Your Dog Eats Better Than You

CPG and retail news from the week of 10/20/25

Hello hello!

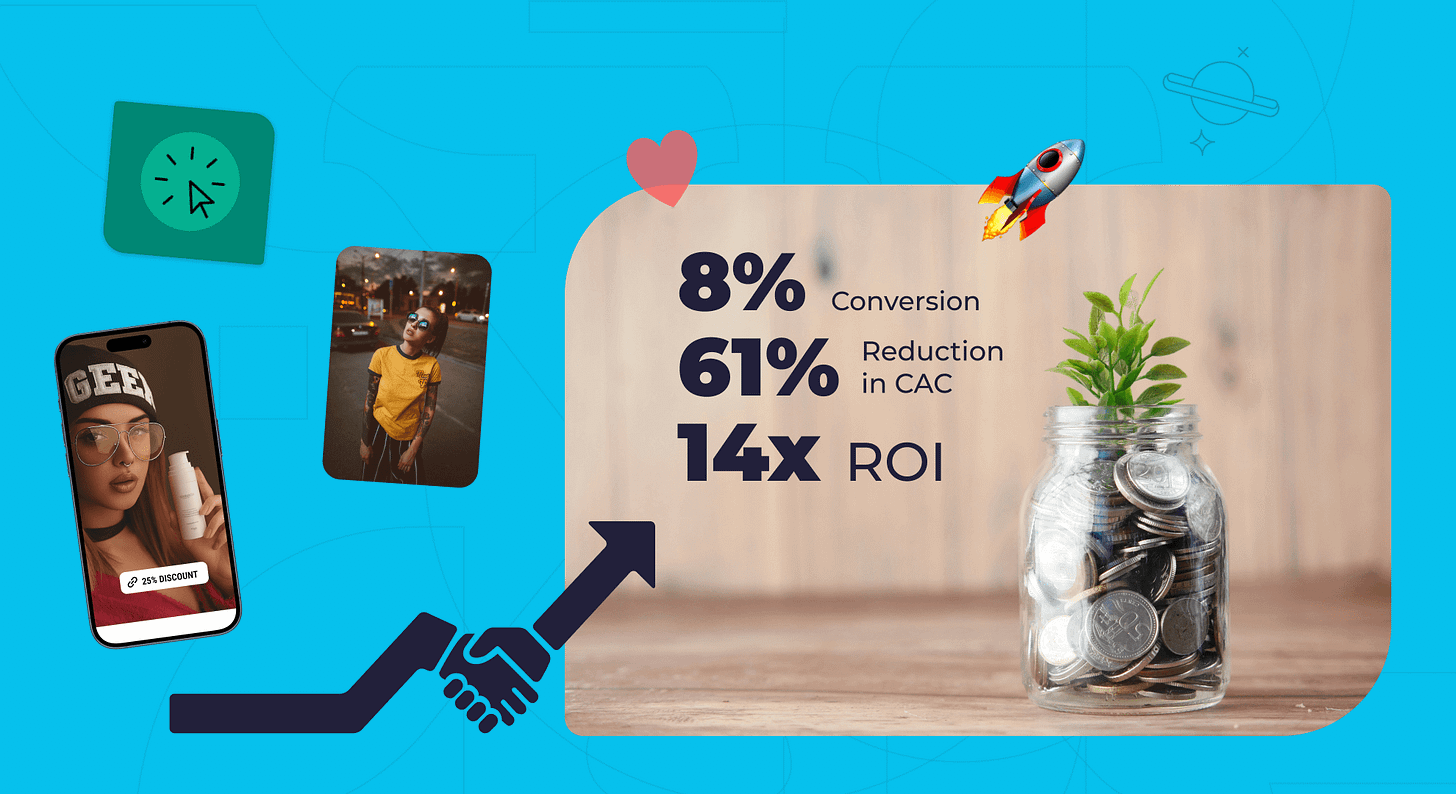

Influencer marketing is getting expensive. Beyond the partnerships themselves, the tools necessary to source, gift, and create affiliates + contracts add up so quickly.

