AI shopping just got real.

CPG and retail news from the week of 9/29/25

Hello hello!

It’s October, which means BFCM is around the corner (SPOOKY!!). 👻

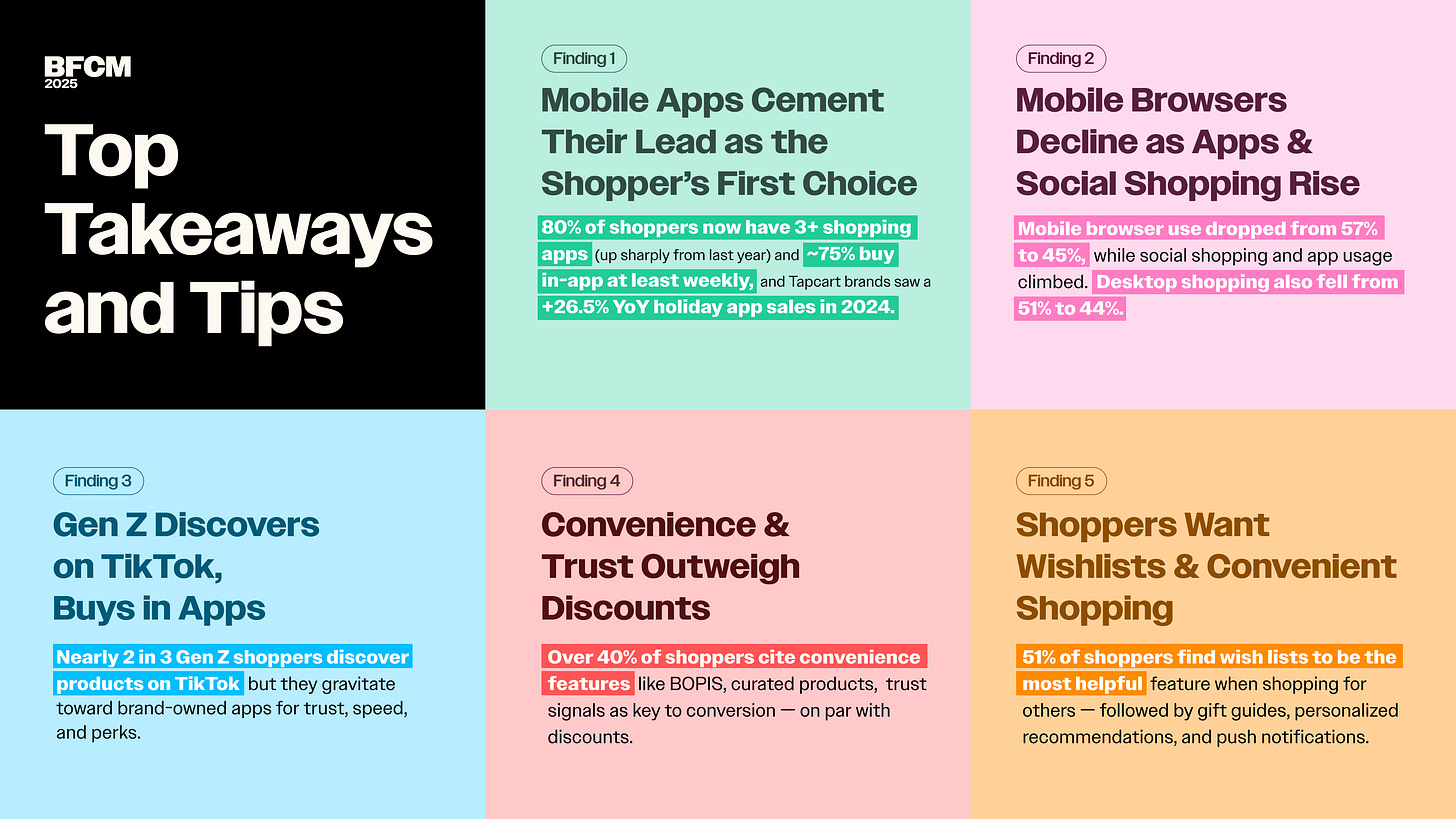

But this year, you have no excuse for a lackluster BFCM strategy, because Tapcart put together the most comprehensive, actionable BFCM playbook we have ever seen—and it just so happens to feature me (Nate)!!

