checkout-chats

Nov 1, 2024

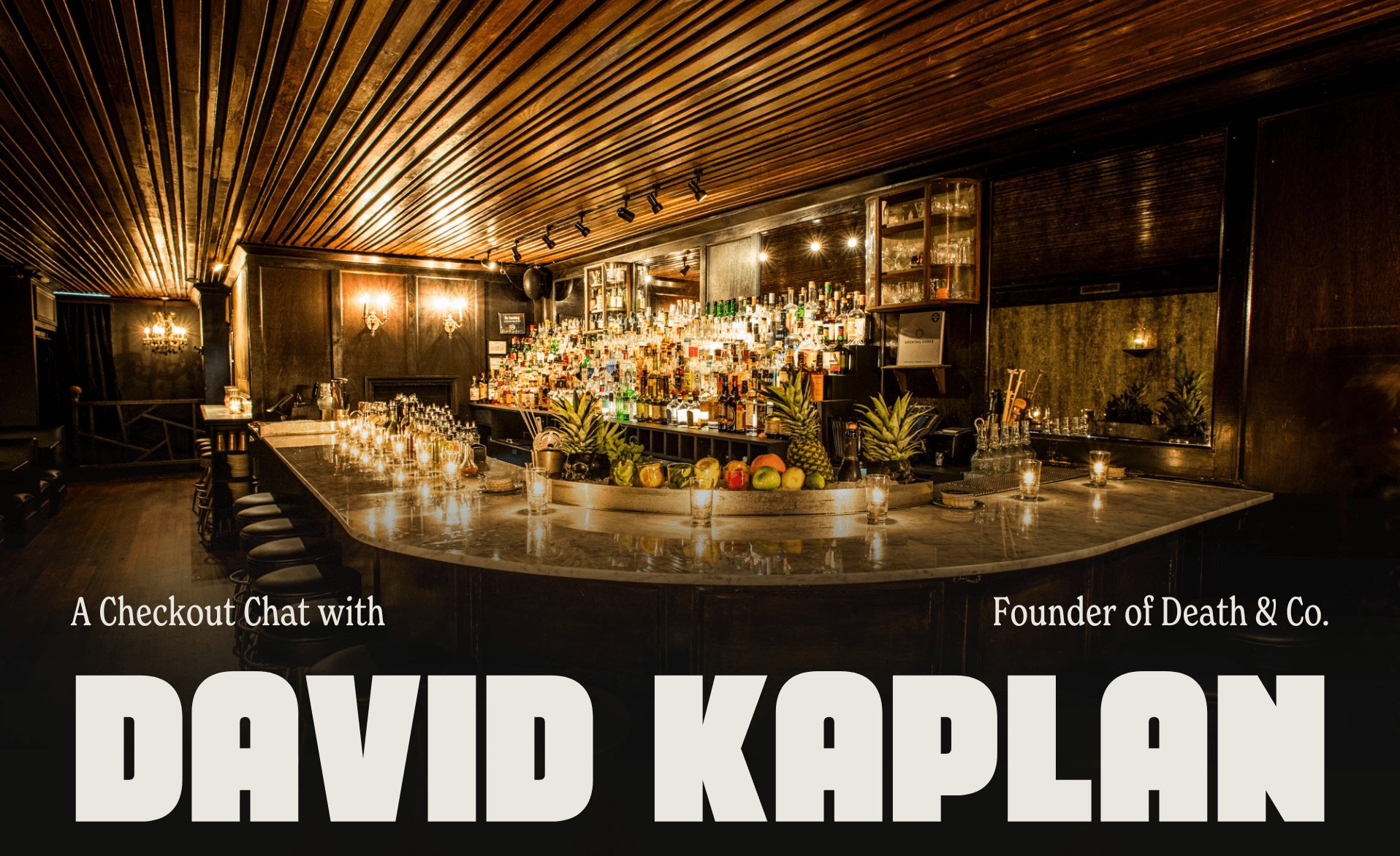

Checkout Chats: Dave Kaplan, Founder of Death & Co.

