Sex sells protein.

+ the new food pyramid, chatbot checkout takeover, and more.

Hello hello from sunny San Diego!

We’ve been having a blast at FancyFaire, and can’t wait to share some of our top finds from the show in our Weekly Pickups edition on Friday 👀.

As we walk the show floor, it’s hard to ignore: it is tough to stand out in CPG. That’s why some of the fastest-growing brands in the industry are taking matters into their own hands with mobile commerce—AKA, their own apps. We know that sounds daunting, but apps are crazy effective retention tools, and customers who download your app spend 3-4x more than web shoppers.

The problem? Building and maintaining an app has traditionally required dedicated resources most CPG brands don’t have. Constant content updates, manual push campaigns, segmentation work—it add up fast.

That’s why Tapcart AI caught our attention.

Now, you can kick off your mobile commerce journey with an app that basically runs itself. A customer adds to cart and leaves? Tapcart AI sends them a personalized push notification—mentioning the exact product, in your brand voice. Launch a new product or seasonal promotion on your site? Tapcart AI syncs your app automatically without someone rebuilding by hand.

For lean CPG teams, this changes the equation entirely. The ROI of an app was always there—now the operational barrier just got a lot lower.

News From the Week

America’s protein obsession shows no signs of slowing down in 2026. Just in the first week of the year, we’ve seen a wave of protein-forward innovation—and the trends tell us this is only the beginning. Let’s get into them all:

Energy + protein for the girls. In a (highly predictable) convergence of trends—energy drinks for women + protein—GORGIE, the female-focused energy drink brand, launched Protein Energy drinks at Target in Strawberry Pop and Power Punch flavors. Each can packs 8g protein, 150mg green tea caffeine, plus biotin and B vitamins (quintessential additions in any female-positioned product). And alongside the new bevvies comes a new activewear collection… because how can anyone know that you’re a protein fiend if you aren’t sporting branded activewear?!

This whole thing feels very Poppi coded. It’s yet another female-focused-functional-beverage-turned-merch-purveyor, and can also be spotted in mega-influencer Alix Earle’s hands (and feed). Earle was an investor in Poppi and long-time brand partner—even featured in the brand’s Superbowl commercial last year—and recently became a strategic investor and partner in GORGIE as well. It’ll be interesting to see just how much GORGIE pulls from the Poppi playbook as it expands.

Clear protein is having a moment. Bloom Nutrition, one of the fastest-growing wellness brands famed for its greens powder, just entered the clear protein space with a juice-like powder delivering 20g of protein per 90-calorie serving. Made with clear whey isolate and “grass-fed collagen peptides,” it’s zero-sugar and fat-free (that’s a claim we haven’t seen in a minute…) and is now available at Target in two flavors.

Let’s give credit where it’s due: brands like Seeq Supply and Clean Simple Eats pioneered this category and proved that clear protein doesn’t have to be weird or chalky—it can actually taste good and look appealing. Now, Bloom is joining a growing roster of brands betting big on lower-calorie, more easily-digestible protein powder in fun fruity flavors, departing from the typical milky vibe of protein products.

