The truth about electrolytes...

CPG and Retail news from the week of 7/21/25

Hello hello!

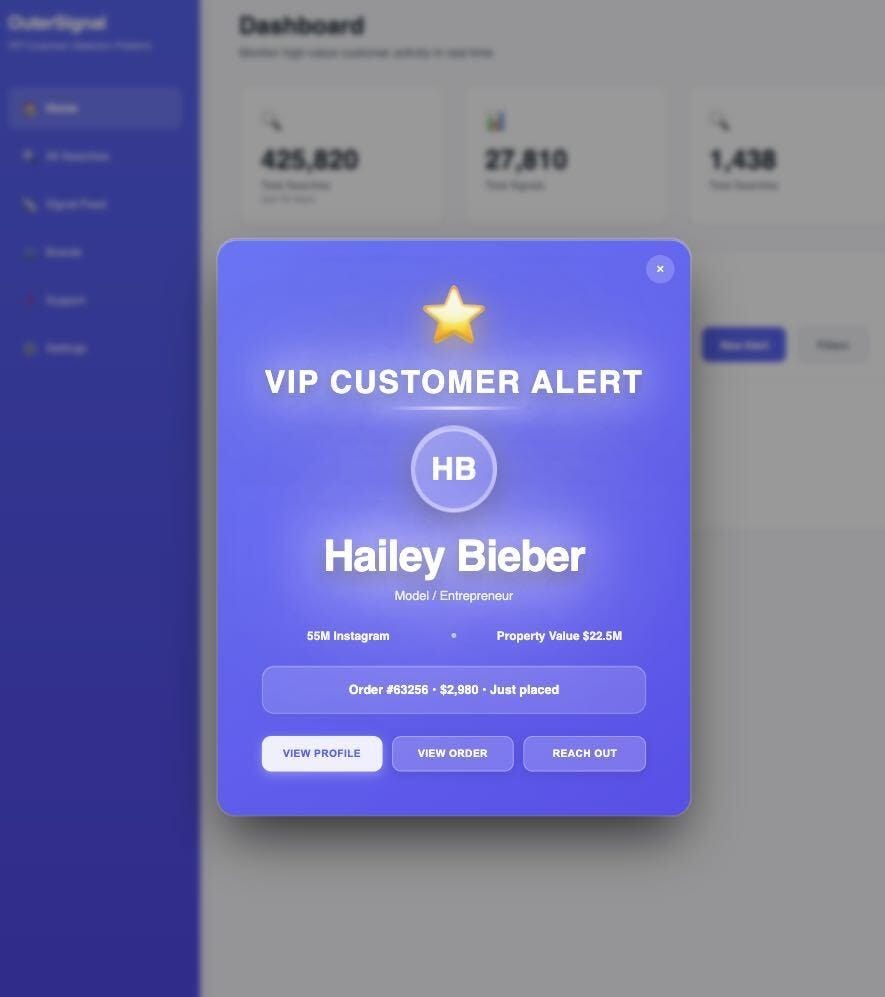

This week, a friend introduced me to what might be the coolest e-commerce tool I’ve ever seen: It tells you when a VIP customer places an order—celebrities, influencers, even buyers from major retailers. You can see exactly who’s buying and their social following.

Most brands have no idea when these game-changing customers are ordering. But knowing if your customer is Brad Pitt, a Walmart buyer, or a big investor? That’s pure gold.

I was so impressed, I became an affiliate partner. My buddy is offering Express Checkout readers some free credits to try it out live. Just reply to this email and I’ll connect you! - Nate

Now, let’s get into the news of the week →