In this value-packed report, you’ll find:

Exclusive consumer insights from 1000+ shoppers (where/how they’re shopping, how much they’re spending, and what they expect from brands)

Proven plays + strategies from the best-of-the-best ecomm experts like Eli Weiss and Grace Clarke

Examples of 2024 BFCM creative from top ecomm brands (and breakdowns of why it works + how to steal like a pro)

Now, let’s get into the news of the week →

News from the week

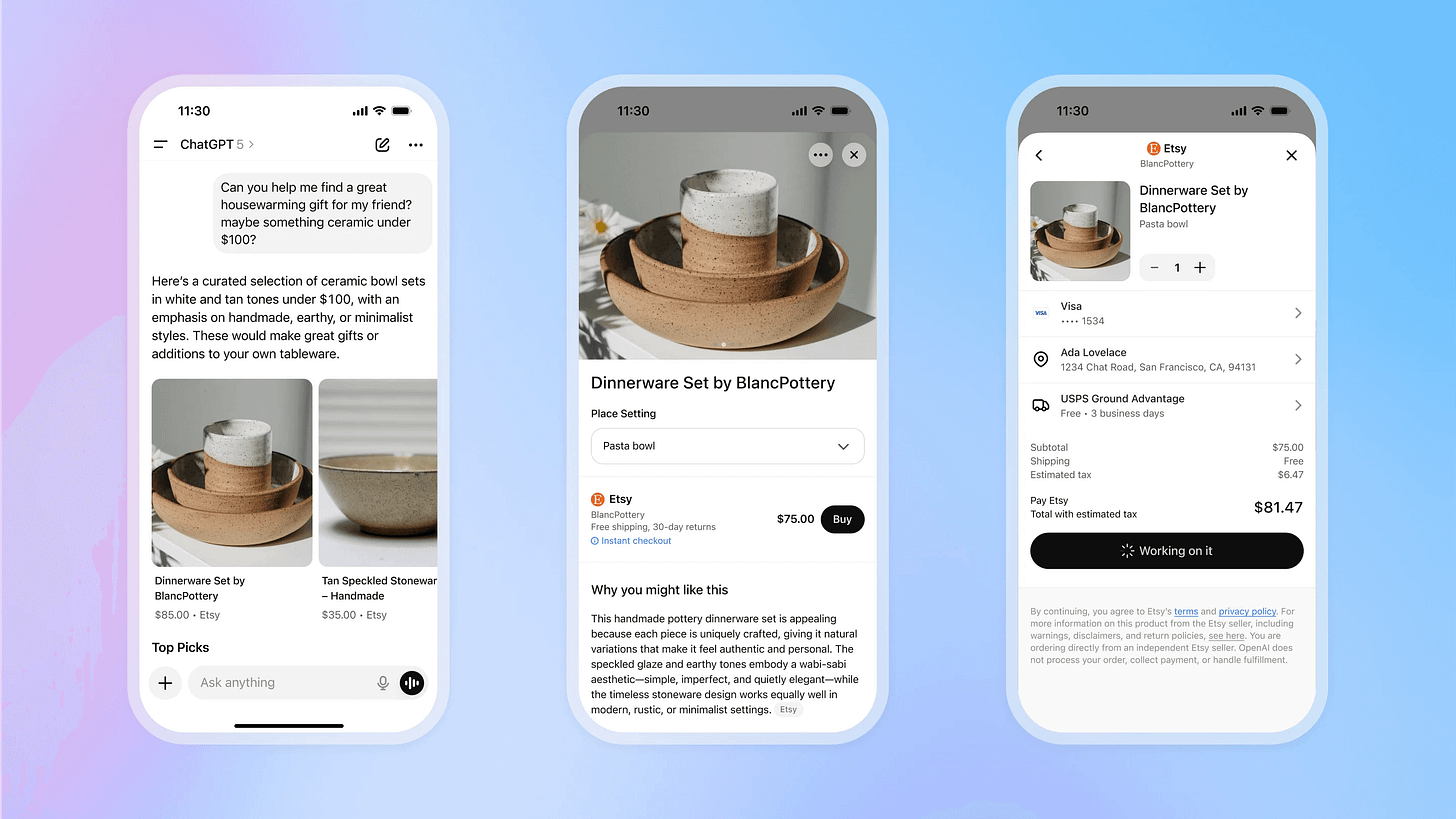

ChatGPT’s in-chat agentic shopping is here. And if you don’t know what that means (or why it’s a HUGE DEAL), here’s your crash course:

US users can officially buy directly from Etsy—and very soon, Shopify merchants—through ChatGPT with their new feature, Instant Checkout (evidently, faster than express 😉). Shoppers shoppers can hit “purchase” without ever leaving the chat—as in, no links, redirects, or switching tabs. That is WILD.

