The rise of branded fruit

CPG and retail news from the week of 10/27/25

Hello hello!

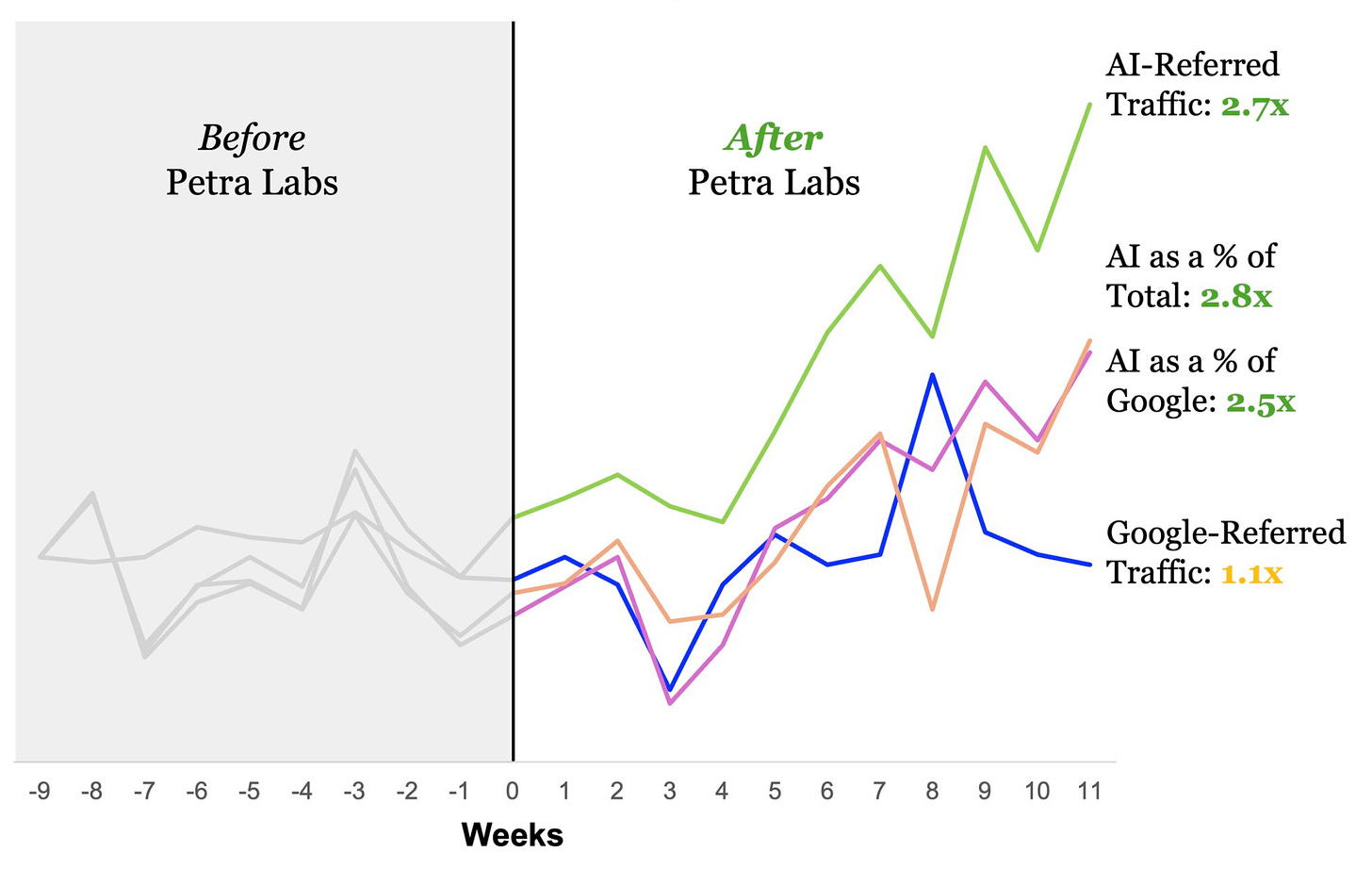

Over the past few months, we’ve been talking a LOT about the shift to AI Search and what it means for consumer brands.

