-over-year revenue growth and is the #1 supplement at Whole Foods, Sprouts, and Erewhon. Plant People also recently launched in over 820 Target stores nationwide.

Media meets money. Paperboy Ventures, originally a media platform for CPG founders, launches its first $3M fund to invest in Seed to Series A brands. 80% of that $3 million will be split evenly among around eight brands for checks of ~$280,000, with the remaining 20% reserved as additional follow-on for one or two brands.

“Paperboy Fund I is the next evolution of our DEALS content series. We’ve always promoted the brands we believe in, and now we’ll invest in them directly via our first dedicated fund.” - Kyle Fitzpatrick, founder Paperboy Ventures

Did you know we have a podcast? It’s called The Curious Consumer! Check out our recent episode, with new episodes every Wednesday.

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

Shocking that there isn’t a first mover in transdermal magnesium - the most bioavailable of all. Guess that will be us!