Men want to smell good now.

CPG and retail news from the week of 10/13/25

Hello hello!

Influencer marketing is getting expensive. Beyond the partnerships themselves, the tools necessary to source, gift, and create affiliates + contracts add up so quickly.

That’s why we’re so excited to partner with the folks at Endlss, the influencer platform that lets you use all of its features… for FREE. Endlss makes every dollar count with…

A free tier that’s ACTUALLY useful, giving you access to its full tooling

Pricing scales with you—at half the price of other solutions!!!

Real numbers: 5¢ CPC, 61% CAC reduction, 14x ROI

With Endlss, you can discover the best influencers for your brand, manage UGC agreements, issue smart affiliate links, and so much more... all in one platform.

Make every influencer dollar count. 👇

Now, let’s get into the news of the week →

News from the week

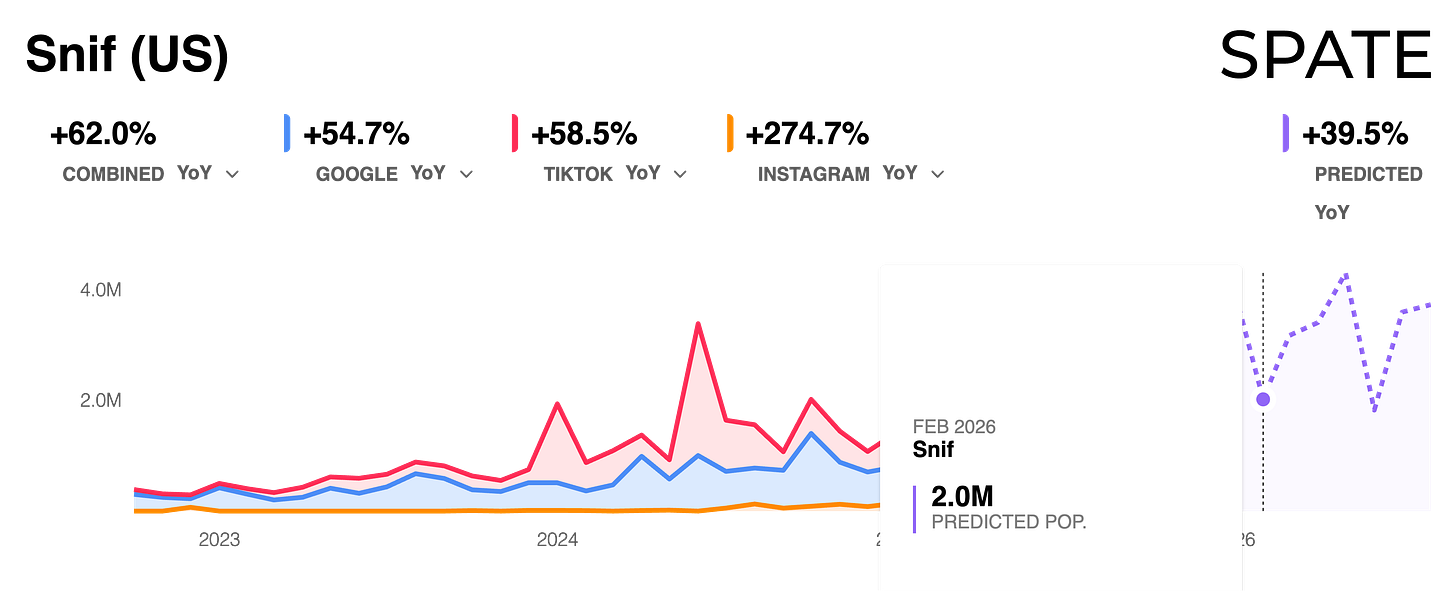

This week, Snif—the popular “genderless” DTC-first fragrance brand known for its affordable, quality scents—announced Notewrks, a subbrand explicitly targeting young men going live in December. And the timing couldn’t be better.

Why? Because, for the first time (at least, in our knowledge of the male race), younger men aren’t seeing fragrance as something reserved for Rolex-wearing finance bros dressed by their girlfriends. They’re seeking out scents themselves.

Let’s back up: Snif has been positioned as “genderless” from day one. Co-founders Bryan Edwards and Phil Riportella (neither from beauty backgrounds) built the brand specifically to challenge traditional fragrance norms, seeing gendered fragrance as an outdated industry standard. The brand took off thanks to its…

…innovative “try-before-you-buy” model (get 3 full-size bottles + samples, test for 7 days, only pay for what you keep—first-of-its-kind in fragrance!)

