The new candy aisle

CPG and retail news from the week of 9/22/25

Hello hello!

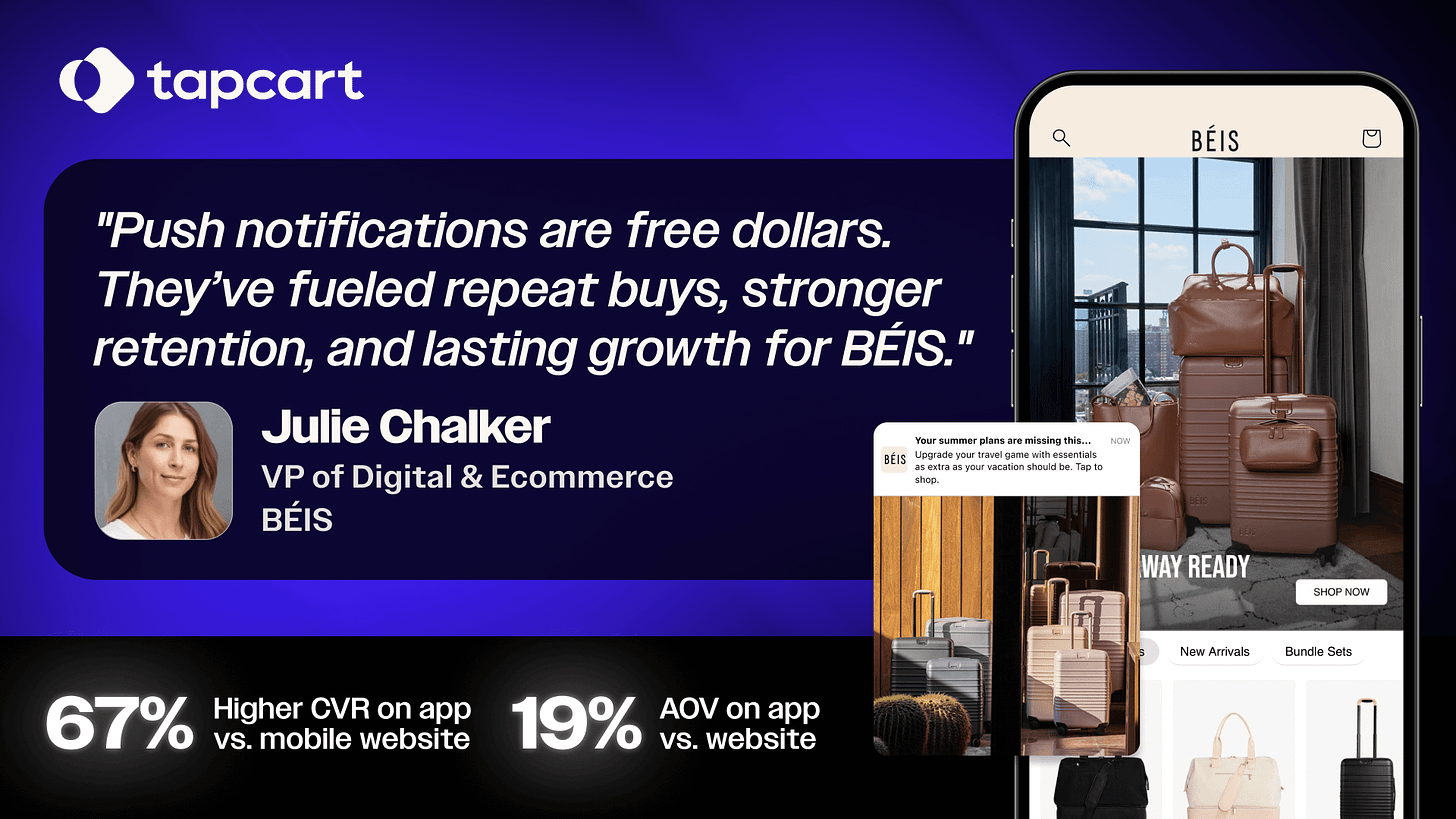

The biggest secret to a winning eComm strategy in 2025? It’s not some growth hack or Shopify integration…it’s mobile apps. The numbers don’t lie—brand-owned mobile apps see:

156% higher conversion rate than web

25% higher AOV than web

75% of app users buy weekly—not just browsing

Those are the numbers from real mobile apps built by Tapcart, the platform powering apps for brands like MUD/WTR, Truff, BEIS, Princess Polly, and thousands more.

Tapcart can get you live in weeks, just in time for BFCM:

Build your app base before BFCM, and see 4.5x more December revenue than web-only competitors.

Update promos and push notifications in real-time (a lifesaver during holiday chaos)

Give your VIP customers early access and app-only drops (the kind of exclusivity that actually drives loyalty)

Book a 15-min walkthrough and leave with a concrete BFCM plan. Build your user base now, thank yourself later.

Now, let’s get into the news of the week →