What it looks like in action: Ask ChatGPT for “under $50 gifts for a ceramics lover,” and it’ll surface relevant products (from Etsy for now, from Shopify soon). If Instant Checkout is enabled, you can complete a single-item purchase right there using Apple Pay, Google Pay, Stripe, or a credit card.

Why OpenAI is going all-in on commerce: Shockingly, the company isn’t profitable yet—it spent $5 billion last year while generating just $3.7 billion in revenue (turns out, computing power is $$$). With 700 million weekly ChatGPT users and a “huge portion” asking shopping-related questions, charging merchants a “small fee” on each transaction could become a massive revenue stream.

This has been a long time coming. AI is being used more and more by consumers instead of Google—or even social commerce—to decide what to buy. Here’s who else is in the game:

Perplexity partnered with PayPal in May to launch similar in-chat shopping for Pro users, with “Buy with Pro” one-click checkout launching this summer.

Phia raised $8M led by Kleiner Perkins (backed by Hailey Bieber, Kris Jenner, Sheryl Sandberg) and hit 500,000 users in five months. The AI shopping agent compares prices across 40,000+ sites and has driven tens of millions in sales.

Google launched its Agent Payments Protocol (AP2) in September with backing from Mastercard, PayPal, and Amex—but it’s still in developer phase with no consumer-facing products yet.

But OpenAI likely has some serious advantages over those other guys: OpenAI is open sourcing its Agentic Commerce Protocol (ACP), built with Stripe (Open sourcing = making publicly available + free to use).

On the surface, this sounds altruistic—any merchant can easily integrate for free. But here’s the catch: By making ACP the industry standard, OpenAI positions itself as the gatekeeper of AI commerce (think: Apple’s App Store—anyone can build apps, but Apple controls the ecosystem).

Plus, product results are “organic and unsponsored, ranked purely on relevance” (a major departure from Google/Amazon’s playbook). But, when ranking multiple merchants selling the same product, ChatGPT does consider whether Instant Checkout is enabled.

What this means for consumer: GEO (generative engine optimization—the AI counterpart to SEO) is about to get hot. The winners won’t just optimize for Google. They’ll need:

Clean, structured product data

Shopify integrations (which gives direct ChatGPT access)

Potentially, direct partnerships with OpenAI for Instant Checkout

We’re watching the potential unbundling of Amazon and Google’s ecommerce dominance in real time. AI agents are becoming the new discovery layer—where consumers find products, get recommendations, and complete purchases without ever touching a search engine (let alone a brand’s site).

As one ecommerce strategist put it: Traditional websites might become supplementary, effectively “print catalogues,” as AI handles the bulk of transactions.

For consumer brands, the message is clear: If you’re not thinking about how AI agents will surface your products, you’re already behind. 🤷♀️ The future of ecommerce is already here, and it’s happening right inside the chat window.

CPG & Consumer Goods

Another celeb (NA) beer. Comedian John Mulaney partnered with Chicago’s Years brewery to become the face of the brand and launch a national campaign for nonalcoholic beer.

Years was launched back in September 2024 by Patrick Corcoran who formerly managed Chance the Rapper!

Just last week other famously recently sober celebrity, Charlie Sheen, launched Wild AF Cold Gold another nonalcoholic beer brand.

…and in more NA-beer-related news: Tom Holland & Robert Downey Jr. (who have apparently been friends for over a decade 🥹) teamed up on a collab between the brands they co-founded—BERO, a premium non-alcoholic beer, and happy® Coffee—to launch two limited-edition products, BERO Coffee Draught & happy® Eternal Hoptimist ground coffee.