Death & Co's Evolution from Cocktail Den to Lifestyle Brand

Dave Kaplan is a name that has become synonymous with the modern cocktail renaissance. As the founder of Death & Co, which opened its doors in New York City's East Village in 2006, Kaplan helped pioneer the craft cocktail movement and transform how Americans think about mixed drinks.

What started as a dimly lit cocktail den on East 6th Street has evolved into one of the most influential forces in modern cocktail culture, spawning multiple locations, award-winning books, and a growing retail presence. The bar's first book, "Death & Co: Modern Classic Cocktails," has become a cornerstone text for both professional and home bartenders, while their follow-up "Cocktail Codex" won the James Beard Award for Best Beverage Book in 2019.

Building a Cocktail Empire

Now in its 18th year, Death & Co has witnessed a complete transformation of cocktail culture from a niche interest to a mainstream phenomenon. The brand has grown from its original East Village location to outposts in Denver's RiNo district and Los Angeles' Arts District, each maintaining the intimate, high-quality experience that made the original famous. Despite expansion, they've managed to do what few bars have achieved: maintain relevance and quality while scaling.

"If you nail the fundamentals, if you nail what should be the simple stuff," Kaplan explains, "you're going to always find an audience."

This philosophy has guided Death & Co through nearly two decades of industry evolution, from the early days of educating customers about spirits to today's sophisticated cocktail landscape.

It’s a philosophy that echoes the work of the legendary Sasha Petraske, founder of Milk & Honey, who Kaplan cites as a foundational influence. Petraske’s dedication to perfecting classic cocktails through precise details—temperature, dilution, and even glass-handling techniques—is something Kaplan continues to uphold.

Embracing the Digital Shift: From Bars to Social Media

In recent years, cocktail culture has expanded beyond traditional bars to home bars and digital platforms. The proliferation of cocktail content creation, from long-form YouTube channels like How to Drink and Educated Barfly to quick TikTok and Instagram tutorials from the likes of @likeablecocktails and @join_jules, has dramatically altered consumer behavior. However, Kaplan points out that the most significant shifts in consumer behavior occurred 10–12 years ago, rather than recently.

"The impact is less noticeable in the last 5–6 years because I think it was already at a very, very high level," Kaplan explains. This evolution has fundamentally changed the relationship between bartenders and guests. In Death & Co's early days, Kaplan recalls with a chuckle, "We very much did not believe anyone knew what they liked. We were like, 'Yeah, you think you like vodka soda, but just trust us for a little bit.'"

Modern customers arrive with more knowledge and confidence in their preferences. "In the beginning, we very much did not believe anyone knew what they liked," Kaplan recalls with a laugh. "We were like, 'Yeah, you think you like vodka soda, but just trust us for a little bit.'" Now, the relationship is more collaborative, with bartenders guiding guests toward specific flavor profiles rather than completely redirecting their choices.

Kaplan acknowledged how digital content, from cocktail tutorials to influencer collaborations, has influenced customer expectations in bars like Death & Co. "We've seen an uptick in people coming in with a more adventurous and sophisticated palate," he said, attributing this shift to platforms like Instagram and YouTube, where cocktail culture thrives. However, he also emphasized that Death & Co has always aimed to be approachable rather than purely instructional.

"We invite knowledge rather than enforce it"

This underscores his belief that hospitality is about creating a welcoming environment for every type of guest, whether they're cocktail novices or enthusiasts.

The RTD Gold Rush

The spirits industry is witnessing a revolution in ready-to-drink cocktails, with sales surpassing $1.6 billion in 2022 and major players making bold moves to capture market share. Anheuser-Busch is investing $16 million to expand its Los Angeles brewery for RTD production, focusing on brands like Cutwater and Nütrl. Beam Suntory has aggressively entered the space, acquiring On The Rocks (OTR) to create authentic pre-mixed cocktails like Knob Creek Old Fashioned and Hornitos Margarita, while also launching celebrity partnerships like Delola with Jennifer Lopez.

