Tweens get their own skincare brand

CPG and retail news from the week of 9/8/25

Welcome back!

Just this morning, Red Bull announced that it officially kicked off construction on a $1.7B plant in North Carolina, set to can 3 billion energy drinks annually by 2028. 🤯

That’s one massive bet on the future of energy drinks… and we weren’t surprised in the least. In our latest pod episode, we dove deep into exactly why the energy drink category is absolutely exploding right now (and why moves like this were basically inevitable).

Want a full breakdown on the energizing world of energy drinks? Listen (and subscribe) below! 👇

P.S. If you have any feedback, ideas, or guest ideas for future episodes, feel free to email us!

Now, let’s get into the news of the week →

News from the week

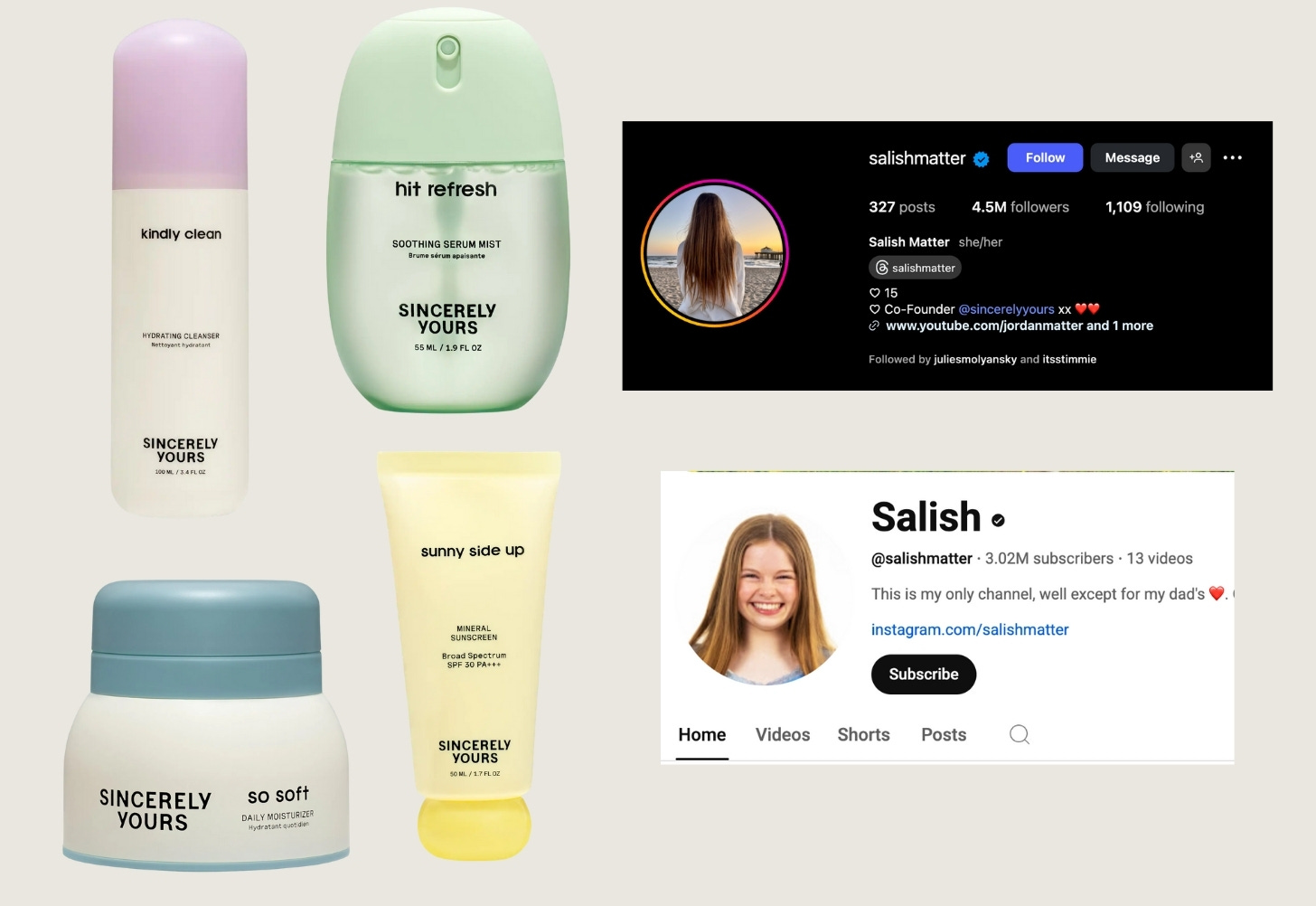

Over 80,000 screaming teens packed into a New Jersey mall this past weekend for… skincare. Sincerely Yours, the new teen-focused skincare brand co-founded by 15-year-old creator Salish Matter, held its launch event at the American Dream Mall—breaking attendance records previously held by MrBeast and Hailey Bieber. Dedicated fans lined up starting at 4 AM, and some even camped out to guarantee their spot (or one of the now-sold-out brand hoodies).