This is happy’s second collab featuring different formats that highlight both company’s hero products (the first being their Tate’s collab, with cookie-flavored coffee + coffee-flavored cookies) and I think it sets a new standard for collabs. It lets both brands really shine and exhibits genuine product innovation—not just slapping a logo on packaging. - Jenna

The CPG and Marvel nerd in me couldn’t be more happy - Nate

Dirty seconds. PepsiCo is launching Dirty Mountain Dew Cream Soda (basically, mountain dew + cream soda) in early 2026, tapping into the 42% growth of the dirty soda trend among Gen Z.

As an avid watcher of The Secret Lives of Mormon Wives*, I have been dying to try dirty soda. It sounds like this version isn’t exactly the real deal (which is usually a normal soda + real milk + flavored syrups—likely hard to bottle sans curdling), but still smart of the brand to hop on this trend. My next bet? Dirty soda ft. protein (think: OLIPOP Root Beer x Fairlife. And yes, I have made this at home 🙃). - Jenna*

One giant leap. Little Spoon, the #1 DTC baby and kids’ food brand, made its retail rebut launching exclusively at Target across five aisles with 23 products. After over seven years of being exclusively available online—and selling over 80 million meals—it was about time!

Wild fact: This is Target’s largest food & beverage launch to date!!

We asked Little Spoon’s Co-Founder and CPO, Angela Vranich, how the brand is adapting to attract the in-store, new-to-brand consumer—here’s what she said:

Online, we could provide context, education, and storytelling. On shelf, parents are making split-second decisions in crowded aisles, so we had to make our brand instantly recognizable and engaging.

We scaled our production to meet Target’s needs and introduced exclusive offerings, like Frozen Multi-Serves, to give parents more mix-and-match flexibility. On the design side, we optimized for discovery: a stacked logo system with bold outlines, brighter saturation, real food photography to signal transparency, and playful details to capture kids’ attention.

Gummy supplements get fit. Create Creatine gummies is making its nationwide debut at Target. It’ll be launching with three flavors (blue raspberry, sour green apple, and orange).

Create has been dominating the creatine space. The brand’s growth has been rapid, since they launched in 2023 they’ve raised close to $8M and have surpassed $15M in annual revenue as they tap into the increasing consumer demand for functional supplements, especially creatine.

Though they’re not the only ones pushing this muscle support supplement: Bloom recently launched creatine gummies as well.

The gummy format is hot right now—just look at Grüns’s massive growth. The all-in-one gummy supplement company raised $35M in Series B at a $500 million valuation back in May 2025 and are aggressively expanding their retail presence in stores like Walmart, Target, and Sprouts.

Even kids are on the #gains grind. Uncrustables is finally launching higher protein sandwiches with 12g of protein each (compared to the 6-8g found in their other sandwiches).

While 12g might not seem very high-protein for you protein-heads out there, this is still a pretty substantial number for a kids product.

Who would’ve guessed it: another protein bar. GHOST, a “lifestyle brand” known for its energy drinks and nutritional supplements, launched its first protein bar (biggest shock is that it took them this long?!). The bars come in three flavors with 20g of protein and 2g of sugar—nothing too novel, except for its fun “shareable” two-stick format (Twix vibes) ((but tbh, who’s splitting gains?)).

GHOST, which is partially owned by Keurig Dr. Pepper, actually developed these bars in partnership with General Mills. Gettin cozy with the big guys…

Taking the taboo mainstream. Norms, a sexy new hemorrhoid cream brand (you read that right), is launching a new line of hemorrhoid treatments aimed at destigmatizing an embarrassing health issue.

Norms is the latest in a line of brands destigmatizing what some deem as taboo health issues and situations, joining forces with brands like Julie (after-sex care), Jones and Blip (nicotine mints and gums), Asset (tushy health), Buoy Hydration (chronic illness), and August (women’s health).

You don’t see this a lot. Seven Sundays, a better-for-you cereal brand, acquired its long-time manufacturing partner Birch Packaging, cementing vertical integration and boosting innovation as it expands into 10,000 new retail doors, including Target and Walmart.

As DJ Khaled would say, “Another one ☝️.” Evereden, a pediatric dermatologist-developed skincare line for Gen Alpha, is launching at Sephora online October 14 and in stores early 2026.

They’re joining the long line of tween skincare (especially ones launching at Sephora), including Sincerely Yours by Salish Matter, Yes Day by 13-year-old Coco Granderson, and brands like Bubble Skincare, Erly, YAWN WORLD, JB Skrub, and Saint Crewe have been laying claim to the category.