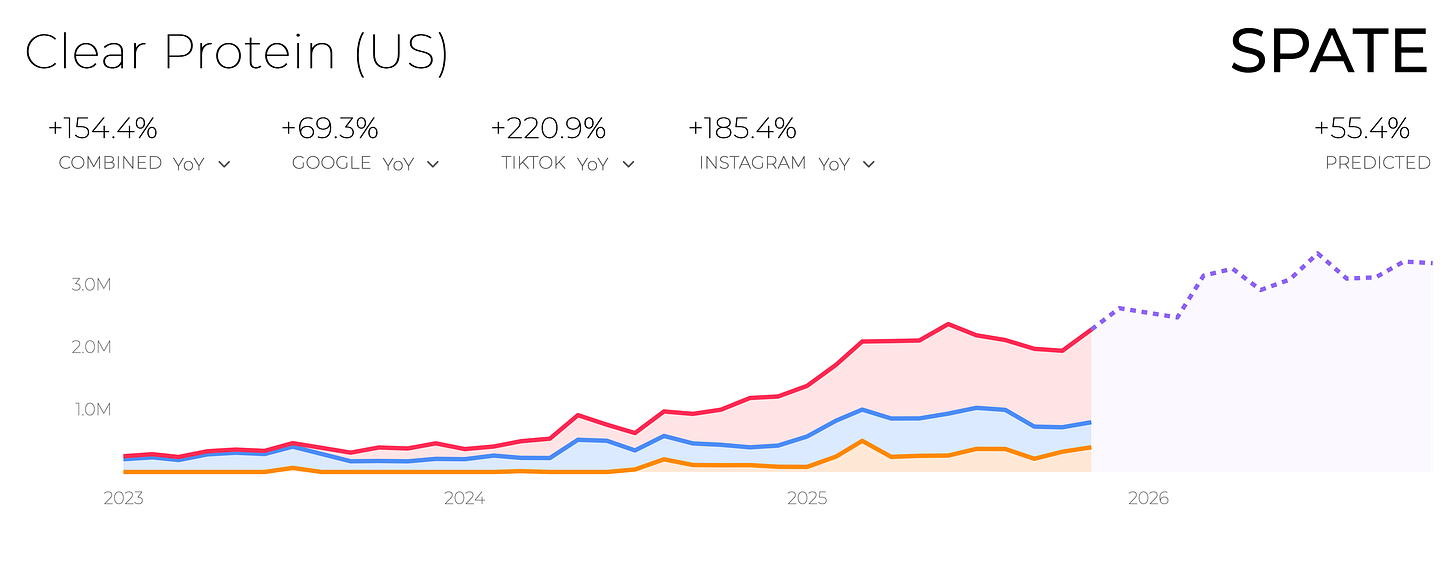

Year-over-year demand for clear protein has surged across Google, TikTok, and Instagram, and search trends predict continued growth over the next few years. As consumers look for more approachable, less “chalky” protein options, clear formats are filling that gap:

via spate.nyc .

Let them do shots...of protein. Mel Robbins, Golden Globe-nominated podcast host and bestselling author of The Let Them Theory, joined Pure Genius Protein as co-founder—launching a 23-gram protein shot. Think 5-hour ENERGY, but protein-powered and TSA-friendly (because how dare we travel sans protein). There’s literally no format safe from protein infiltration at this point.

And last but (certainly) not least, from the most controversial company in protein... David launched its first new product since the company’s founding (besides its Cod stint, that is). The new Bronze bar series features a candy bar-style coating with crunchy pieces and chocolate. Each bar delivers 20g of protein, zero sugar, and 150 calories across four flavors: Double Chocolate Crunch, S’mores Chocolate Crunch, Peanut Butter Chocolate Crunch, and Cookie Dough Caramel Chocolate Crunch.

The product itself feels fairly standard and, frankly, extremely similar to beloved Barebells. But what waswild about this was the brand’s launch strategy. David partnered with the incomporable Julia Fox for a full campaign and video in which she shares (in a literal confessional booth) that she’s regretful, hungry for more, perhaps even aroused… but she swore off men. It’s then revealed that the “David” she’s seduced by is actually a protein bar, which doesn’t make her choose between her macro goals and satisfying her sweet tooth. If you haven’t heard, sex sells—and evidently, in the year of our lord 2026, the David team is shamelessly embracing that fact.