Even having worked with DTC/CPG brands for years, we’re honestly still trying to understand this beast of a topic ourselves. We’ve been looking for experts who understand this topic deeply (not just those who jumped on the GEO bandwagon), and discovered Petra Labs: a combo of a brilliant software and an agency that manages AI discovery end-to-end.

Basically, their software reverse-engineers how and why ChatGPT recommends brands, and then their service team actually does the work and writes the custom content that gets your brand mentioned in the right places (yes, actual humans are behind every piece of optimized content they write).

Petra Labs customizes both their software and services for every brand that they work with, so your customers can find you on tomorrow’s most important channel: ChatGPT. Here’s a real example from one of their current, happy customers:

If you aren’t taking a step towards AI discovery for your DTC brand… you’re already behind.

Start with a baby step by booking a call with the pros at Petra to learn more!

Now, let’s get into the news of the week →

News from the week

This week, Fruitist raised $150 million led by JPMorgan and Ray Dalio’s family office, boosting its value to over $1 billion…for blueberries. Giant blueberries, but blueberries nonetheless.

We’re not talking about a blueberry energy drink, protein powder, or hydration powder. Just really big, literal blueberries in a package with some fun branding and an absurd valuation.

It’s officially time to unpack the world of branded fruit. →

First, let’s get into the ~technicality~ of it all: Is fruit even CPG?

Traditionally, CPG means packaged, branded products that get used up and repurchased frequently. Picked an apple on flannel-clad apple-picking adventure this Fall? That’s produce, owned by no one but Mother Nature. That’s not CPG. But take that same apple, put it in a clamshell with 5 more apples, and slap some cute branding on the package? Suddenly… we’re talking CPG.

And the shift is real: Packaged produce has grown from 53% to 62% of sales since 2018. More fruit is now branded, packaged, marketed, and positioned just like any snack brand. The produce aisle is increasingly starting to function like the rest of the grocery store.

Walk through any grocery store and you’ll see what looks like simple produce. But look closer at those little stickers, and you’ll realize you’re already buying branded fruit without even knowing it:

Cuties (owned by Sun Pacific): Those seedless, easy-to-peel mandarins are actually a brand, and they’re competing against Halos (owned by Wonderful, as in Wonderful Pistachios).

Cotton Candy Grapes (owned by Grapery): Took 12+ years to develop grapes that taste like Cotton Candy… so yes, they’re a brand.

Sumo Citrus (owned by AC Brands): These have become so popular that people now look forward to “Sumo season,” spending nearly $62 million on them in 2021. Most don’t realize it’s a trademarked brand.

Even those familiar produce giants like Chiquita (brand name launched in 1944) and Driscoll’s (marketed as Driscoll’s since the 1940s) are all brands that have been playing this game for decades. Driscoll’s alone is the world’s largest berry company, yet most consumers barely register it as a brand.

So why is Fruitist different? They’re taking branded fruit to the next level. Fruitist started in 2012, focusing on Peruvian blueberries. Now, they operate vertically integrated farms worldwide and have expanded to blackberries, raspberries, and cherries—all under the Fruitist brand.

With $400 million in sales and presence in 12,500+ stores, they’re not just playing in the produce category. And yes, a good portion of that success comes from growing genuinely high-quality fruit. But the rest is looking a whole lot like traditional CPG…

Innovative form factor. Fruitist turned blueberries into portable Snack Cups—fresh, premium, resealable containers designed for on-the-go snacking.

New merchandising. Instead of hiding in the fridge drawer, Fruitist blueberries are getting dedicated coolers in stores—just like Red Bull or Celsius!

And even ambassadors. From star quarterback Caleb Williams to USC Athletics and D.C. United, Fruitist is marketing like “Got Milk?” did for dairy—making fruit aspirational.

Fruitist CEO Steve Magami isn’t being subtle about the strategy: “Regular blueberries are for the blender. These are snacking berries to replace a meal.” They’re not competing with other blueberries. They’re competing with RXBARs.