…drop culture strategy, which regularly sold out at launch

…Gen Z focus and “scent board” made up of 55% Gen Z (and 40% male)

Five years later, this “genderless” brand is on track to hit $40 million in gross revenue for 2025 and has raised over $27 million in total funding with distribution across 1,500+ Ulta doors and a 50+% repeat purchase rate on DTC. So why are they launching a men’s-focused line now? As Edwards explained: “Men’s fragrances are a multimillion-dollar market that don’t have an accessible luxury option.”

And boy (pun intended), are they right about the market opportunity. Men’s fragrance spending surged by 26% in just one year, with the men’s fragrance segment projected to grow at an 8.94% CAGR from 2025-2030, outpacing both its female counterpart and the overall market. On Amazon alone, men’s fragrance is growing by 19%.

So, what’s driving this fragrance frenzy? Two converging trends: men’s grooming going mainstream and Gen Z’s broader entrance into scents—with social media acting as the catalyst for both.

Guys are glowing up. More than half of US men now use facial skincare products—a 68% increase from 2022. Ten years ago, a guy with a ten-step skincare routine would’ve been roasted. Now? He’s getting millions of views on TikTok. Influencers are giving men “permission” to use scents and skincare, transforming what was once seen as “feminine” into aspirational self-care.

And, like any social media-driven trend, teens are leading the charge—bringing a whole new segment to the fragrance market.

TikTok Shop surpassed more than $100 million in fragrance sales over the past few years, providing awareness for brands without bandwidth to get retail distribution.

Gen Z consumers are spending $204.15 a year on cologne and perfume—$38 more than the average consumer.

And unlike previous generations who wore “signature scents,” Gen Z opts for a “fragrance wardrobe” that enables them to choose fragrances based on mood—leading to demand for smaller, affordable options that can be mixed and matched.

This creates the perfect storm for brands in the under-$100 space. Snif’s fragrances are priced at $65, while brands like Dedcool ($90), Noyz ($85), and Lore ($88) are all carving out space in what’s being called the “masstige” segment (mass + prestige).

This shift is especially pungent (sorry) in men’s fragrance, where traditional luxury brands have dominated with $200+ bottles positioned as lifetime investments. When the “signature scent” model dies, so does the justification for that price point. As Edwards told us:

“Men today want variety and discovery, but we’d make the bet they don’t want to spend $200 every time they experiment. That’s the white space: high-end quality at accessible pricing.”

And retailers and brands are taking notice, rapidly expanding their accessible men’s fragrance offerings:

Target is committing prime real estate to men’s lines such as Papatui, Harry’s, Bevel, Scotch Porter, Mando, Dr. Squatch, Duke Cannon, Every Man Jack, Native and Old Spice.

Harry’s, the men’s grooming brand, launched its first three colognes at $35 for a 50ml bottle, developed in partnership with French fragrance house Mane—betting on accessible luxury with sophisticated scents without the luxury price tag.

So, what’s next? For the first time, there’s a real men’s fragrance revolution happening. Young guys are treating fragrance as self-expression instead of obligation, and demanding accessible price points that let them experiment.

The old playbook—one signature cologne, serious masculine branding, luxury pricing—is dead. For brands that can offer quality at accessible prices while making men’s fragrance feel less intimidating and more fun?

The opportunity smells pretty sweet. 🫡

CPG & Consumer Goods

Hold my shake—more protein news incoming:

Barebells, the brand known for its candy-like protein bars, launched Protein Soda, a 12oz drink packed with 10g of protein and 200mg of caffeine.

Protein soda is quickly becoming a crowded space in the world of protein. Barebells is joining brands like Clean Simple Eats, Don’t Quit, Bucked Up, Genius Gourmet, Protein Pop, and Waay. Wouldn’t be surprised if Olipop comes out with a protein soda soon!

This is actually an energy drink, but it’s loudly + proudly called Protein Soda. That 200mg of caffeine is nothing to scoff at, on par with most energy drinks—but the packaging confidently stands on protein messaging. It’s a bit misleading, and also begs the question of use case: Protein is often consumed post-workout, while 200mg of caffeine would be far more useful as a pre-workout. To me, this feels like a smattering of trends without a ton of thought put into it—but I’d love to be proven wrong! - Jenna

The other *interesting* choice here is Barebells’ distinct departure from its bar branding. Its bars, most recognized by their matte black border, look completely unrelated to these pastel-y cans. - Jenna

Pop-Tarts launched its first-ever protein innovation with three classic flavors—Strawberry, Brown Sugar Cinnamon, and Blueberry—each with 10g of protein per serving, available nationwide this November.