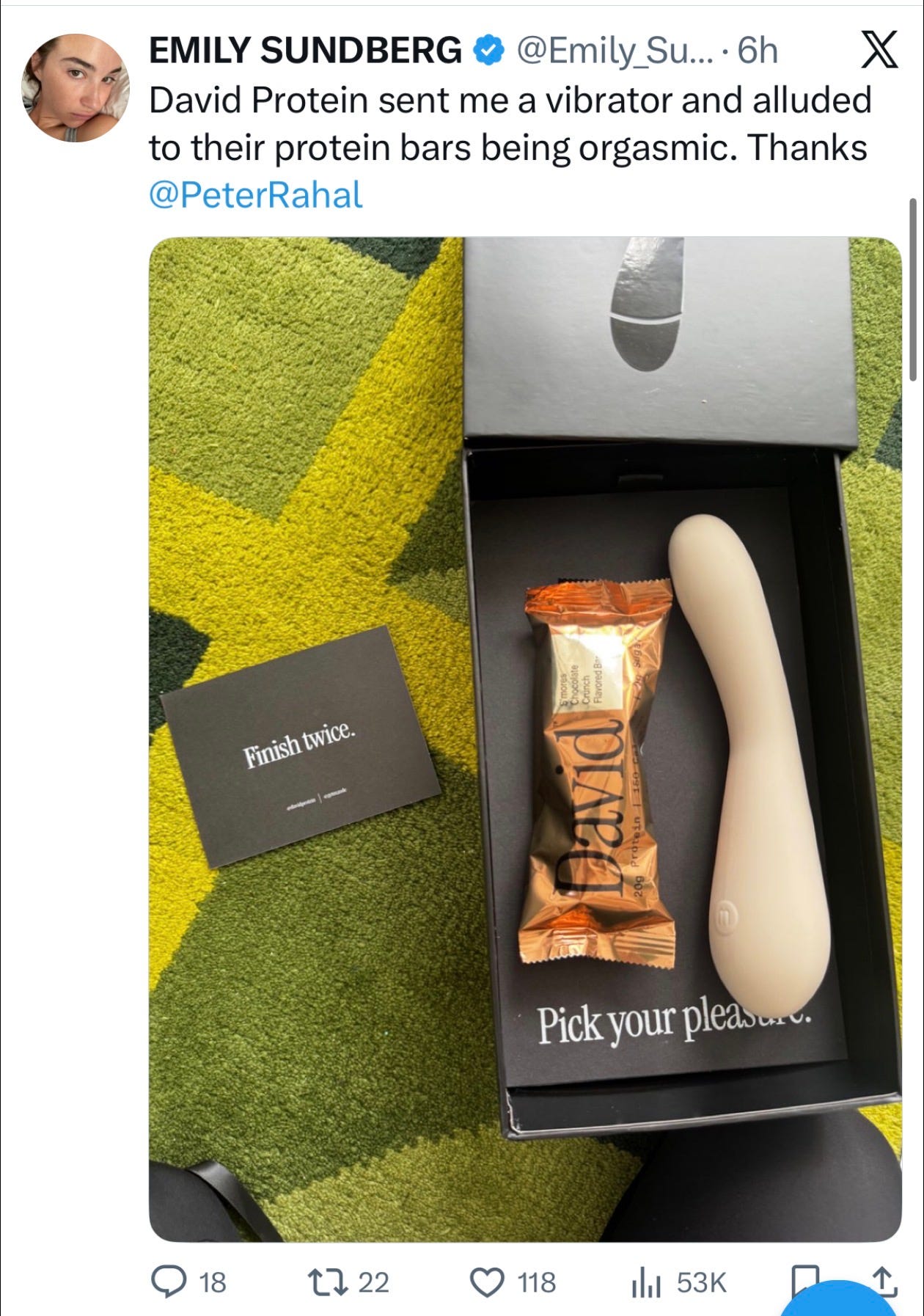

While we shouldn’t be surprised by the sheer audacity of this brand—might we remind you about the cod of it all—this does feel especially unabashed and weirdly gendered. The OG bar, which features 8g more protein, was marketed more towards men. Meanwhile, this lower-protein, more indulgence-oriented bar is quite literally being shilled out with vibrators and claiming equal opportunity pleasure. I could write a thesis on this launch, and its inherent connections to GLP-1s and sexualization of ever-skinnier bodies, how the “wellness” world is weaponizing shame, and more, but for now, I’ll leave you with this… (shoutout Emily Sundberg for sharing) - Jenna

CPG & Consumer Goods

The new food pyramid is…something. The Trump administration released new dietary guidelines that flip the traditional food pyramid—which hasn’t been in use since the ‘90s—upside down, prioritizing animal proteins (meat and dairy) at the top while downplaying plant-based options like beans and lentils. Health Secretary RFK Jr. called it “the most significant reset of federal nutrition policy in history.”