The brand (and everyone talking about this raise) are quick to credit the GLP-1 medication boom for fruit’s moment. And yea, it’s true: GLP-1 consumers do gravitate towards low-calorie, high-fiber foods like berries. But we see things differently. This “trend,” like protein, has been building for decades.

The better-for-you movement isn’t new. We’ve been moving away from ultra-processed foods and toward whole ingredients for years. And now, in a world where every packaged snack category is saturated with new entrants and consumers are simultaneously health-conscious and bored, produce suddenly has room to innovate through branding alone.

For decades, Cheetos has had a bigger marketing budget than broccoli. Tony the Tiger is more recognizable to kids than a bell pepper. Ultra-processed snacks have dominated shelf space, consumer mindshare, and marketing dollars—not because they’re better, but because they had capital-B brands.

Platform brands like Fruitist are leveling the playing field, giving whole foods the marketing muscle to compete. This is decades of consumer education around health, ingredients, and nutrition finally meeting the infrastructure to scale.

Add in the broader shifts:

Snackification. Americans graze throughout the day rather than eating structured meals

Ingredient simplification. Consumers are exhausted by long ingredient lists, and are looking for whole food options

Convenience culture. The people want grab-and-go options!!

Fruit was always healthy. It just never had a big enough megaphone. And now, Fruitist is the marketing platform with potential to elevate an entire food category.

The question isn’t whether produce will become more branded. That ship has sailed. The question is whether this branding will add genuine value—consistent quality, better flavor, real innovation—or whether it’s just slapping fancy names on commodity produce to charge premium prices.

Based on Fruitist’s billion-dollar valuation, someone’s betting big that consumers want their fruit to be brands.