With an audience of over 35 million, Salish is a true Gen Alpha/Z celebrity. But, creator hype aside, thousands of tweens are essentially losing their minds over… face wash. So what’s really happening? →

Tweens have always had acne (trust us 🙃). But BTT (Before TikTok), teen skincare was purely functional: harsh, medicinal products hidden in medicine cabinets (think: Proactiv and Clearasil with sterile packaging and clinical messaging).

…then TikTok happened. "Get Ready With Me" videos transformed daily routines into entertainment and a moment of vulnerability/relatability.

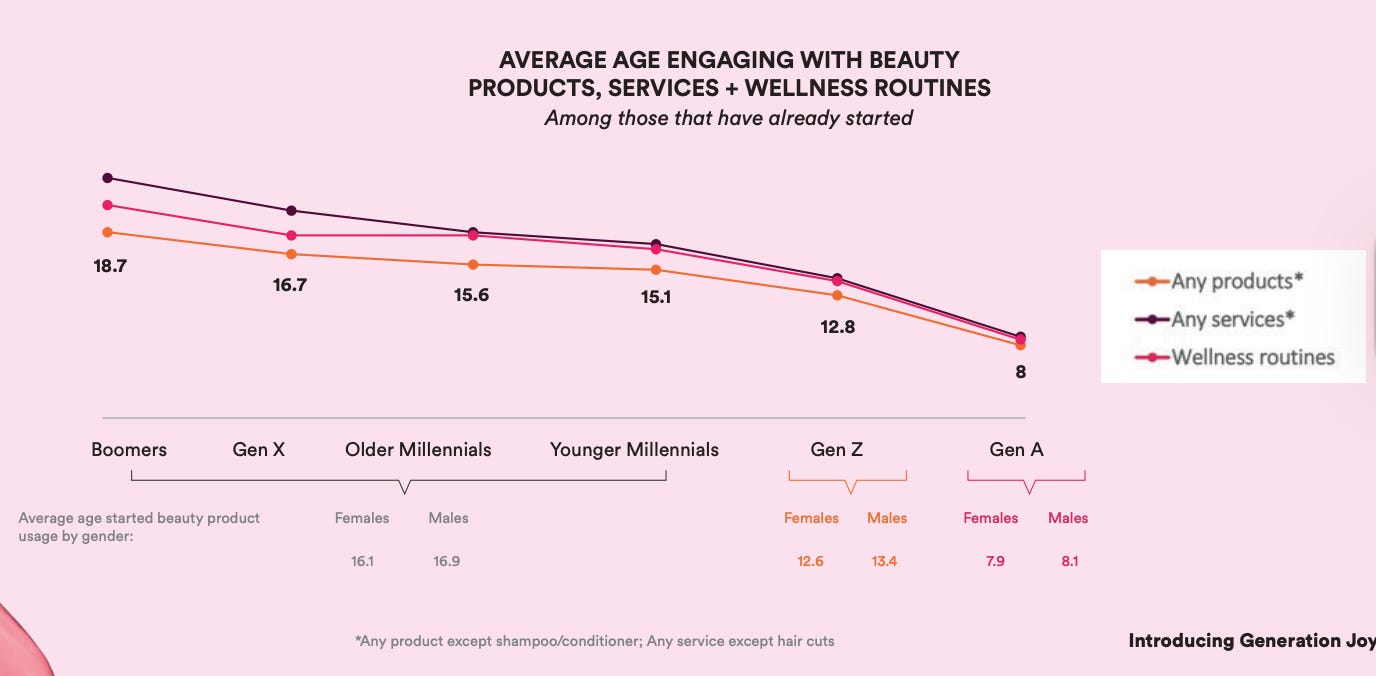

Now? Young girls ages 7 to 18 use an average of six different skin care products on their faces, turning what was once a quick face wash into a ritual worthy of documentation.