The new guidelines directly contradict their own scientific advisory panel, which recommended listing plant proteins ahead of meat because Americans don’t get enough fiber and could benefit from eating more beans and lentils. The inverted pyramid doesn’t even reflect the actual quantities recommended in the text—it’s more of a political statement than useful nutrition guidance if we’re being honest. Plus, the pyramid is genuinely confusing to read. The whole thing reads less like evidence-based policy, and more like MAHA vibes packaged as scientific fact. There’s a lot to say on this, most of which other people have said better than us (some fave creators/thinkers: Elly Truesdell, Jessica Knurick, PhD, RDN, and our fave food scientist, Hydroxide), but at the end of the day, most Americans ignore federal nutrition advice anyway. 🤷

Kids snacks are finally getting cool. Meet Cadootz!, a new kids’ snack line featuring healthy cheese crackers made without seed oils, gluten, or artificial additives and boasting 5g protein per serving. The brand was co-founded by famous blogger/recipe developer rachel mansfield, Jordan Carpenter, and Kiva Dickinson of Selva Ventures.

It’s no surprise that parents these days are looking for cleaner snacking options for their kids. There’s been a surge of innovative new entrants in “clean-ingredient” kids products, including brands like Jubilee’s (protein milk flavored with fruits + veggies) and Little Spoon, which just launched nationally in Target after dominating DTC.

Seeking tariff justice. Over 1,000 companies have sued the US government challenging Trump’s tariffs, seeking refunds on duties paid. With the US Supreme Court potentially set to release opinions soon regarding the legality of these tariffs imposed under the 1977 International Emergency Economic Powers Act, companies are racing to file protective lawsuits to preserve their right to refunds. Major brands include e.l.f. Cosmetics, Costco, Revlon, Dole Fresh Fruit, J.Crew, Bumble Bee Foods, and Diageo, with potential refunds totaling $150 billion if courts rule the tariffs unlawful.

Fun-sized cult vibes. Coconut Cult, the literal cult-favorite probiotic coconut yogurt, just launched two-serving, 4 oz yogurt cups at Target for $3.99. The brand’s OG glass jars contain eight servings are ~$10 a pop, so this new launch (should) make the brand more accessible to the Target consumer looking for a gut fix.

PB&J sans bread. Mid-Day Squares, makers of refrigerated functional chocolate bars, have launched their first non-chocolate product, the No Bread PB&J bar, available nationwide at Target.

As co-founder and co-CEO Lezlie Karls told us, “Some of the best innovation happens when your back’s against the wall. Cacao prices squeezed us hard, and exposed a real vulnerability.”

If you didn’t know, the past two years saw a chocolate shortage that shot cocoa prices nearly 300% due to supply shortages in West Africa. Though the 2025/2026 season is looking more promising, J.P. Morgan Global Research expects cocoa prices to remain structurally higher for longer.

But the MDS team decided to turn this threat into an opportunity. “Our goal became clear: Bring the most exciting category in Frozen into the fridge, with a Mid-Day Square spin,” Karls told us. “No bread PB&Js was the hardest and most fulfilling thing we have done, but we truly believe this is an innovation that has not been done before.”

A non-chocolate product reduces the company’s exposure to these rising commodity costs—but perhaps more importantly, this bar marks a major evolution for the brand. As their first non-chocolate SKU, this bar expands MDS from a “functional chocolate” company to a broader “functional snack” player.