CPG & Consumer Goods

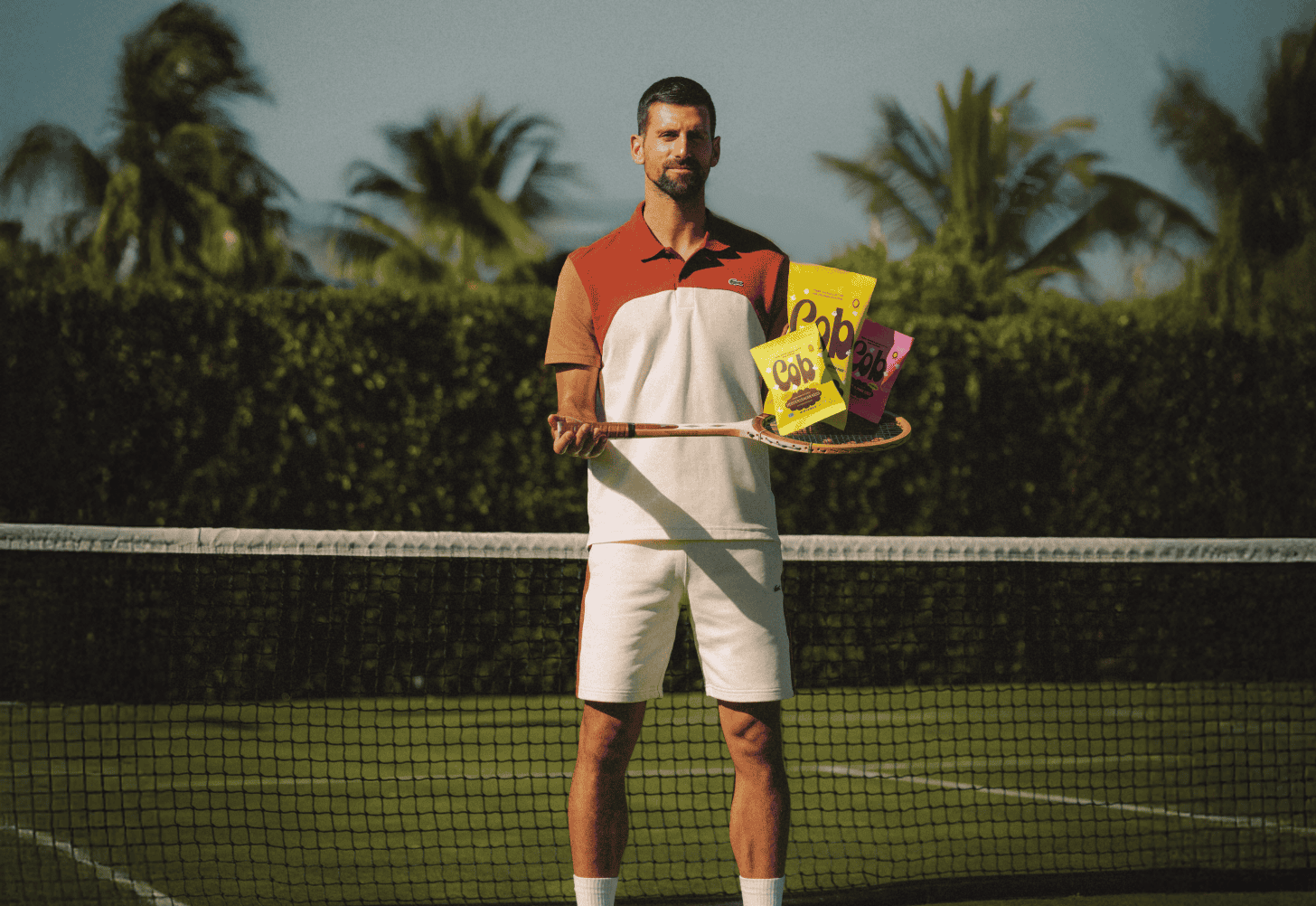

Djokovic serves up a new snack. Tennis legend Novak Djokovic joined Cob, a sorghum-based (corn free) popcorn brand, as co-founder and led a $5 million seed round into the company.

Djokovic has been loud about his gluten-free (and overall very health-conscious) lifestyle. He’s already the founder of a supplement brand, Sila, which leans more on performance messaging and branding. Now, he’s entering the world of snacking with a more fun, universal, lifestyle-centric brand with Cob.

And it makes sense, because popcorn is having its celeb moment. Over the past few years, we’ve seen a slew of new popcorn brands backed by celebs: Rob’s Backstage Popcorn (Jonas Brothers), Khloud Protein Popcorn (Khloé Kardashian), and Boldly Grown Popcorn (Luke Bryan).

While most of the messaging around this brand revolves around its health claims, I’m especially excited to see this launch bring attention to sorghum more broadly. I love that this 10,000-year-old grain is getting its moment in the spotlight, because it’s also more sustainable than corn! It’s a drought-tolerant and heat-resistant crop, meaning it requires a lot less water to grow and is adaptable to a changing climate. Shoutout to Chasin’ Dreams Farm for first exposing me to sorghum with their fantastic puffs (you gotta try the Sour Cream + Onion!). - Jenna

Danone’s yogurt dilemma. Danone is struggling to meet surging demand for high-protein yogurts due to manufacturing constraints, limiting innovation across its portfolio. With half of its U.S. offerings being Greek yogurt, the dairy giant is racing to expand production capacity to keep pace with consumer appetite.

Meanwhile, it looks like Chobani (the next 100 year brand) will continue to take the reins, having raised $650 million at a $20 billion valuation to fuel massive expansions including a $1.2 billion dairy processing plant in New York and a $500 million expansion in Idaho that will increase production by 50%. The Greek yogurt giant—the U.S.’s top selling yogurt brand in 2024—is on track for $3.8 billion in sales this year (up 28% from last year) and continues to dominate a category it helped build from less than 1% to 50% of the US yogurt market.

POV Beauty lives up to its name. Seven months after launching with skin prep products, POV Beauty—the beauty brand by influencer and makeup artist Mikayla Nogueira—launched its first makeup product: the Amp It Lip Kits, featuring six shades and hydrating ingredients.

Nogueira strategically launched POV Beauty in March 2025 with five skincare products, positioning skin prep as the foundation before expanding into color cosmetics. She explains that starting with skincare was intentional—treating it as an “appetizer” to build brand credibility and educate her audience on proper makeup prep, despite being widely known for her full-glam makeup content.