The category's explosive growth has attracted attention across the beverage alcohol industry. Pernod Ricard recently acquired French RTD brand Cockorico and opened a new US canning line, while Diageo continues to innovate with products like the Captain Morgan Sliced line. The trend's momentum has even influenced regulatory frameworks, with states like Pennsylvania amending laws to allow RTD sales in convenience stores. Beyond retail, the category's sophistication has reached new heights, with airlines upgrading their in-flight offerings to include premium RTDs made with real fruit juices, spirits, and bitters.

Amidst this gold rush, Death & Co's approach to RTDs reflects their methodical, quality-first philosophy. However, they face a unique challenge: due to three-tier system regulations dating back to Prohibition, they can't directly own their RTD line. These laws, which require separation between alcohol producers, distributors, and retailers, create interesting dynamics for brands looking to expand in the space.

"Very few things within this space are actual cocktails," Kaplan observes about the current market. "Most of them are seltzers." Death & Co's solution has been characteristically authentic: creating genuine cocktails using real ingredients and quality spirits, maintaining the same exacting standards they apply in their bars.

This attention to quality sets them apart in a landscape where many RTDs rely on artificial flavors and malt bases. While other brands prioritize convenience and price point, Death & Co is positioning their RTDs as premium offerings that maintain the sophistication of their bar program.

Kaplan sees particular opportunity in treating RTDs more like craft beer, with limited releases and seasonal offerings that could create excitement and exclusivity. However, he acknowledges the regulatory challenges of this approach, particularly when aiming for nationwide distribution. It's a complex balance of innovation, quality, and practicality – themes that have defined Death & Co's evolution from the beginning.Beyond Alcohol: Evolving with Consumer Preferences

It wouldn’t be a conversation about alcohol if I didn’t ask Dave about the non-alcohol category. While non-alcoholic cocktails have generated significant media buzz, Kaplan provides a more nuanced view of the category's actual impact. In his bars, non-alcoholic drinks currently represent about 5-6% of orders at Death & Co locations, though this number spikes during Dry January. The brand has long featured non-alcoholic options, predating the current trend, and is now seeing increased interest in non-alcoholic RTD offerings.

"Just because Death & Co is cocktail-driven doesn't inherently mean alcohol," Kaplan emphasizes.

"What we do is build platforms for connectivity. We happen to do so through cocktails and great hospitality."

Nevertheless, he’s committed to offering quality non-alcoholic choices to ensure that every guest has a satisfying experience, alcoholic or not. For Kaplan, the goal is simple: “It’s about bringing people together,” regardless of what’s in their glass.

Looking Forward

Death & Co's journey from a single influential bar to a multi-faceted hospitality brand offers valuable lessons about maintaining quality at scale, navigating regulatory constraints, and adapting to ever-changing consumer preferences while staying true to core brand values. In an industry that often chases the next trend, Death & Co has proven that focusing on fundamentals while thoughtfully evolving can create lasting success. For the broader beverage industry, Death & Co's story demonstrates how a strong brand foundation can support expansion into multiple categories without diluting quality or authenticity. As the RTD market continues to grow and consumer preferences evolve, their measured approach to growth and unwavering commitment to quality provides a blueprint for sustainable success in the premium beverage space.

As Death & Co prepares for its next funding round, Kaplan remains excited about innovation in the spirits world. The craft cocktail movement they helped pioneer has matured, but opportunities for innovation remain abundant. As Kaplan puts it, "If you absolutely are monomaniacally in pursuit of improvement and dialing in those little details instead of the next new thing, you're going to always find an audience."

Quick Takes: What's Exciting Dave Kaplan Now

Current Favorite Cocktail: The Vesper, particularly pre-batched, pre-diluted, and served extremely cold

Favorite Spirit: American whiskey

Emerging Category to Watch: Eaux-de-Vie (unaged fruit brandies)

Under-appreciated Spirit: Calvados