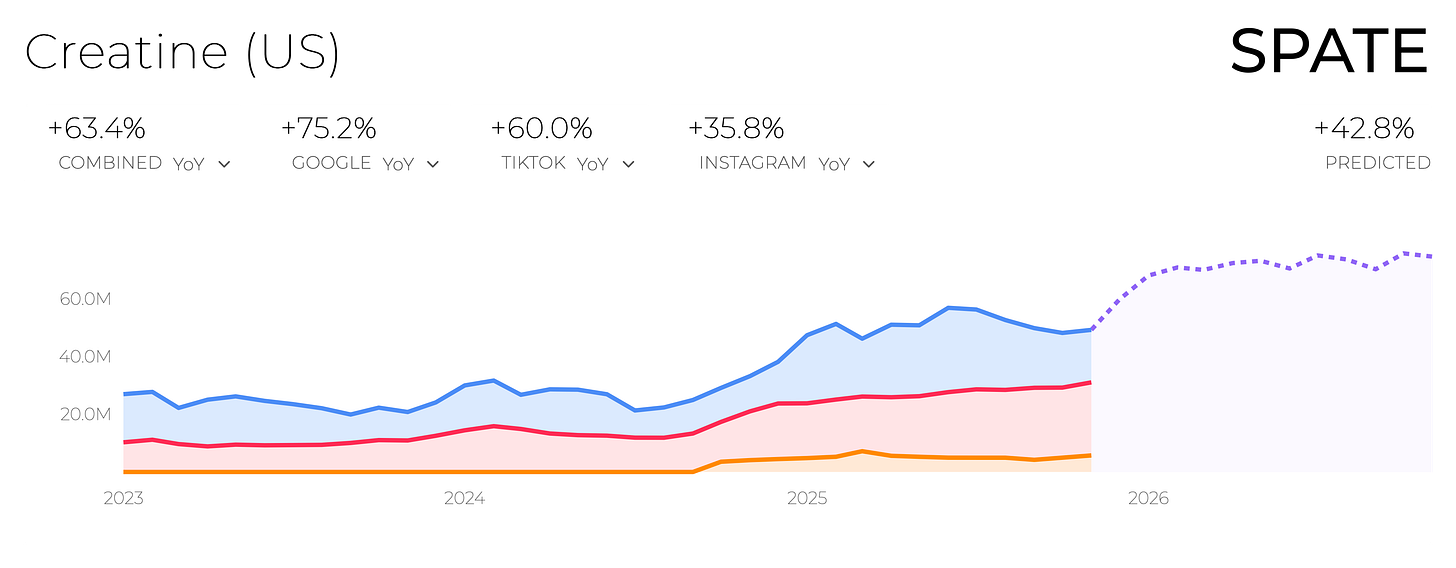

Creatine gummy takeover. Lemme, Kourtney Kardashian Barker’s wellness brand, launched Creatine Body Toning Gummies targeting the growing women’s performance nutrition market. Each serving delivers 5g of micronized creatine monohydrate.

Creatine has been growing in popularity, especially in gummy format—and we can definitely thank Create for that. The brand pioneered creatine gummies when it launched in 2023 and has since raised close to $8M while surpassing $15M in annual revenue. Now, other brands are joining the creatine gummy boom: Bloom just launched their version (available at Target and on TikTok Shop), and popular supplement brands Arrae and Momentous also have creatine gummies in the market.

eCommerce

Hopping on the in-chat checkout train. Both Microsoft’s Copilot and Google’s Gemini just launched their versions of ChatGPT’s Instant Checkout—Copilot Checkout and Direct Checkout, respectively. And for both chatbots, the launch partners include Etsy and Shopify (meaning users can directly checkout from Etsy and Shopify merchants within both chatbots).

And Google, per usual, is standing out as the overachiever. Beyond developing direct checkout capabilities, Gemini’s Checkout is supported by technology called Universal Commerce Protocol (UCP)—basically, a new set of rules/standards that helps different shopping systems talk to each other, like a “universal translator” so all these systems (retailers, software like Shopify, and chatbots) can work together smoothly. Shopify, Etsy, Wayfair, Target and Walmart all collaborated on the development of UCP.

And Google is piloting Direct Offers in AI mode, which will allow advertisers to present exclusive offers for shoppers who are ready to buy.

Retail

Another big year for wellness. Target is expanding its wellness assortment by 30%, adding thousands of new products across protein options, supplements, functional beverages, family solutions, skincare, and even performance apparel. They’re positioning themselves as the wellness destination for consumers.

This marks Target’s second major wellness push—the retailer previously announced a massive expansion in January 2025, adding over 2,000 new items. And Target isn’t alone here, other retailers like Ulta Beauty and Walmart are also betting big on wellness, dedicating more shelf space and significantly expanding their product offerings across multiple categories to capture this growing consumer trend.

Target is leaning into what they do best: exclusivity. This week, they secured two first-ever retail launches for beloved DTC brands: ButcherBox and Nara Organics (German-made infant formula). They also recently launched exclusive products from clinically-backed supplement brands like Cymbiotika, Arrae, and The Coconut Cult (see above), plus functional beverages like RYZE mushroom coffee and Protein Pop.