We can’t believe we’re writing these words, but Erewhon is launching its first toothpaste-inspired smoothie (🥴) in partnership with Boka, a fluoride-free “mindful” toothpaste (sounds riiiight up Erewhon’s alley). This $11 mint + cacao smoothie honestly shouldn’t come as a shock at this point, especially following Erewhon’s collab smoothie with Vacation sunscreen. With enough clout, anything can be smoothie-fied. 🤷♀️

Time to munch down on more meat sticks. Snacking sensation Chomps is opening a 160,000-square-foot plant in Nebraska by 2027 to boost production by 15%, responding to surging demand for protein-packed snacks.

Chomps has been CRUSHING it since launching back in 2012, with impressive 161% year-over-year sales growth that far outpaces the category’s 16.1% growth. The brand’s big break came in 2016 when Trader Joe’s placed an initial order for a million meat sticks across 400+ stores after an executive’s daughter discovered them while doing Whole 30. After bootstrapping for a decade, Chomps secured an $80 million investment from Stride Consumer Partners in 2021, helping rocket retail sales from $45 million in 2020 to nearly $250 million in 2023! Highly recommend this CNBC Make It video on the brand.

So plant-based meat isn’t dead…yet. MyForest Foods, a mycelium bacon and pulled pork brand, is now in Whole Foods locations nationwide, increasing their retail footprint to over 2,500 points of sale—bucking the trend as U.S. alt meat sales drop 10.2%.

The first of many. Model and content creator (known for her #tradwife content) Nara Smith partnered with Algae Cooking Club to launch her first culinary product: Nara’s Roasted Garlic Oil. This limited-edition infused oil combines roasted garlic, yuzu, white miso, and charred scallions in algae oil.

This is a BIG deal—Nara is known for her culinary creations, but unless you are also a 24-year-old model with seemingly 8 more hours per day than the average person, you probably haven’t gotten a chance to whip up one of her elaborate (to say the least) recipes. As her first culinary product, this oil offers the first chance to recreate a Nara experience at home with little-to-no labor required. And this is incredibly organic to Nara, this is what she makes in her own kitchen.

I’m most excited that this will bring a whole new audience to algae oil. It would’ve been easy for Nara to collab with an avocado oil or buzzy olive oil brand (👀) that wouldn’t require much education for her audience. Instead, she opted to partner with the little-known algae oil. From a branding perspective, it makes sense for her: it has a neutral flavor and a very high smoke point, making it very versatile for cooking. Plus, it has only a fraction of the omega-6 fats as other oils, which makes it a great option for seed-oil-spooked folks. But when these culinary- or health-focused consumers start gravitating to this new oil (thanks to Nara), they’ll also accidentally make the most sustainable choice: made from algae, this oil emits half the amount of carbon as other plant-based oils, and uses much less land and water. Win-win-win. - Jenna

All the trends in one. BelliWelli’s new Daily Fiber Gummies combine fiber, probiotics, and collagen into one gummy bite, launching exclusively at Walmart.

Everything comes in gummy form these days. Functional gummies have exploded in popularity, with brands like Lemme, Gruns, and Bloom leading the charge. Consumers want convenience more than ever, and gummies are a fun, easy, tasty way to deliver function.

Meanwhile, fiber is experiencing a parallel surge. Over the next year, everyone and their mother will be adding or launching fiber-rich products. Whole Foods recently named fiber as a key trend on their 2026 list.

PepsiCo (corporate) gets a makeover! The beverage giant unveiled a new corporate brand identity, including a new logo and tagline (NOT for the Pepsi brand itself, but the Pepsico holding company that has 500+ portfolio brands).

The tagline, “Food. Drinks. Smiles.” is

laaaaamean attempt to help the 79% of consumers who can’t identify a single brand under Pepsico other than Pepsi (couldn’t be us).

Retail

Diving head first into beauty. Old Navy Beauty Co. launches a family-friendly line of body, skincare, and haircare products, debuting in 150 stores with prices ranging from $7.99 to $16.99.