That’s why we’re so excited to partner with the folks at Endlss, the influencer platform that lets you use all of its features… for FREE. Endlss makes every dollar count with…

A free tier that’s ACTUALLY useful, giving you access to its full tooling

Pricing scales with you—at half the price of other solutions!!!

Real numbers: 5¢ CPC, 61% CAC reduction, 14x ROI

With Endlss, you can discover the best influencers for your brand, manage UGC agreements, issue smart affiliate links, and so much more... all in one platform.

Make every influencer dollar count. 👇

Now, let’s get into the news of the week →

News from the week

This week, Maev—a fresh-frozen dog food brand—launched the first 100% “human-grade” New Zealand lamb recipe for dogs. The ready-to-serve formula features grass-fed lamb, sweet potato, spinach, and even vitamin K2 for allergy support—and costs roughly $6-8 per day for a medium-sized dog.

If you just did the math and realized that’s more than you spend on feeding yourself… you just stumbled upon the $157 billion pet industry’s not-so-secret secret: dog food is in its glow-up era.

In 2025, the premium pet food revolution isn’t really about nutrition—it’s a complete cultural shift around what pets mean to us. Maev’s lamb launch is just the latest (bougie) manifestation of something much bigger happening in America.

Okay but, how did we get here? While the term “human-grade” emerged from The Honest Kitchen in 2002, the modern premium pet food wave really kicked off post-2007 melamine recall, when thousands of pets died from contaminated Chinese ingredients. Pet parents started demanding transparency and “Made in USA” claims, and DTC brands delivered—with beautiful branding to boot. Just a few of the biggies:

2014: The Farmer’s Dog and Nom Nom both launch (”Blue Apron, but for dogs”). The Farmer’s Dog is now valued at $2.5 billion, and even aired Super Bowl ads.

2016: Ollie Pets entered the scene, and has since raised over $21M

2020: Jinx was founded by a former Casper executive (of course), doing $100+ million in revenue

Pet spending has been climbing year-over-year, with its biggest jump during—you guessed it—the pandemic.

And the category keeps expanding—with brands like Sundays for Dogs (air-dried), Spot & Tango (fresh and baked), A Pup Above (gently cooked), and now Maev pushing into premium proteins like New Zealand lamb.

Some brands are going even further. JustFoodForDogs has actual retail locations that look like Sweetgreen—essentially “slop bowl shops” but for dogs, where you can watch them prepare fresh meals.

Even Target gets it—the retailer launched multiple private-label, aesthetically pleasing pet food and care brands (with names like Kindfull, which feels like a ChatGPT answer to “name for brand that wants to sound healthy and premium”).

The numbers tell the story: The global pet food market is projected to reach $193.65 billion by 2032. Over 41% of U.S. pet parents purchased premium dog food in 2024, with the fresh/frozen segment alone growing at 16.71% CAGR.

People have always done more for their animals than themselves—that’s not new. What is new is that as we (humans) have gotten better (and more aesthetically pleasing) products, we’ve started demanding the same for our pups.

The shift from “what’s cheapest/most convenient” to “what matches my aesthetic and values” in pet food mirrors exactly what happened in human DTC/CPG over the last decade. Consider the parallels:

Human: Factor_/Blue Apron → Dog: The Farmer’s Dog

Human: Athletic Greens/Bloom → Dog: Native Pet supplements

Human: Away luggage → Dog: Wild One carriers

Human: Our Place/Caraway → Dog: Modern Beast bowls

Human: Whoop/Oura Ring→ Dog: Fi collar

Pet food has become the ultimate “discretionary non-discretionary” spend. You have to feed your dog. But which $50/week option you choose? That’s pure lifestyle signaling.