Beyond launches, Target is leaning in with dedicated “wellness zones” at the front of stores featuring curated cross-category displays, and launching a refreshed Wellness Hub on Target.com with “personalized” recommendations.

Will this be the next Costco? No, but Amazon might be trying. They’re planning a 229,000-square-foot retail store just outside Chicago which is larger than a Walmart Supercenters (~180,000 sq. ft)! The facility will offer groceries, household essentials, and general merchandise, with warehouse space for deliveries.

As we’ve covered in the past, Amazon is actively testing new formats and delivery options to compete with retail giants like Walmart and Target. They’ve expanded Same-Day and Next-Day delivery to over 4,000 smaller cities and rural communities, are piloting 30-minute delivery in Seattle and Philadelphia using micro-fulfillment centers, and have even deployed drone deliveries promising arrival in under 60 minutes. Amazon’s investing over $4 billion to build out this infrastructure, positioning themselves to own the entire delivery experience from click to doorstep.

The future of THC beverages is looking bright. Sprouts Farmers Market is rolling out hemp-THC beverages in 115 Texas and Florida stores, tapping into a booming $28.3 billion market for alternative adult beverages.

The hemp-THC beverage space is truly booming, and it gets even bigger when major national retailers enter the game. Back in October 2025, Target became the first mainstream retailer to sell THC beverages, soft-launching at 10 Minnesota stores with 12 brands including Cann, Wynk, Hi Seltzer, and Trail Magic. We actually dove into this when the news first broke, breaking down how impactful this is to the category.

And the money is flowing too. Uncle Arnie’s raised $7.5M Nowadays raised $10M and partnered with Kygo’s Palm Tree Crew festivals, and BRĒZ opened a $25M raise after surpassing $60 million in profitable revenue.

Funding

Private equity will come for us all eventually. Good Culture, the brand that launched cottage cheese into the stratosphere, has taken a majority investment by consumer-focused private equity firm L Catterton for an estimated $500M.

Interest in cottage cheese, and especially Good Culture, has been on the rise for the past few years. It went from a grossly underrated and overlooked chunky dairy product to the talk of the town (at least on #proteinmaxxing TikTok). Demand has been so high—cottage cheese sales jumped 20% in US retail last year—that Good Culture and other cottage cheese brands have struggled to keep up, seeing constant “out-of-stocks”. Some brands saw even higher spikes: Organic Valley’s cottage cheese grew over 30% in the first half of 2025 (per CNN). Most existing production facilities are fully maxed out, with manufacturers now expanding capacity and building new plants to meet the sustained demand.

Beyond the obvious push from protein, Good Culture won because it took a dying dairy product and fully revived it, featuring cleaner ingredients (no gums, preservatives or thickeners) and noticeably better texture. Over the past three years, Good Culture’s sales jumped over 300% and it became the #1 cottage cheese brand in the natural channel, holding 50% of the cottage cheese set at Whole Foods. 🤯

Interestingly, Daisy contains strictly skim milk, cultured cream, and salt—even simpler than Good Culture—yet Good Culture marketed the “clean label” positioning more effectively. And that’s on the power of great marketing.

iHerb, one of the largest e-commerce health and wellness destinations, has acquired Vitacost from Kroger. The deal adds over 40,000 products to iHerb’s lineup and expands its U.S. reach, positioning the company as a major player in the booming health and wellness eCommerce market.

With major retailers like Target and Walmart becoming major wellness destinations, this is a smart move from iHerb.

More frozen food wins. Evergreen, a better-for-you frozen waffle brand, raised $15.2 million in equity funding with participation from Melitas Ventures and Terpsi Capital. The brand has seen great growth since launching in 2020, they’re now sold in over 8,000 doors such as Whole Foods and Walmart.

Check out our recent episode of The Curious Consumer!

If you haven’t yet, please subscribe, like, leave a comment, and share it! It helps us continue to bring you the most interesting news + nuance in consumer and retail every week.

i don’t remember a protein brand’s product launch creating so much interest and controversy recently, and smart of david to be doing this right now. at the same time, hard to ignore jenna’s comment & from the beginning (the “housewife” posts) it’s making me pause here and there… another amazing newsletter thank you!!!