This move is clearly designed to attract younger consumers like Gen Z and Gen Alpha, increase cultural relevance, and capitalize on the booming beauty market. A category we’ve seen more and more brands target recently like brands launching like Sincerely Yours and Yes Day.

Uber Eats adds another partner. Kroger partners with Uber Eats to deliver from 2,600+ stores starting early 2026, enhancing loyalty programs and e-commerce strategy. This follows a similar DoorDash partnership, marking Kroger’s shift toward store-level fulfillment over automated warehouses.

They’re not alone: Uber Eats has been on a partnership spree, recently teaming up with Hy-Vee, Save Mart, The Fresh Market, and other major grocers, as well as non-food retailers like Best Buy, Five Below, Big Lots, and Dollar General to expand its delivery footprint across the country.

eCommerce

Let’s get personal. Pinterest launched an AI-powered visual assistant that enables personalized, conversational shopping recommendations. Built on visual AI rather than text, it allows for its 600 million monthly users to discover and shop by understanding their style preferences, saves, and boards.

Funding news

Keurig Dr Pepper gets a $7B boost. The beverage giant secured $7 billion from private equity to fund its $18 billion acquisition of JDE Peet’s, addressing investor concerns and positioning itself to become the world’s largest pure-play coffee business.

From CBD to relaxation. Recess, the relaxation beverage brand, has raised $30 million in Series B funding led by CAVU Consumer Partners, with participation from Rocana, Midnight Ventures, Torch Capital, Doehler Ventures, and KAS Venture Partners.

Since launching in 2018 as a CBD-infused sparkling water brand, Recess has become a leader in the functional beverage space with iconic branding that helped define modern CPG aesthetics and beverage trends. Of course Recess didn’t invent functional beverages, but it was hugely influential in kicking off the category’s explosive growth over the past several years.

The company has also successfully pivoted to capitalize on two major trends—functional wellness and alcohol alternatives—through its magnesium-based Recess Mood line and mocktails, now distributed across 15,000+ stores nationwide. And the Mood line? It now drives nearly all sales!

Homecourt, the fragrance brand founded by Courteney Cox, just secured $8M in Series A funding led by CULT Capital. The brand launched back in 2022 and alongside their DTC channel they’ve expanded into 300+ doors including Blue Mercury, Nordstrom, and Revolve.

I just love how she played a neat freak on TV for 10 seasons and then launches her own cleaning brand years later. I want to see them lean into that more! Especially with so many people still watching Friends and leaning heavily into nostalgia. - Nate