Like every consumer trend, multiple cultural factors are at play here. It’s the perfect storm of:

Pet humanization reaching peak levels (82% of owners say their pet is “like my own child”). A 2019 study found 44% of respondents said buying healthy food was more important for their pet than for themselves (wild).

The DINKWAD lifestyle (dual-income, no kids, with a dog). 22% of Millennials and Gen Z delayed having children, and pets offer companionship—at a fraction of the cost of a small human 🙃. That extra spending power, plus a deep emotional bond with your pet = the perfect customer for a cool $6,103/year in pet food spending.

On the companion note: The loneliness epidemic and COVID certainly contributed to the pet boom. Everyone and their mother knows someones with a spoiled COVID pup.

The Social Media Pet Industrial Complex. Social has seriously normalized premium pet spending, with two in five people preferring to fill their social feeds with pets > people. When you see premium pet food brands sponsored on Instagram by influencer dogs, it normalizes spending $100/week on fresh food delivery.

What’s next? We’re witnessing the full “premiumization” of pet food in real-time. Just like how oat milk went from Whole Foods to gas stations, premium pet food is normalizing fast. Expect to see:

More exotic proteins (if New Zealand lamb works, why not… wagyu beef??)

Functional ingredients everywhere (anxiety support, joint health, cognitive function)

Retail expansion (Target’s already there, everyone else will follow)

Price normalization (as scale increases, “premium” just becomes the baseline)

Maev’s lamb launch isn’t selling dog food. It’s selling the ability to be the kind of person who feeds their “child” ethically-sourced, grass-fed New Zealand lamb with vitamin K2.

In 2025, that’s not extravagant. That’s good parenting. 🐶

CPG & Consumer Goods

It’s the season of the pop. Grammy-nominated folk musician Noah Kahan partnered with Culture Pop, a probiotic soda brand, to launch a quirky social series highlighting the brand’s “authentic storytelling and real ingredients.”

In this new soda wars era (post-Poppi’s acquisition by Pepsi and with Olipop likely getting acquired soon), everyone else is fighting for eyeballs and market share.

This is a clear departure from Poppi’s vibe of ~ influencer girlie ~. Noah isn’t beloved for his it-girl lifestyle (or it-girl looks, for that matter)—he’s known for his craft. Celeb storytelling campaigns are nothing new, but they’re often reserved for front-of-camera stars whose aesthetic alone communicates something aspirational. I love that Culture Pop is thinking outside of the box here—not just partnering with a celeb for their visible star power, but because he represents their brand ethos. - Jenna

Buffy goes baller. WNBA star Kelsey Plum joined Buffy Protein—a new, female-owned protein dip brand—as both brand ambassador and founding team member, helping shape its market entry and retail strategy.

We love to see a female-owned brand working with a female athlete!! Even more, we love to see a protein brand working with an actual athlete—because, as we constantly reiterate, protein can’t do too much if you don’t actually work out.

Donut worry, you’ll hit your protein goals. Quest Nutrition launched its first-ever protein donuts, with 14 grams of protein and fewer than 1 gram of sugar each.

It’s not the first protein donut on the market, though—Legendary already has one, and our current favorite is from the folks at Drumroll Snacks (who just launched protein muffins!). Excited to see how Quest’s stacks up against the rest.

Plant-based pulls the plug. Stockeld Dreamery, a fermented cheese brand, is shutting down after raising $20M and debuting in Whole Foods, highlighting the challenges even well-funded plant-based startups face in today’s market.

The plant-based industry has seen a wave of closures and struggles recently: Meati Foods, which raised $365M total including a $100M Series C1 round in 2024, sold for just $4M after losing most of its cash reserves. Plant-based bacon brand Hooray Foods shut down in 2023 after raising $4M+, citing that “economics simply do not match our revenue.” Vegan chicken brand Nowadays also closed its doors in 2023 despite raising nearly $10M.