Right trend, wrong application. If you listened to our second pod episode on protein, you’d know how we feel about this kind of innovation. There’s nothing sticky about throwing some extra protein into an otherwise conventional, sugary snack—this is the “protein bubble” that we bet will burst. - Jenna

Quick, someone pull the macros on lead. This week, the internet lost its collective mind over a finding from Consumer Reports that showed “high levels of lead” in protein powders and shakes.

The finding has been shouted from the rooftops by some, and strongly contested by others, who claim it’s a fear-mongering tactic (a criticism that Consumer Reports frequently receives). We’ll let you come to your own conclusion.

Smucker’s is coming for TJs. J.M. Smucker is suing Trader Joe’s for allegedly copying its Uncrustables sandwiches with similar packaging and design, claiming this constitutes unfair competition and trademark infringement.

I wouldn’t be surprised if we see more of these lawsuits come forward as private label has continued its domination across pretty much every retailer, not just strictly private-label ones like Aldi and Trader Joe’s. - Nate

Is Target the new wellness destination? It seems like it:

Plant People, a “clean” gummy supplement brand, is now available at Target, challenging sugary legacy brands with zero-sugar gummy options.

Cymbiotika, a DTC liquid supplement brand which just hit $200M in sales, also launched at all 1,900+ Target stores.

Dates are hot right now! The team behind Dr. Smood is launching Smood Sweets, a new candy brand featuring candy-coated dates. Dr. Smood is also behind the sea moss beverage brand Moss.

eCommerce

Hey ChatGPT, buy toilet paper. Walmart is partnering with OpenAI to enable AI-powered shopping through ChatGPT itself, allowing customers to purchase straight from Walmart. Users can link Walmart accounts, discover products, and checkout instantly. This comes just after the big news that ChatGPT users can shop directly with Shopify brands within ChatGPT itself. Check out our analysis on what this means here.

But… how do brands *actually* get discovered on ChatGPT? We just met the incredible founder behind Petra Labs—the smartest AI discovery platform + partner that we’ve encountered—and he has some answers. Check them out if you want to win AI search before the big guys beat you to it.

“Chat, do we like this mascara?” E.l.f. Cosmetics is partnering with Amazon Ads to introduce the first in-stream shopping feature on Twitch. This allows viewers to purchase beauty products directly during live streams, tapping into the growing social shopping trend—especially in the beauty industry.

Retail

From DTC darling to retail darling. Bombas, the mission-driven DTC sock brand (that seems to be sponsoring countless YouTubers), is opening its flagship store in NYC (featuring socks and other apparel) and partnering with Target and DSW to expand its retail presence—aiming to grow its wholesale business by 10% in the coming years.

Bombas has built an insanely successful sock business, with over $2 billion in sales and 150 million donations made to shelters in its one-for-one donation model.

Funding news

The next 100-year brand. Chobani raised $650 million, reaching a whopping $20 billion valuation. The funding will support continued expansions in New York and Idaho, including a $1.2 billion dairy processing plant in Rome, New York, creating 1,160 jobs. Chobani expects $3.8 billion in sales this year, up 28% from last year, continuing its growth since founding in 2005.

We said this months ago: We’re unlikely to ever see another century-spanning brand like Coca-Cola or Hershey in today’s fragmented market… but Chobani just might be the exception. They helped build the Greek yogurt category when Greek yogurt represented less than 1% of the US market. Today? It’s 50% (and likely growing alongside consumer obsession with protein + return to animal products).

The Mammoth grows. Mammoth Brands, the CPG holding company behind Harry’s, Flamingo, Lume, and Mando, signed a deal to acquire Coterie, a premium baby care brand, expected to close by the end of 2025. This acquisition taps into the $12 billion diaper market and positions Mammoth Brands as a key player in baby care.

Luxury beauty is changing. Kering, the French luxury group that owns brands like Gucci, Bottega Veneta, and Balenciaga, is reportedly in advanced talks to sell its beauty division to L’Oréal for about $4 billion, which includes the fragrance brand Creed and rights to develop products for its fashion labels.

Unilever parting ways. Rare Beauty Brands acquired skincare brand Kate Somerville from Unilever. The acquisition aims to revitalize the struggling skincare brand and expand Rare Beauty’s presence in the luxury skincare market. Kate Somerville joins Rare Beauty’s skincare portfolio alongside Patchology and Dot Dot Dash.

Time to sell? Bubble Skincare, the teen-focused buzzy skincare brand, enlisted Centerview Partners to explore strategic options as it eyes expansion after rapidly growing its U.S. footprint and entering the UK market. With its products reportedly selling out every 10 seconds and with distribution across 12,000+ stores, sounds like it might be time.

If you haven’t yet, please subscribe, like, and leave a comment! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.