If you’re getting deja vu… same.

eCommerce

Spooked about competing with ChatGPT this Black Friday/Cyber Monday?* Check out Tapcart’s FREE 2025 BFCM Playbook.1 This comprehensive playbook reveals brand-new consumer data + insights, plus easy-to-implement tactics to capture customers (and conversions) from ecomm pros like Grace Clarke and Eli Weiss.

The only BFCM reading you need to do this year ✅

Retail

The great grocery revamp. Amazon launched “Amazon Grocery,” a private label food brand featuring 1,000+ items, mostly under $5. The brand combines Amazon Fresh and Happy Belly private label products, available on Amazon.com and in Amazon Fresh stores.

You can’t go a week without some retailer expanding, launching, or improving their private label lineup. This week, it’s Amazon’s turn. And it’s doing this for a few reasons:

Lately, Amazon has been trying to rein in its grocery business. Jason Buechel, Whole Foods CEO, has taken over as Vice President of Amazon Worldwide Grocery Stores. This move clearly aims to streamline the Amazon Grocery brand, especially alongside Whole Foods.

Amazon needs to catch up—private label represents just 2% of their sales volume while other retailers are dominating, like Walmart’s Bettergoods (one of the fastest growing store brands) alongside Target’s Dealworthy.

Consumer demand is clearly here and growing. Sales of private label rose 4% last year to a record $271 billion. With inflation driving up prices and a struggling economy, consumers are more price-conscious than ever, making this trend unlikely to slow down. Moreover, as private label brands continue to improve in quality, they benefit from a halo effect that has fundamentally changed consumer perception from good to bad.

Meanwhile, Walmart cleans up its private-label. The retail giant plans to eliminate synthetic dyes and 30 additives from its private brands by January 2027. Following in the footsteps of so many other big CPG brands recently.

But why is it so cute?! DoorDash recently unveiled Dot, a delivery robot that travels up to 20 mph on roads, sidewalks, and driveways. This compact, autonomous vehicle is part of DoorDash’s new Autonomous Delivery Platform, designed to streamline local deliveries. Smart they made it look like a cute stroller, hopefully people will be less likely to take a bat to it.

Drones and autonomous delivery are rapidly becoming mainstream. Autonomous delivery vehicles like Dot are joining aerial drones that companies like Wing—used by Walmart and DoorDash—and Amazon have been testing extensively. Walmart just surpassed 300,000 drone deliveries!!

These technologies are transforming last-mile delivery with faster service and reduced costs, despite initial public skepticism. As autonomous delivery scales up, we’ll see these robots become a common sight in neighborhoods and cities across America.

…and Kroger, apparently, wants to get in on the fun. Kroger is expanding its delivery capabilities by using DoorDash’s new DashMart service, enhancing the retailer’s existing ecomm strategy and reaching customers in areas beyond its store footprint.

Funding news

From squeeze pouch to Wall Street. Jennifer Garner’s brand, Once Upon a Farm has filed for an IPO with plans to list on the NYSE under ticker “OFRM.” With a 66% revenue increase in six months, this baby food company is poised to make serious waves.

Clearly consumers (and retailers) want better baby and kid food products. Just look at Little Spoon and Yumi’s success.

The coolest thing about this brand? It essentially created its own shelf. Initially, its products were placed in dairy sections, since baby food aisles rarely had refrigerators. But, in 2015, co-founder Ari Raz predicted that every baby food section would have a refrigerator in 3-5 years.

By 2023, the brand began successfully rolling out dedicated “fresh baby coolers” directly in baby aisles at major national retailers—fundamentally changing how fresh baby food is merchandised.

Sazerac snaps up Western Son. The Buffalo Trace Bourbon maker acquired craft distiller Western Son for an undisclosed sum, marking its third acquisition in 18 months.

Cane sugar is back, baby. Pura just raised $15M to scale its cane sugar soda in the U.S., tapping into a 50% growth in natural sugar beverages. As consumers ditch synthetic sweeteners, this could signal a major shift in the soda landscape.

Check out our third podcast episode on the most anticipated (and contentious) topic yet: protein, baby. This is just part one of our two-part protein series, so make sure you tune in and subscribe for our next protein (knowledge) drop this week!

If you haven’t yet, please subscribe, like, and leave a comment! It helps us out a lot.

*Sponsored content