And perhaps most spectacularly, Beyond Meat’s stock has cratered 98% from its $234.90 peak in 2019 to around $2 today, shrinking from a $12B market cap at its peak to just $870M.

The plant-based dairy market has also slowed significantly, with fewer alt milk brands launching and existing players struggling to maintain shelf space. The category faces multiple headwinds: plant-based meats remain 82% more expensive than conventional meat, consumers are skeptical of ultra-processed ingredients, and sales have fallen for two consecutive years.

“Our hypothesis was always that nobody’s going to pick up these products because of climate or animal welfare, and cheese is not a health food,” cofounder Sorosh Tavakoli told Ag Funder News. “So essentially, it comes down to cultural acceptance … and it wasn’t enough.”

No one’s screaming for ice cream right now. Unilever’s planned spin-off of its Magnum ice cream unit is currently on hold due to the U.S. government shutdown.

An interesting NA/Hydration take. Hyli Drops just launched zero-calorie, pocket-sized liquid flavoring with cocktail-inspired tastes like Margarita, Moscow Mule, and Espresso Martini. It’s as if Buoy hydration and SAYSO cocktail sachets had a baby, combining electrolyte hydration with cocktail flavoring in a convenient drop format.

Guess it’s not a Dry Country for Bon Jovi. Jesse Bongiovi, son of Jon Bon Jovi, launches a new brand incubator, Lily Pond Group (LPG), with its first partner spirits: Five Springs Infused Bourbon and Mezcal Mezul. LPG will also oversee Hampton Water Rosé, the successful wine brand he co-founded with his father.

Battle of the teas. Surfside, the vodka-based hard tea brand, is suing AB InBev for allegedly copying its signature packaging with the launch of Skimmers, claiming confusion and deception could mislead consumers.

It makes sense Surfside wants to protect themselves. The brand launched in 2022 and grew from 200,000 cases to 1.3 million cases in its second year (a 563% jump), reaching 4.9 million cases by 2024—making it the fastest-growing alcohol brand in US off-trade.

Another THC bev has entered the race. Cincinnati’s Rhinegeist Brewery rolled out Fuzzy Bones, a THC-infused seltzer with 5mg Delta-9 per can, tapping into the booming alcohol-free beverage market as consumers crave new higher experiences.

The cannabis beverage market is seriously expanding lately. Investment capital is pouring in, with brands like Uncle Arnie’s raising $7.5M, Nowadays raising $10M, and BRĒZ opening a $25M raise after surpassing $60 million in profitable revenue. Retailers are betting big too—we recently wrote about how Target became the first mainstream retailer to sell THC beverages, starting with 10 Minnesota locations and featuring a dozen brands!

Shampoo into a social movement. Teen sisters Leah and Misha Burdeen teamed up with their mom Julie Smolyansky (CEO of Lifeway Foods) to launch Burd Beauty—a clean hair care brand on a mission to fight teen dating violence. With every bottle sold, they fund training for stylists to spot signs of abuse.

As we’ve discussed in previous issues, we’re witnessing an explosion of tween and teen-focused skincare brands entering the market—it was only a matter of time that teen haircare came to the scene.

There’s a more obvious need for teen-specific skincare—teen skin is uniquely challenging to manage. Haircare has a less-obvious teen-focused bend, but I love how this brand brought mission to the forefront. As a teen, many brand’s core causes feel out-of-reach or harder to empathize with—but by focusing on teen dating violence in particular, this brand is bringing it closer to home. I’m hopeful that more brands emerge like this, encouraging teens to “vote with their dollar” from an earlier age. My prediction? We’ll start seeing more brands orienting themselves with causes tackling the loneliness epidemic or phone addiction. - Jenna

We told you, men want to smell good! Men’s skincare brand, Bravo Sierra, is rolling out three unisex body fragrances for $50 each, inspired by its body care line. With projected first-year sales of $2–3 million, Bravo Sierra is strategically tapping into the fast growing fragrance market (especially for me - Nate).