While Gen Z started experimenting with beauty products around age 13, Gen Alpha is starting at the ripe age of 8.

Suddenly, skincare wasn't just about clearing acne—it was about self-care, community, and identity expression.

The tipping point came when Gen Alpha discovered Drunk Elephant—a brand never intended for teens. Its brightly-colored packaging makes for very social-worthy content… and Gen Z/Alpha latched on.

But there was a problem: these products often contain active ingredients that are too harsh for children, like retinol, glycolic acid, and vitamin C.

Drunk Elephant's confused response—claiming products were safe for kids while warning against acids—satisfied no one. The brand became so strongly associated with Sephora tweens that it lost credibility with older consumers, with sales plummeting 65% year-over-year.

The lesson was clear: the teen skincare market needed brands built specifically for them.

Brands rushed to capitalize: Bubble Skincare dominated early with distribution across Target, Ulta, CVS, and Walmart, offering gentle formulations in bright + fun packaging.

New entrants like Erly, YAWN WORLD, JB Skrub (for young boys), Saint Crewe, and Ever Eden followed, all focused on gentle formulations over harsh actives, and colorful and playful packaging over sterile and medicinal.

Despite the explosion of teen-focused brands, something was missing. As Daniel Faierman, Partner at Habitat Partners (an investor in Sincerely Yours), told us:

"We saw a major gap in the market for an offering that was aspirational without trying too hard to deliberately speak to teens/tweens.”

It’s one thing to create a brand for Gen Alpha—but they can sniff out who’s behind it. And they don’t want another mom trying her hand at Gen Alpha slang to sell them moisturizer.

Enter Salish Matter: At 15, Salish is a founder who IS her target demographic. While competitors hired consultants to decode teen behavior, she built authentic relationships with 60,000 fans through a private text community.

"Their engagement and following is unlike anything I've ever seen," Faierman told us. "Salish exudes self-acceptance and authenticity, which is a nice dichotomy from the message that many of today's influencers push (...perfection at all costs)."

And this authenticity extends to the product itself. Unlike Drunk Elephant's accidental teen adoption, Sincerely Yours was designed from the ground up for young skin:

"SY's formulations are intentionally crafted for sensitive skin - derm involvement, safety tested, non-irritating products, with the NEA [National Eczema Association] seal at an accessible price point," Faierman explains.

What's really happening here is simple: Gen Alpha finally has skincare brands that actually get them. Not products designed by adults trying to guess what teens want, but brands that speak their language, understand their skin, and show up where they are.

When 80,000 teens pack into a New Jersey mall for Soothing Serum Mist, it's not just about the products. It's about finding brands that treat them as the savvy consumers they are, not just "future customers" to be groomed for adult brands.

CPG & Consumer Goods

Another week, another slew of protein launches. While we could write a whole thesis on “reaching peak protein”—and how we actually don’t think we’ll ever really will—we’ll spare you (for a future pod episode 😉). For now, we’ll leave you with this week’s protein launches:

Lifeway launches Muscle Mates™. Lifeway Foods, the brand known for its kefir and fermented probiotic products, is launching an all-in-one, ready-to-drink fitness bev. Muscle Mates™ packs in 20g of protein, 5g of creatine (of course), and probiotics.

Alex Cooper gets jacked. The media mogul launched protein-packed Unwell Hydration drinks with 10 grams of clear protein and only 2 grams of sugar in flavors like watermelon strawberry.

Clear protein is another trend we’ve been seeing a lot of!! Especially in soda.

And another high-protein coffee: Bulletproof, an OG leader in functional coffee (which somehow still exists…), launched its High Protein Iced Coffee, with 12g of whey protein.

Shockingly, according to the FDA, any food with 20% or more of the Daily Value (50g) of protein per serving qualifies as "high-protein"…and in a world of 30g+ as the standard I’m shocked it’s this low. high for coffee, low for 2025 standards. - Nate

Summer is never ending. Cointreau, the orange liqueur brand, launched its Cointreau Citrus Spritz, a ready-to-serve (RTS) cocktail line with 10.5% ABV.

Consumers are clearly seeking more premium and convenient ways to consume their cocktails. On the back of the RTD canned cocktail boom, ready-to-serve is now surging as it’s up 15% over the last year and 16% in the last quarter alone.