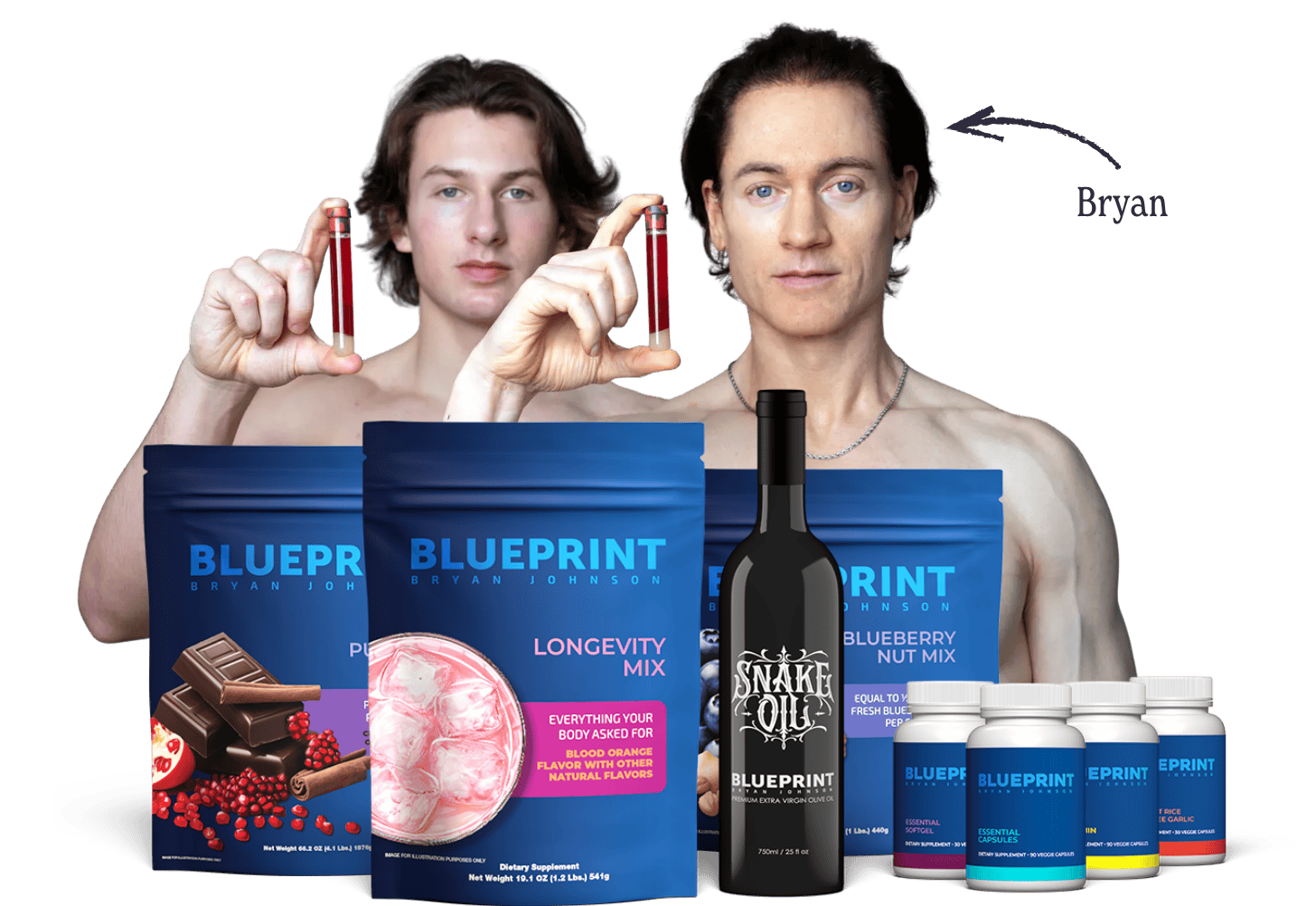

You too can live forever. Bryan Johnson, yes the guy famous for penis shock therapy treatments, blood transfusions from his son, and downing 111 daily pills, raised $60 million for his brand Blueprint to help “democratize” longevity. The brand is backed by influential investors including Kim Kardashian, Naval Ravikant, Logan Paul, and Paris Hilton.

Justin’s breaks free. Hormel Foods is spinning off Justin’s into a standalone company, with Forward Consumer Partners owning 51%. Founder Justin Gold—who started the brand in 2004 and has since served as Chief Innovation and Strategy Officer at Rudi’s Organic Bakery—will return as a strategic advisor and board member. Former CEO Peter Burns, who led Justin’s at the time of the 2016 sale to Hormel, is also returning to helm the company!

This spin-off is part of a broader trend of legacy CPG companies restructuring to focus on core business. In 2023, Kellogg’s split into Kellanova and WK Kellogg which earlier this year, was then sold to Ferrero for $3.1 billion. Mars has agreed to acquire Kellanova for $36 billion. Kraft Heinz is also reportedly exploring a potential $20 billion separation into two focused companies. Even Unilever has been restructuring, announcing plans to spin off its ice cream business into a standalone entity.

Did you know we have a podcast? It’s called The Curious Consumer! Check out our recent episode, with new episodes every Wednesday!

If you haven’t yet, please subscribe, like, and leave a comment! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

That Pepsi Co rebrand...woof

I hate blueberries. I saw The Fruitist blueberries at Trader Joe’s a couple of years ago and tried them. And now I love blueberries, go through multiple packages of these a week and am sad when Trader Joe’s is out of stock. Clearly the marketing has worked on me but also it’s a dang good product.