As we highlighted in our recent newsletter about men’s fragrance trends, the men’s fragrance market is booming—spending surged 26% in just one year. Fragrance overall has been the fastest-growing beauty category, significantly outpacing other segments. Gen Z men are leading the charge, spending $204 annually on fragrances and building “fragrance wardrobes” instead of sticking to one signature scent. This shift has created a huge opportunity in the under-$100 “masstige” space, where brands can offer quality without the luxury markup.

Think of it as a bougie pine tree. Inkbox co-founders Tyler and Braden Handley are launching Olauto, a premium car freshener brand priced at $33 each. The elevated fresheners feature scents that supposedly “evoke real environments” and last over three months. They also just look really cool. 🤷♀️

If men are starting to get excited about scents, it’s only a matter of time that cars will get the same scented treatment—cars, after all, are basically just an extension of men.

Mānuka magic. Former Victoria Beckham Beauty executive Jennifer Krouse launches Aunu, a skin care brand featuring medical-grade Mānuka honey from New Zealand producer Comvita.

I’m surprised we haven’t seen more Mānuka-based skincare brands come to market given the growth of the Mānuka honey market (especially with brands like Manukora taking over grocery stores) - Nate

Retail

This is a scary week in America. We need retailers to step up. Due to the government shutdown, SNAP and WIC benefits could be cut for 40+ million Americans—leaving families nationwide at risk of going hungry. It’s nothing less than a food emergency, and we are looking to major food corporations to respond appropriately. A few already have stepped up:

DoorDash launched an emergency food response, delivering 1 million free meals through food banks and waiving fees for 300,000 SNAP recipient grocery orders.

H-E-B committed to donating $6 million to food insecurity relief in central Texas.

It’s worth noting that delayed SNAP benefits could affect these retailers, too. Beyond the ops challenge, sales will likely take a hit, which could trickle down to impact employees at grocers as well.

Special shoutout to Eleanor Hayden, founder of Veriti, for bringing this topic to light! If you know of brands who are rising to this occasion, share them on her post for vis.

Target is struggling… loudly. Target is cutting 1,800 corporate jobs, marking its first major layoffs in a decade, as it struggles with a four-year sales slump. It’s an 8% workforce reduction.

Funding news

Cashing it in. Kirin Holdings is reportedly seeking buyers for Four Roses Bourbon, with first-round offers expected next month. The Japanese company, which also owns beer brands Kirin Ichiban and New Belgium (acquired in 2019), acquired the Kentucky-based brand in 2002. Sources suggest the sale could reach up to $1 billion, marking Kirin’s continued shift from spirits toward healthcare, pharmaceuticals, and core beverages.

Speaking of bourbon…Westward Whiskey is rising from the ashes. The American single malt brand secured its future selling to a group of private investors called Aqua Ardens after a Chapter 11 bankruptcy filing.

Clean body care grows. Body care brand Hanni secured $2M in funding led by Melitas Ventures, with CULT Capital and Rodeo GP participating, bringing total funding to $9M. The investment will fuel Hanni’s expansion into Sephora, positioning the clean beauty brand for nationwide growth.

Don’t sleep on influencer commerce. ShopMy raised $70M at a $1.5B valuation to scale its curated commerce platform, connecting premium brands with 185,000+ “tastemakers.” The profitable company has over $1B in annual sales.

ShopMy clearly has been growing as they position themselves as this full-stack commerce platform. Rather than just connecting brands and creators, they now control discovery (Circles), validation (ThingTesting), distribution (creator storefronts), and transaction.

Definitely check out my ShopMy. - Nate

A happy boost. Taste Tomorrow Ventures invested in happy®, the RTD coffee brand led by Craig Dubitsky and Robert Downey Jr.

Did you know we have a podcast? It’s called The Curious Consumer

If you haven’t yet, please subscribe, like, and leave a comment! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.