While RTS isn't new, this wave of premiumization is transforming the category. On The Rocks, acquired by Beam Suntory in 2020, remains the market leader with near-ubiquitous distribution, but new entrants are elevating the space. Legacy players like Diageo are leveraging their brands to make classic "bartender quality” cocktails in a bottle. Newer premium players are also flooding in. Yellowstone Bourbon, Via Carota (yes, the restaurant), and craft-focused brands like Gardenista are betting that consumers will pay more for quality and authenticity in a bottle.

Add it to the growing list of BFY sodas. Keurig Dr Pepper Canada inked a partnership with Cove Drinks that will expand availability of the probiotic, zero-sugar Cove Soda across Canada.

Cove (which only launched in 2023) is one of the hot new better-for-you soda brands taking on the current industry leaders, Olipop and Poppi. Apparently they’re already at $100 million in revenue and growing fast.

Cold season is coming. Lemme is launching Immunity, a new supplement that packs 120mg of vitamin C and 25mcg of vitamin D. Shocked that they didn’t have this SKU before!

We have been testing another (also orange) immunity gummy that will be releasing at the end of the month 👀 - email us if you can guess the brand!

FDA tightens the GRAS reins. The FDA is proposing mandatory health data submissions for self-affirmed food additives.

If you’re unfamiliar: GRAS (Generally Recognized as Safe) is currently a rule that allows companies to declare an ingredient as safe, which means they do not require pre-market review by the FDA. Under this new rule, companies would have to provide health data + additional documentation when declaring a new food ingredient/substance as safe.

eCommerce

Sephora and Uber Eats team up. The beauty retailer is now the first prestige beauty brand on Uber Eats, and members of its Beauty Insider program can link their account to earn points on Uber Eats orders.

Uber Eats is offering $10 off first Sephora orders over $50!!!

To me, this signals that we’re aging out of the era where convenience conflicts with premium positioning. Historically, the “get it quick” mentality was associated with lower quality—if it’s easily accessible, then it’s not exclusive enough, and therefore not premium. I imagine seeing this headline a few years ago and thinking that association with Uber (plebeian) would be a hit to Sephora’s (high-end) brand. But today? Instant access is expected. It’s baseline. Relying on unattainability for premium positioning is a weak foundation. - Jenna

It's an omnichannel world. Pinterest launched “where-to-buy” links that allow CPG advertisers to send shoppers directly to multiple retailers while collecting purchase intent data.

Retail

Albertsons pulls the plug on Safeway stores. The grocery giant is closing 12 Safeway locations, including 10 in Colorado, as part of a consolidation effort after a failed merger with Kroger.

Funding news

Nudestix gets a new lease on life. The Canadian cosmetics brand has been acquired by an undisclosed U.S. private group. The cofounders will be staying on board.

Bansk makes a move on BYOMA. Bansk Group secured a majority stake in the fast-growing skincare brand BYOMA, known for its science-backed products that strengthen the skin barrier.

Bansk has been making moves since it started in 2019, acquiring stakes in several popular brands in the personal care and consumer goods space. Notable acquisitions include Red’s All Natural, Amika and Eva NYC, No Man’s Land Foods, and Arcadia. This latest acquisition further expands their presence in the fast-growing personal care category.

Bloom is booming! Following a successful $90 million financing round in 2024, Nutrabolt is increasing its investment in Bloom Nutrition which is expected to surpass $1 billion in annual revenue. This is all further strengthened by a distribution partnerships with Keurig Dr Pepper that has skyrocketed Bloom’s retail presence.

Nutrabolt, whose portfolio includes the major energy drink brand C4, proved out its investment thesis with its successful collaboration with Bloom on its Bloom Sparkling Energy drink (our bev of choice in our last podcast episode).

Premium spirit shift. The Pathfinder, an alcohol-free spirit brand, has raised a $3.6 million Series B round led by Stoli Group. The company will leverage Stoli's distribution network (recently expanded through a deal with Breakthru Beverage) to reach 41 states and build a stronger off-premise presence—they're currently 70% on-premise.

Shockingly, Stoli Group USA filed for Chapter 11 bankruptcy in late 2024 and are still kicking…kinda. Just last month (August 2025) they proposed an unusual restructuring plan to pay their $78 million debt to Fifth Third Bank with 35,000 barrels of unfinished bourbon and other alcohol inventory. Fifth Third objected, stating bourbon prices are depressed and that the bank lacks the capacity to manage liquor sales.

Make sure you’re subscribed so you don’t miss our next edition!